The migration of old existing Rajasthan VAT Dealers has been started. The time period for the migration was 16/12/2016 to 31/12/2016. In upcoming details, we divided Rajasthan migration process for VAT dealers. In the first step, we explain how to get the provisional Ids. In the second step, we explain that how to convert the provisional Id’s in the GST Id and password. In the last step, we explain what the mandatory requirements while filling GST registration form are.

Recommended: Free Download Gen GST Software for GST India

Here we are explaining the overall process of migration to the GST structure in easy to understand way.

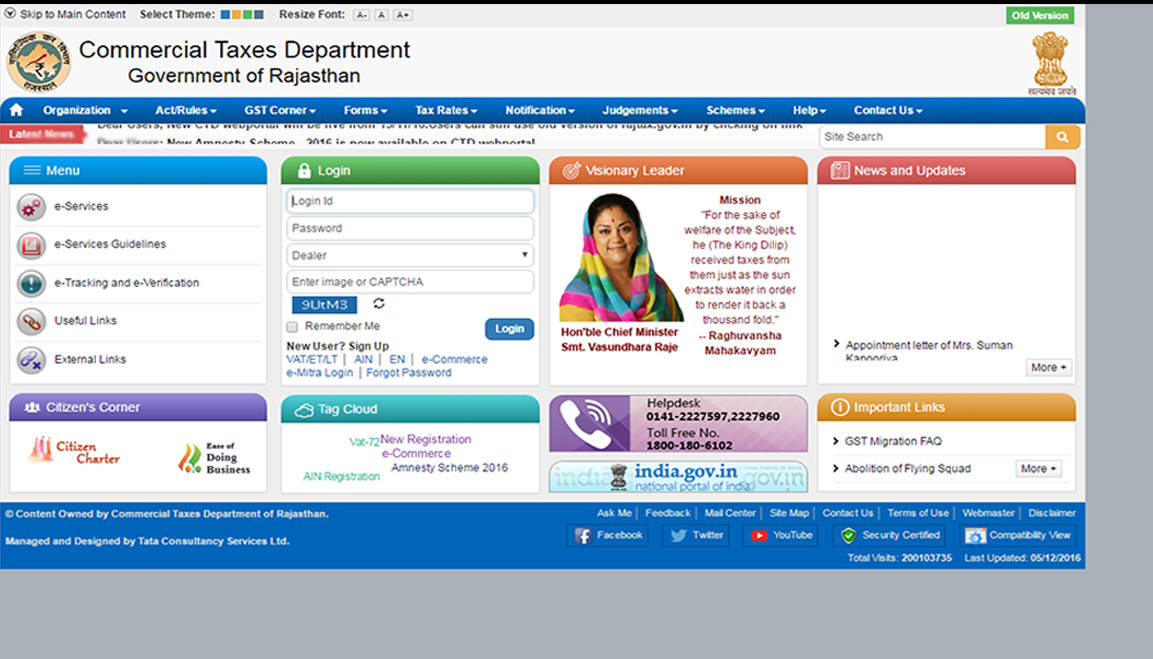

Step 1: Steps to get Provisional ID – Rajasthan

GST Migration starts From 16-December-2016 for Rajasthan State, Once Dealer will log in on Rajasthan Commercial Tax Department Portal. Open the Rajasthan vat site i.e. http://rajtax.gov.in/vatweb/ and enter user id and password of the client.

