Input tax credit (ITC) benefit stated by the Madras High Court cannot be denied even if the column is mistakenly filled

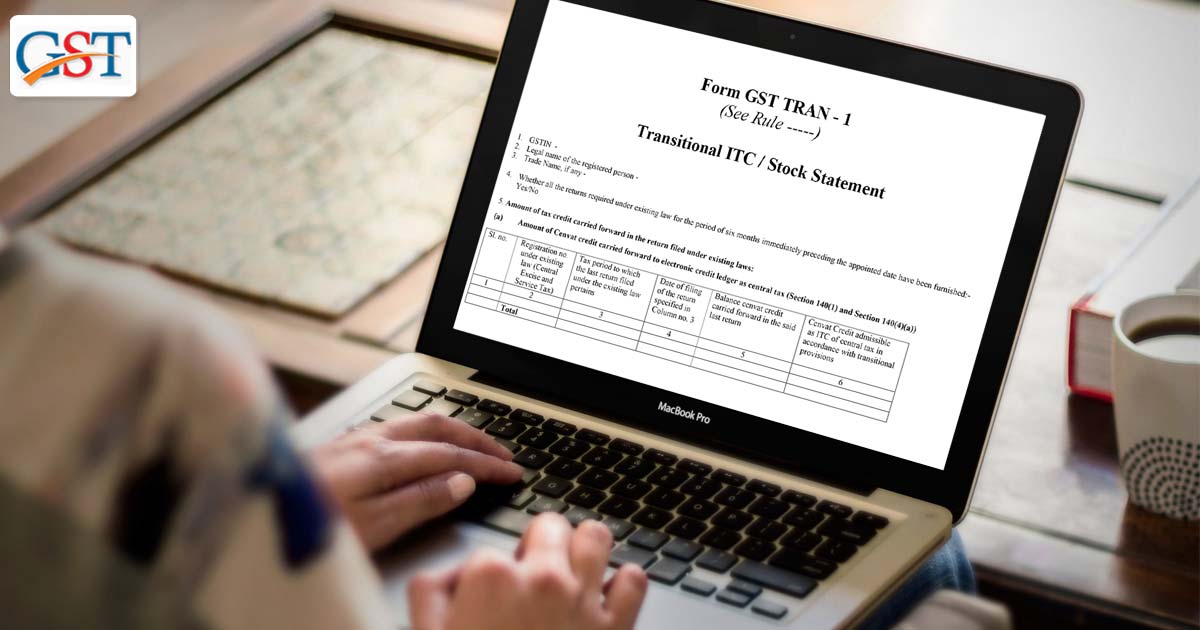

The applicant is the owner of Ram Auto and is a dealer in two-wheelers. He was enrolled under the taxpayer beneath Tamil Nadu Value Added Tax Act, 2006. The applicant held ITC to raise Rs 4,85,684, the mentioned are the introduction of GST regime transition and migrations from the system which was developed before. The applicant like any other dealer was needed to furnish the important GST TRAN-1

During furnishing the said Form rather than entering the information beneath column 7(a), the applicant falsely inserted the information with respect to column 7(d). Column 7(d) has been applied only for the cases of the stock of goods not supported through the invoices or credentials proofing the tax payment.

The applicant very much possesses the mandatory invoices or credentials proofing of tax. Since the applicant has not correctly inserted the information the applicant was not provided the credit beneath the latest GST regime.

The applicant has furnished the appeal in which it reveals that the mistake done through them was with an accident. Hence the applicant was unable to adjust the availed credit as from the present liability.

So to allow the jurisdictional Assistant Commissioner to take the actions needed information was filed through the applicant to the jurisdictional Superintendent of Central Central GST and Central Excise. The information filed through the applicant was verified duly and vide communication, the assistant of jurisdiction commissioner provided that the assessee’s request was original and that the mistake done through them was not with an intention and suggested their case to Goods and service tax network (GSTN) for acknowledgment. Despite providing the positive suggestion through the jurisdictional Assistant Commissioner there is nothing that took place. Hence the applicant repeated their request vide letter. In answer to it, the disputed communication came to be issued.

The jurisdictional Commissioner or first respondent answered the applicant that it is not possible for them to acknowledge the request of the applicant in absence of the particular court order.

Justice G.R.Swaminathan the judge saw that the applicant has furnished FORM GST TRAN-1 within the duration and he has been refused the advantage of ITC for entering the information in the wrong column.

During the persimmon given by the court, the respondent had stated to provide the application of the applicant to the respondent directly. The cross-appeal has been verified by the respondent which is discussed in the discussion of the jurisdictional Assistant Commissioner to the Commissioner of Central Taxes & Central Excise, Madurai. On the respondent who is being satisfied with the trueness of the similar object, the third respondent will provide the relief as sought through the writ applicant. The whole practice will be ended in the duration of 12 weeks.