It’s a fact that the GST (Goods and Services Tax) regime has brought about significant changes to the automobile industry in India. The government is very cautious, particularly for this sector, and the industry is adapting well to the new regulations.

GST subsumed nearly all previous taxes, such as excise, VAT, sales tax, road tax, motor vehicle tax, and registration duty. This has streamlined procedures within the automobile industry. The GST Bill was introduced to create a uniform tax structure across the country. Here’s a look at the GST rates applicable to cars in India after the latest updates.

56th GST Council Meeting Update

In the 56th GST Council meeting, the GST rate on the automobile sector was reduced from 28% to 18%. The revised rate will be applicable from 22nd September 2025.

| Automobiles Goods | Motor Vehicle for Transport of Goods |

|---|---|

| Motor Vehicle for Transport of Goods | 18% |

| Petrol & Petrol Hybrid, LPG, CNG Cars (Not exceeding 1200cc & 4000mm) | 18% |

| Diesel & Diesel Hybrid Cars (Not exceeding 1500cc & 4000mm) | 18% |

| 3 Wheeler Vehicles | 18% |

| Motocycles (Not exceeding 350cc) | 18% |

| Motocycles (Exceeding 350cc) | 40% |

| Petrol & Petrol Hybrid, LPG, CNG Cars (Exceeding- 1200cc & 4000mm) | 40% |

| Diesel & Diesel Hybrid Cars (Exceeding- 1500cc & 4000mm) | 40% |

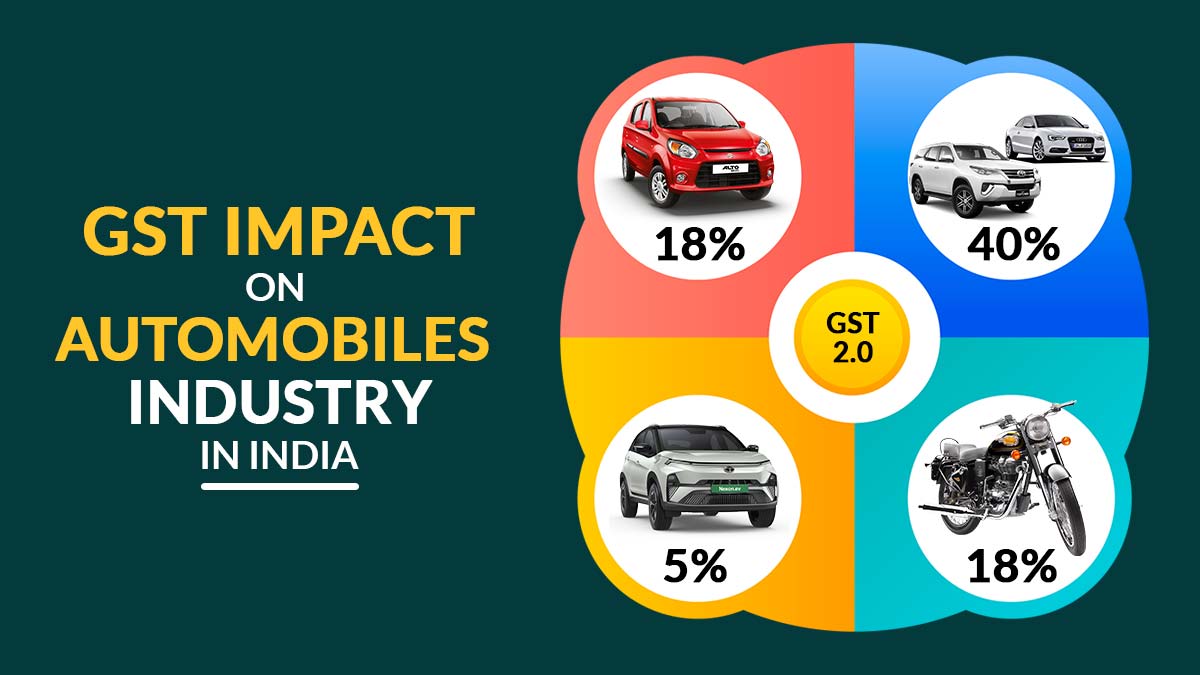

GST Rate Based on Car Category

Cars can be divided into 5 categories, so the GST rates are given below.

- Small Cars: Small cars like the Hyundai Grand i10, Tata Tiago, Maruti Suzuki Swift, and Volkswagen Polo now attract an 18% GST. This is a significant reduction compared to the previous rates (28% GST + Cess).

- Mid-size Cars: The tax rate on mid-sized cars like the Tata Nexon and Nissan Kicks has been adjusted to 40%. While the percentage may seem higher, the removal of previous taxes has effectively reduced the overall tax burden.

- Luxury Cars: Luxury car owners also benefit. For cars such as the Bugatti Chiron, Land Rover, and Lamborghini Aventador, only a 40% tax is now applied, a notable decrease from the previous total tax of over 42% (28% GST + Cess).

- SUVs: SUVs like the Renault Duster, Jeep Compass, and Maruti Vitara Brezza now attract a 40% GST, a substantial drop from the earlier total tax of 45-50%.

- Electric Vehicles: Electric vehicles will now be taxed at 5% GST

After engraving the GST Rates on Car Categories, here we are providing a comparison to mention the tax rates applicable to each car segment before and after the GST regime was implemented:

| Segment | Engine capacity | Tax Rates Before the 56th GST Council Meeting | GST Rate From 22nd September | Difference |

|---|---|---|---|---|

| Small cars | <1,200cc Petrol <1,500cc Diesel | 29-31% | 18% | -11% to -13% |

| Mid-size cars | 1,200cc to 1,500cc | 43-45% | 40% | -3% to -5% |

| Luxury cars | >1,500cc | 48-50% | 40% | -8% to -10% |

| SUVs | 1,500cc, >4000mm & 170mm+ Ground Clearance | 48-50% | 40% | -8% to -10% |

| Electric vehicles | All Sizes | 5% | 5% | No change |

In the previous form of taxation, advances received on goods supply did not attract Excise/VAT and composite rate while in some of the states, there is VAT applicable on used cars sales.