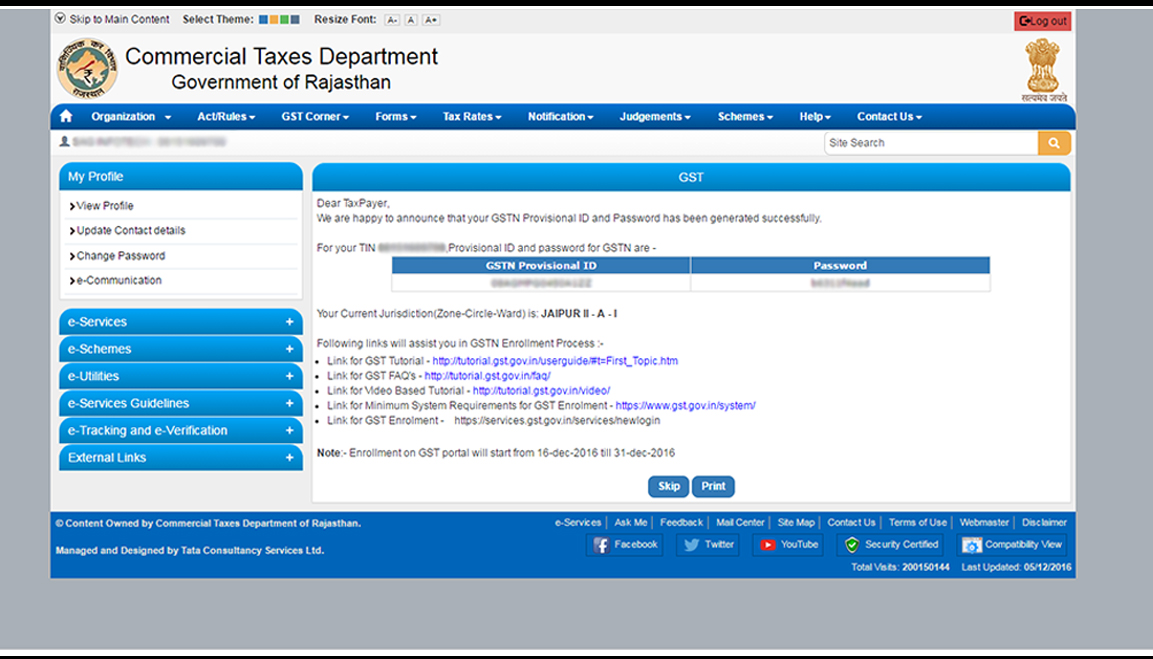

It will show pop-up window which will show details of GSTN Provisional Id and Temporary password on screen to enroll on GSTN Portal

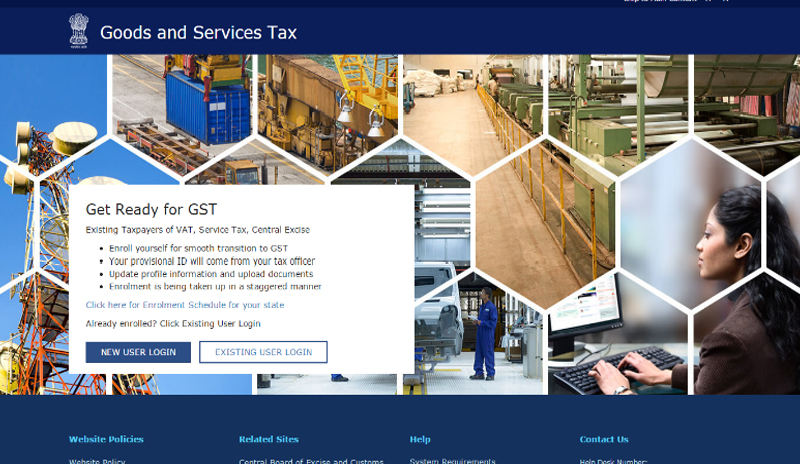

Step 2: How to Convert Provisional ID into GST User ID and Password

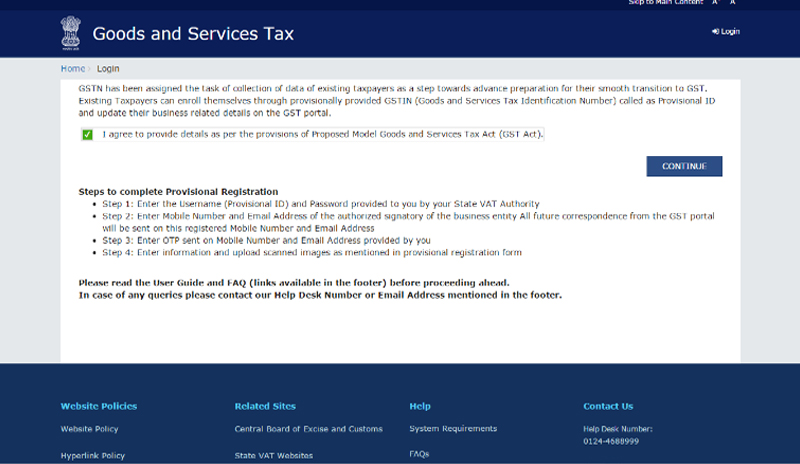

Go to www.gst.gov.in site

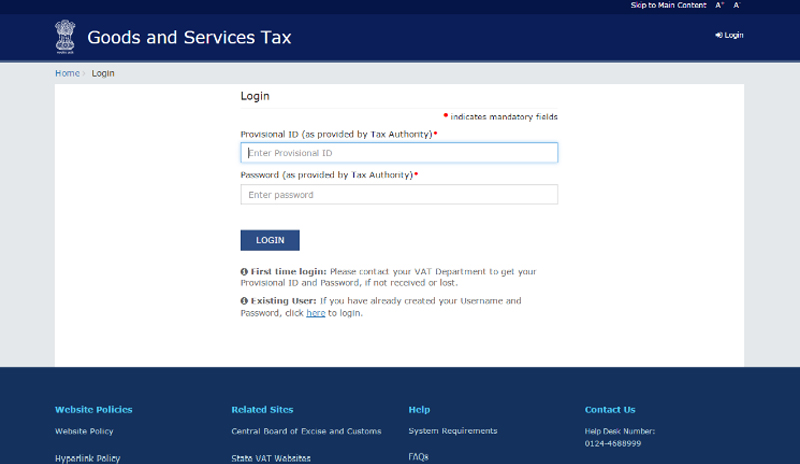

After Clicking on Continue button, enter provisional ID, and password:

After entering the details, enter mobile no. and email address

An OTP will generate and enter the same.

After that make a user id and password of your choice for the GST.

Step 3: Mandatory Requirements for Filling GST Registration Form

- Have your PAN card, Name, Address, Passport Number, Aadhar No available for updating them on the portal for the owner, authorized signatory, partners, proprietors, Karta of HUF, directors or partners of LLP.

