The 24 schemes are somehow free as the Insurance premiums do not attract GST. However, GST would have been levied on the reinsurance as part of the insurance premium charge. These would have been collected by the insurance companies and shared with the centre and state governments.

In its 25th meeting held on January 18, 2018, The GST Council approved the proposal to exempt reinsurance schemes in respect of specified insurance plans. The IRDAI has requested Insurance Companies to ensure that the benefits of reduction in premiums must trickle down to the beneficiaries and the state and central exchequers.

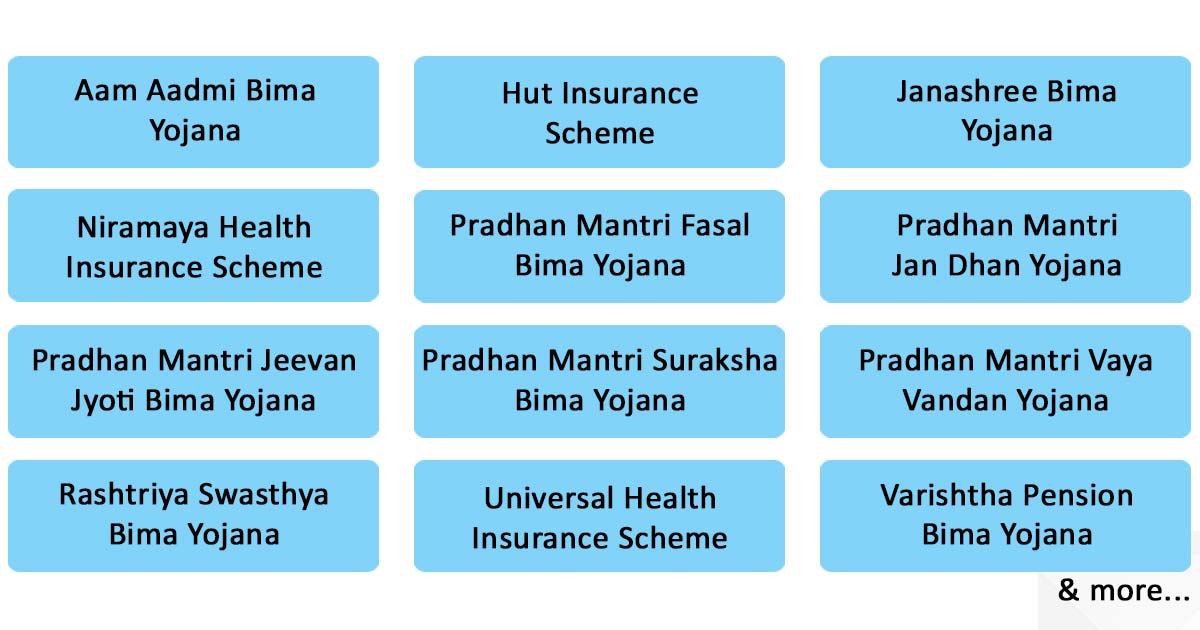

Some of the important schemes which are part of the list approved by the GST Council include : Pradhan Mantri Suraksha Bima Yojana, Janashree Bima Yojana, Pradhan Mantri Fasal Bima Yojana, Universal Health Insurance Scheme, Rashtriya Swasthya Bima Yojana, Aam Aadmi Bina Yojana, Varishtha Pension Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Vaya Vandan Yojana, Hut Insurance Scheme, Niramaya Health Insurance Scheme, etc.

Read Also: Goods and Services Tax Impact on Insurance Industry in India