Goods and Service Tax (GST) is applicable to the salaries of the individuals posted as directors in the company, says Authority of Advance Ruling (AAR). Directors being the employees of the company have TDS and PF deductions from their salaries as per the laws applicable to their services.

In the application filed by a Clay and Craft India Pvt Ltd. in Authority of Advance Ruling (AAR)

The company further added that the directors are the employees of the company and they are paid with regular salaries and other allowances for the tasks they perform helping in the progress of the company.

The company is duly deducting Tax Deducted at Source (TDS) and PF from the salaries of the directors which clearly states that the format of their salary disperse is the same as other employees working for the company. Directors are the employees of the company that are paid for the services they render in the progress of the company and therefore in anyways, the salaries of the directors working for a company shall attract GST as well.

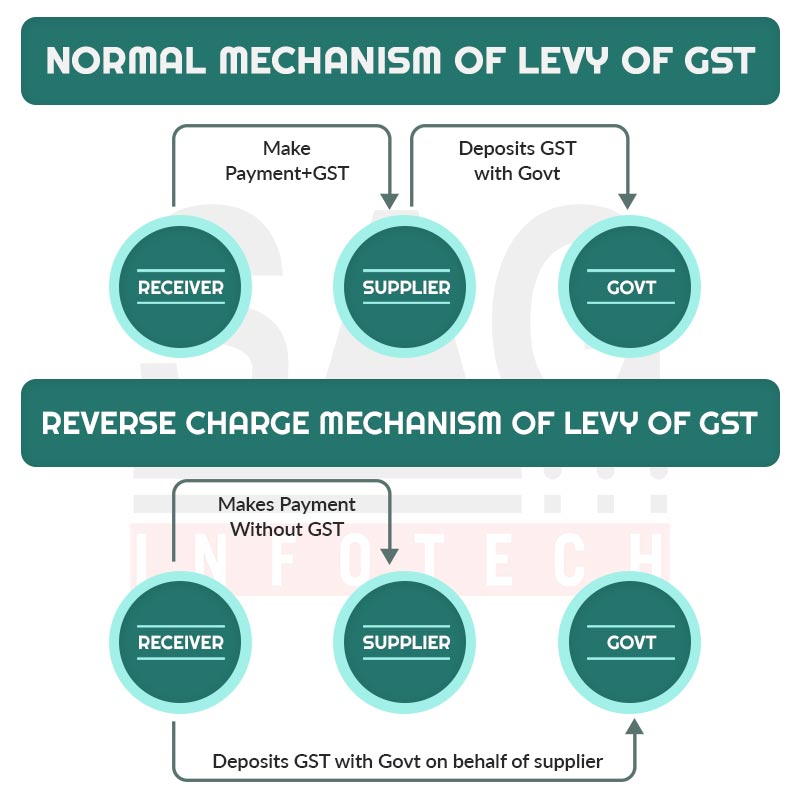

AAR said that the remuneration paid by the applicant company to the director will attract GST but in reverse charge mechanism. AAR here considered the Director as the supplier of services and the applicant is the recipient of the services.

The fact is even stated by the Central Tax notification which says that the director who serves as the supplier of services to the company for which he is working. So it is clear that the services given by the directors of the company shall not be exempted from GST. The remuneration given to the directors will have GST under RCM (Reverse Charge Mechanism)

dood! what about earlier years 2017-18, 2018-19? Whether director remuneration already paid as salary now needs to pay RCM in GST Audit?