- Keep handy of bank account number, IFSC code and bank address ready as well.

- Pick out all your required documents in soft copies as pdf / jpeg with each file size up to maximum 100 kb, ready for the quick migration process.

- Fill up the required details W.R.T. each page for registration. On successful updating of details, each page will show a right click mark

- Get the DSC of the applicant verified / registered beforehand on the GSTN portal.

- On complete updating of all required pages, the application shall be verified using the DCS of applicant or E-signature. As of date, there is no clarity on e-signature.

Recommended: Gen GST Registration Utility: Easy Way for GST Migration & Registration

in case of govt. dept. which have no bank a/c and its all transaction made through treasure then how to migrate in GST my question is what we fill in the bank detail so our profile will become complete.

Contact department for assistance.

Our Firm Is Registered Under Vat Normal Scheme. Now I Want Migrated To GST Composition Scheme. Then If I Transfer My Vat Closing Stock To Gst Composition Then What Amount I Pay To Reversal Of Credit Rule Basis. My Vat Credit Lager Is 0 Itc Balance. our Vat Rate 14.5 Percent, Gst Rate Is Our Product 28 Percent. Please Help Me And

Suggest Which Tax Rate I Pay 28 OR 14.5 To Our 30-06-2017 Stock.

Dear Madam,

Please help me for, I have taken GST file from other tax pratitioner ,but problem occured when I donot know user id and password and I search transaction id through gst portal but I want to know about user id and password What procedure should be adopted for receice id & password ….please guide me…

Dear madam, Plz help for last process verify. We send OTP receive and verify than show error what we can do, Plz help

dear madam,

I am ca final student and also be tax pratitioner, I have taken tin no. dated on 09/06/2017, but madam i have not yet received use id and password, i contact to sales tax department jalore but not proper response have received ,say that you will receive early id & password but what i should adopt procedure for receiving id & password. please tell me …

User id and password will be provided from 25th June if not given earlier.

thanks madam

1.from last two year i am registered in vat but want to register in Composition scheme because my total turnover is not more than 10 lacks. can suggest how can i change this. can i migrate in GST and then convert to Composition scheme.

2. if i want to close my firm and want to surrender my vat registration i also need to register in GST ?

please advice me what to do so confusion.

our Migration process are already done, but my GST no, are not generated.and GST portal are not open.

How can know my GST No.

hi shikha …

i would like to ask that.. in case of HUF …along with the details of karta (whose DSC we will be using further in filling form)..whether details of member (son ) as additional signatory is acceptable …and can he be also selected as primary signatory although in presence of karta (father)

I Am A Ca Final Student. My Advocate Is Not Giving Me My Gst User Id And Password And He Write Own Email id And Mobile No. In My Registration. I m Not Interested To Work In Future In Our Advocate.

What Remedy about Me.

How Can i Complete My Gst Registration Process.

If you know 5 secrets question answer which your advocate had filed. Then you can get your user id and password at new phone no. and mail id.

Hi shikha,

What is the last date for application for GST Form for ARN in Rajasthan?

and if the address is changed but will be effected in April/May 2017,should we fill details with old add or new add?

Department has extended the enrollment date till 30th April. And you can also fill your current address if you want to change your address in near future than to make an amendment for the same.

What is the Threshold limit for registration in GST (Rajasthan) ?

I am already registered in VAT-Composition scheme, what is the procedure for me ?

For all the assessee to all over India there are only 2 threshold limits one is Rs.20 lacs and for north eastern area there is Rs.10 lacs. For Rajasthan, if you are already registered composite dealer then go to VAT login page and get provisional Id from there and fill the form.

Dear Mam

I want to close my firm on 31/03/2017. in my case GST migration is required.

No in that situation, there is no need to get enrolment in GST.

no you don’t want to migrate in gst

deepesh singh

sales tax bikaner

Dear mam,

If it is possible than give a separate list of HSN code in your website or in GST portal, so we generate the complete details and than start working on utility. Or if possible than mail the list on my mail I’d.

Yup… we will try to provide the same as soon as possible.

Dear mam,

I have a proprietor of two firms , having two service tax registration.

how can migrated from service tax to gstn.

You have to apply for 2 GSTIN no. with your 2 different provisional ids.

How many Documents are uploaded on GST portal.

Please share in details.

for example: Period of Bank statment

There are many documents are there for uploading purpose.

Like

– for constitution of Business: upload Registration certificate,

– for Partner’s Proprietor information : Photos

– for authorized signatory : photos and proof of appointment of authorized signatory

– Principal Place of Business – Address proof (Electricity Bill/Bank Passbook/ Registration Certificate/ MOA or AOA ) etc.

-Bank Details : Bank Statement or first page of pass book

My Name Mithun Kumar

Email : mithun.kaiyar@gmail.com

I Liked your GST Solution for any help . my question is a vat from gst registration after than

wrong data appling in gst to can information data changing data , yes how to gst changing applying data

Yes, you can change data after 01 April 2017. That time department gives facility to change your data online.