GST collection crossed Rs 1.30 lakh crore mark for the 5th time. Revenues in Feb 2022 18% is more than the GST revenues in the similar month last year and 26% more than the GST revenues in Feb 2020

Rs 1,33,026 crore is the gross GST revenue obtained in Feb 2022 where the CGST stands at Rs 24,435 cr, SGST stands at Rs 30,779 cr, IGST is Rs 67,471 crore along with that Rs 33,837 crore collected on import of goods and cess is Rs 10,340 crore as well as Rs 638 crore collected on import of goods.

The government has settled Rs 26,347 cr to CGST and Rs 21,909 cr to SGST from IGST. The sum of revenue of the center and the states post to the regular settlement is Rs 50,782 cr towards CGST and Rs 52,688 crore for the SGST for the month of February 2022.

In February 2022 the revenues are higher by 18% as compared to the GST revenues in the identical month last year and 26% more than the GST revenues in February 2020. In the same month, the revenues via import of goods were 38% more and the revenues from the domestic transaction along with the import of services are 12% more with respect to the revenues from these sources in that month last year.

As February month comprises of 28 days and poses lesser revenues as compared to January month. The same growth in Feb 2022 is revealed in the partial lockdowns, weekend and night curfews and various restrictions were there through different states because of the Omicron wave, which was higher around 20th January.

It was the 5th time the GST collection has crossed Rs 1.30 lakh cr. since the start of GST for the first time the GST has crossed Rs 10000 cr which points to the recovery of specific sectors, particularly automobiles sales.

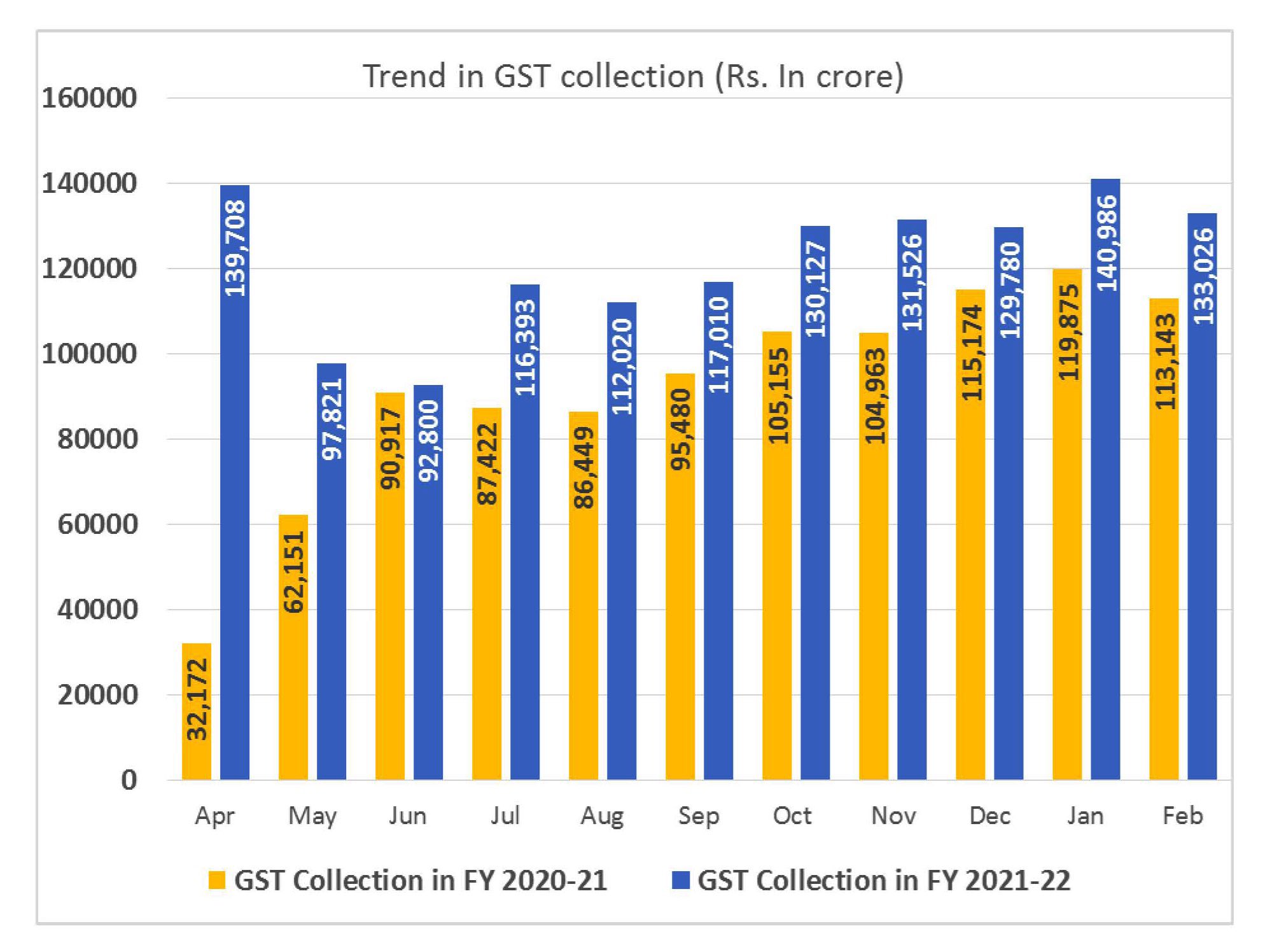

The chart below mentioned the trends in monthly gross GST revenues in the present year. The table represents the state-wise figures of GST collected in every state for the month of Feb 2022 with respect to Feb 2021.