Finance minister ruled the 42nd GST official meeting under the authority of the union finance and corporate affairs minister via video conferencing.

The finance minister advocated the revised need of declaring harmonised system nomenclature HSN for goods and service accounting SAC for the services of invoices and in form GSTR 1 that will be effected from April 1 2021. GSTR 1 is a monthly return

Firstly, it is recommended that HSN/SAC at 6 digits to supply goods and services for the taxpayers with an average turnover of Rs 5 crore.

Secondly, HSN/SAC at 4 digits for B2B goods and services supplies for assessee with average yearly turnover up to Rs. 5 crores. The third is the government which has the power to notify 8 digit HSN to notify the supply by the taxpayers.

The 42nd GST official meeting

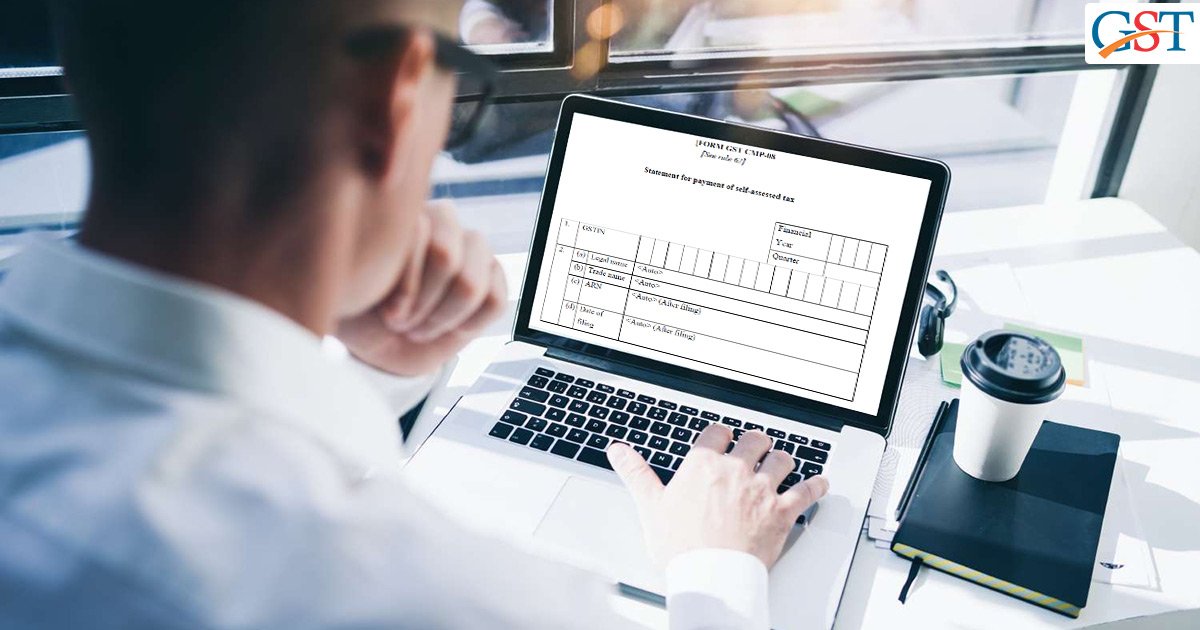

A composition dealer will use the GST form CMP-08

Moreover in CMP-08, by 30th April a composition dealer is required to file his/her yearly returns via the revised format of form GSTR 4 concluding the finishing of the financial year. The assessees who adopted the composition scheme needs CMP-08 in order to give payments for each quarter.