The net GST revenue received in November month 2020 is Rs 1,04,963 cr where CGST comprises Rs 19,189 crore, SGST settled Rs 25,540 crore, IGST comprises Rs 51,992 crore along with Rs 22,078 crores received on import of goods and Cess is Rs 8,242crore as well as Rs 809 crores collected on import of goods. Rs 82 lakhs is the sum collected for GSTR 3B returns furnished

For CGST Rs 22,293 crore and Rs, 16,286 crores to SGST from IGST as the legitimate settlement is done by the government. The revenue received by central and state government post to normal settlement toward the month of November 2020 is Rs 41,482 crores toward CGST and Rs 41,826 crore concerning the SGST.

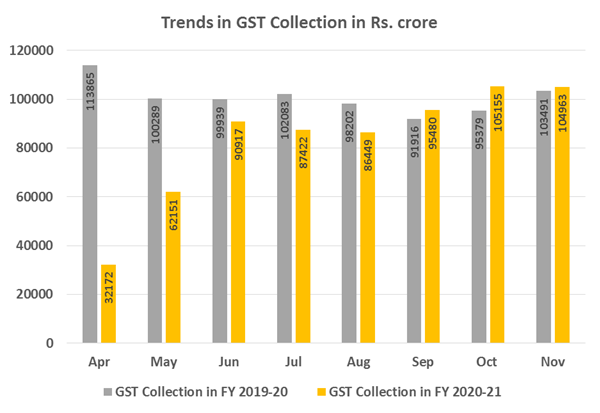

Trends in GST Revenues in INR Crore

Concern about the recovery of GST revenues due to the gone pandemic. The collected revenues for November 2020 are raised by 1.4% which is more than the GST revenues that have been received in the previous year. There is a rise of 4.9% in the import revenues during the month and the domestic transaction from import of services reported 0.5% more than the same month of last year.

The mentioned chart below indicates the net monthly GST revenues in the current year. The displayed statistics of GST collection for every state in November 2020 with respect to November 2019 is shown in Table.