The government is taking the actions with respect to the declarations done by the GST department written in Notification No. 94/2020 – Central Tax, which notifies the CGST (Fourteenth Amendment) Rules, 2020. The GST enrollment concerned procedure is changed by the notification besides providing extensive authority to cancel or suspend the existing enrollment of the GST council. The GST council has refused nearly 1.63 lakh non-compliant and doubtful GST registrations

Changes & Recommendations is Mentioned:

- A new sub-rule (4A) is initiated in Rule 8 of CGST Rules 2017, which gives out GST registrations. This new sub-rule will make the GST council to receive Aadhar biometric information through petitioners or related allowed individuals.

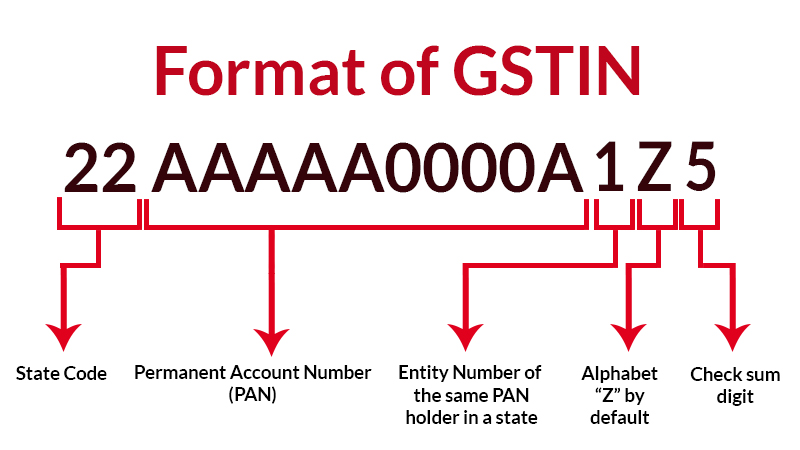

- To cancel the GST identification numbers the GST jurisdictional officer has the authority to cancel the GST identification numbers (GSTIN)

- The officer has the authority to carry on through the cancellation of enrollment on the less liabilities inside GSTR 3B stated under GSTR 1 for a particular month

- There is no chance to be given to the assessee for hearing concerning the extension of GSTIN in which the proper officer has no answer to trust that the enrollment of the individual is entitled to get refused for breach which is written in Rule 21. “opportunity of being heard” has been omitted from clause (2) of Rule 21A

- The breach is displayed as there is enough deviations in information of the outward supply in GSTR 3B face to face GSTR1 or inward supplies (ITC) in GSTR 3B vis-a-vis GSTR 2B, the council can now gives a notice in FORM GST REG 31 urging an answer that why GSTIN should not be cancelled

- An assessee will not be able to claim the no refund u/s 54 of CGST Act 2017 in which a GSTIN has been suspended

What Answer is Being Given Through the Ends?

As it has been declared above that these new changes seem to allow extensive powers to the GST council to collect information and refuse GST enrollment if they trust that the assessee to be in breach of particular procurement of GST legislation.

To enhance the process of GST enrollment the Aadhar authentication feature

The Authority Directed to Responsibility

GST officials have to do a lot of effort to check out the bogus GST and tax theft cases and are spreaded with large amounts in the past 2 years. The government seems to be explained in doing the technology along with data analytics to deal with the problem, however, it has been the matter with the past initiatives it is the technology that has proven to be the weak spot in doing any large initiative.