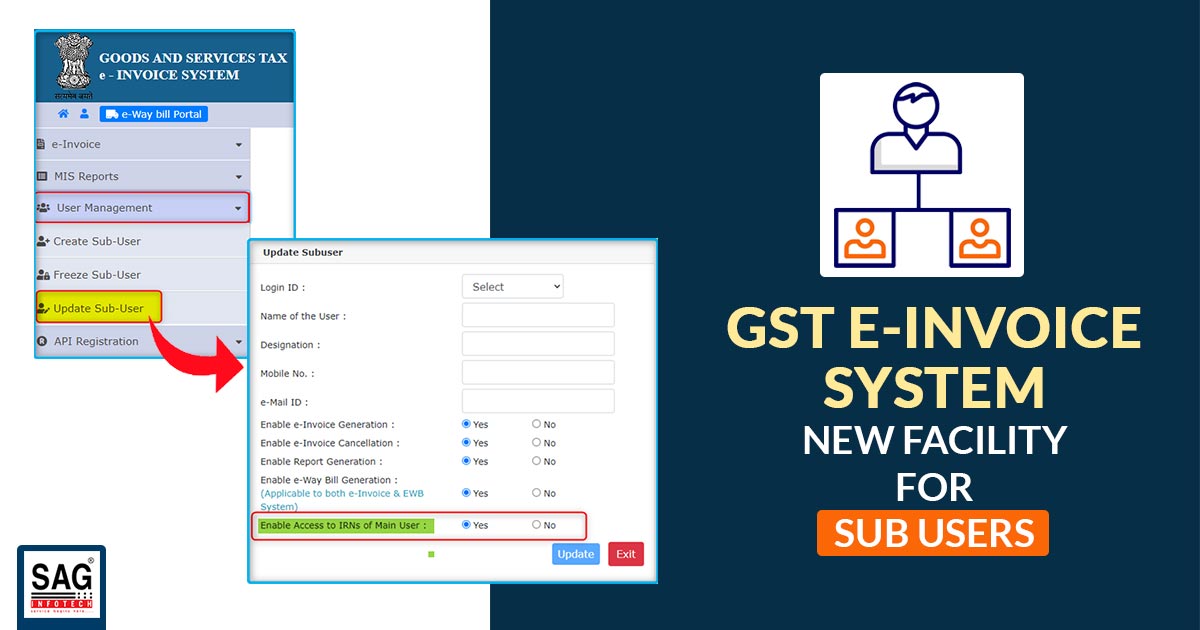

The latest update in the GST e-invoice system is launched. Beneath the new option, the sub-users would not get permitted to access the e-invoices made through the main user and perform the measures such as viewing, cancelling, and Generating E-Way Bill (EWB). The main user could use the update sub-user feature and nextly choose the needed sub-user from the given list.

As per the update opt for the sub-user from the given list. The latest option access to the IRNs of the main user would be given. For the case the main user wishes to provide access to the IRNs generated through him to the sub-user, he could choose Yes to the same option.

Read Also: GSTN New E-Invoice Verifier App for Easy and Accurate Verification

Keep in mind that one or all alternatives, such as Cancel, View report, and e-Waybill creation, must be given in addition to this. For instance, if enabling access to IRNs of the main user would have been chosen as Yes and enabling e-invoice cancellation would be opted as Yes, the IRNs generated through the main user can get cancelled by the sub-user.

Regarding E-invoices, the Goods and Services Tax Network (GSTN) has published guidelines. The advice lists the numerous E-invoice services offered by the just-launched Invoice Registration Portal (IRP). According to a recent update, starting on August 1, 2023, organizations with a turnover surpassing 5 crores would be required to use e-invoicing.

The 4 new IRPs would be

- Cygnet-IRP – (https://einvoice3.gst.gov.in)

- Clear-IRP – (https://einvoice4.gst.gov.in)

- EY-IRP – (https://einvoice5.gst.gov.in)

- IRIS-IRP -(https://einvoice6.gst.gov.in)