While many of the states do make available OEM Original Equipment Manufacturers (OEMs)/component manufacturers linked with various investment-linked incentive schemes. The significant components can be considered as interest-free loans and subsidies being attached with CST/VAT paid on the sales.

Read Also: GST vs VAT: Simple Way to Describe the Differences

It is also learned that the selling of goods and services unattached to a form of consideration is exempted from taxes under the service tax and VAT. While the dealers and importers are not eligible for the excise duty and CVD which is paid by the OEMs (Original Equipment Manufacturers). The current tax rules mentioned that VAT/CST is not applicable but excise duty is certainly on the tax part while transferring any goods from the manufacturer’s place and factories.

These vehicles have exemptions from auto cess/Nccd: electrically operated vehicles, three-wheeled vehicles, hydrogen vehicles based on fuel cell technology, vehicles used solely as taxis, the ones used by physically handicapped persons, and hospital ambulances.

GST Rate Based on Fuel Type

The GST Rate also depends on the fuel type the car uses, it is not that simple so let’s understand this.

- Sub-4-metre Cars

- Petrol engines less than 1.2l: Cars such as the Maruti Suzuki Dzire, Hyundai Grand i10, and Volkswagen Polo are now taxed at a total rate of 18%. This represents a significant reduction from the previous tax regime.

- Diesel engines more than 1.5l: Subcompact sedans (like the Honda City) and SUVs (like the Mahindra Scorpio) that have larger engines now attract a total tax of 40%. This is a reduction from the previous rate which was often 55% (28% GST + cess).

- Petrol engines more than 1.2l and diesel engines less than 1.5l: Subcompact sedans and subcompact SUVs with petrol engines larger than 1.2l and diesel engines smaller than 1.5l attract taxes equal to 40% decrease from the previous (28% GST plus cess).

- Larger than 4-metre SUVs: SUVs with petrol or diesel engines, regardless of displacement, such as the Mercedes-Benz GLC and Tata Hexa, are taxed at a total of 40%. This is a drop from the previous 55% (28% GST + cess).

- Larger than 4-metre non-SUVs: Hatchbacks and sedans with petrol engines larger than 1.2L and diesel engines larger than 1.5L, like the Maruti Suzuki Ciaz and Honda City, also have a 40% tax rate.

- Electric cars: Electric cars like the Mahindra eVerito are now required to pay a tax of 5%.

The table below shows the difference in the tax rates for each car segment based on fuel type, comparing the old regime with the new rates effective from September 22, 2025:

| Car type | Engine type | Fuel tank capacity | Tax Rates Before the 56th GST Council Meeting | GST Rate From 22nd September | Difference |

|---|---|---|---|---|---|

| Sub 4-metre cars | Petrol | <1.2l | 28% + cess | 18% | -10% |

| Diesel | >1.5l | 28% + cess | 18% | -10% | |

| Petrol, diesel | Petrol: More than 1.2l; Diesel: Less than 1.5l | 55% | 40% | -15% | |

| Larger than 4-metres SUVs | Petrol, Diesel | Any capacity | 55% | 40% | -15% |

| Larger than 4-metres non-SUVs | Petrol, diesel | Petrol: More than 1.2l; Diesel: More than 1.5l | 55% | 40% | -15% |

| Electric cars | Electric | NA | 20.5% | 5% | -15.5% |

Recommended: GST Master Class: Schedule and Time Table for Live Streaming

Impact of Current GST on the Vehicle Industry

The GST has been beneficial for the end consumer, dealer, as well as manufacturer. The Impact of GST on the automobile industry for each segment is as given below, make sure to take a look:

Consumer: As you can observe from above, the overall tax rate levied on automobiles currently has reduced significantly as compared to the rates applicable before GST. Due to the beneficial deduction owner has to pay a lower tax amount than before the introduction of GST.

Dealers/importers: Before the GST, Dealers and importers couldn’t claim VAT and excise duty, But Now after the GST inclusion Importers and dealers in the automobile industry are getting all the benefits from the new tax regime as they can claim the tax paid.

Manufacturers: The current GST system subsumes all previous taxes that reduce the overall cost of manufacturing. Therefore, carmakers also get all the benefits from the new tax regime. They are also reaching more customers.

The introduction of GST has been a great relief in automobile sectors it is a beneficial step because, besides the vehicle, services and warranties offered by carmakers are also taxed, and there is a discount in almost every stage. Some of them were not even taxed earlier but now almost everything is being taxed under the GST system.

Anyone can notice that the GST regime focuses on the consumption state more than the origin state, which provides a way better growth structure for the automobile industry.

Can you kindly mention the source of the tables shown in the article, which document or website you referred to as I need them?

Sorry,

I think the table is self made

Require more detailed information in the following separate points/categories… the influence of GST.

1. OEMs

2. Automobile Dealers

3. Auto components manufacturers

4. Auto components after sales

5. Auto components (intermediate) manufactures

6. The above aspects taking as tier 1, tier 2 & tier 3.. and explaining in-depth.

Dr Vijay Bhasker V.

Though it is too early to provide an in-depth analysis of cost per product post-GST implementation, as some ambiguity still remains due to incentives/exemptions provided by different states to the manufacturers/dealers for manufacturing car/bus/bike etc.

This information is different from different websites. So, I’m a bit confused.