The Gen GST Software now features a new facility to ease compliance and quickly communicate between Suppliers and Receivers each other regarding taxation work.

What is Communication Between Taxpayers?

It is a new feature of the Gen GST Software that enables communication and coordination between Suppliers and Receivers with respect to various tax-related matters.

This facility provides a platform for both parties to exchange information, resolve any issues, and ensure compliance with the relevant tax laws and regulations. This feature aims to improve the overall tax payment process and provide a seamless experience for taxpayers.

How Does Email Functionality Work?

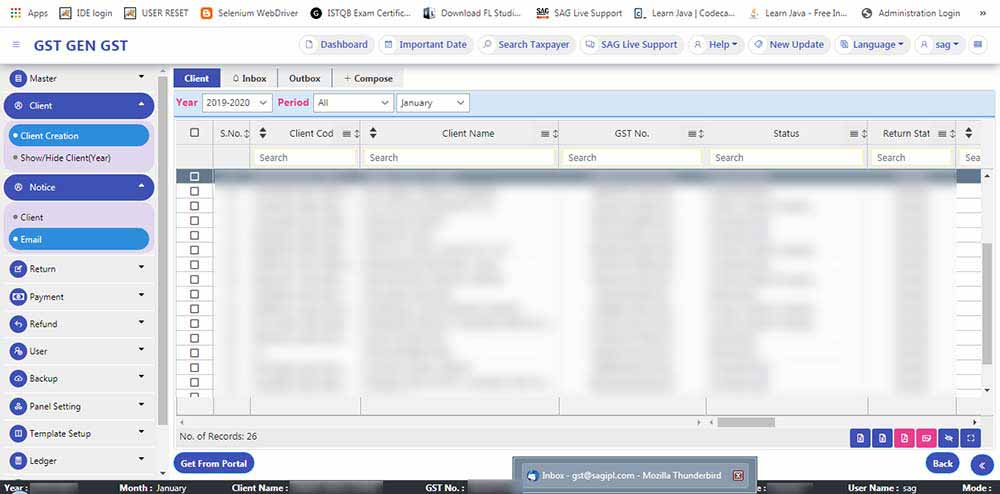

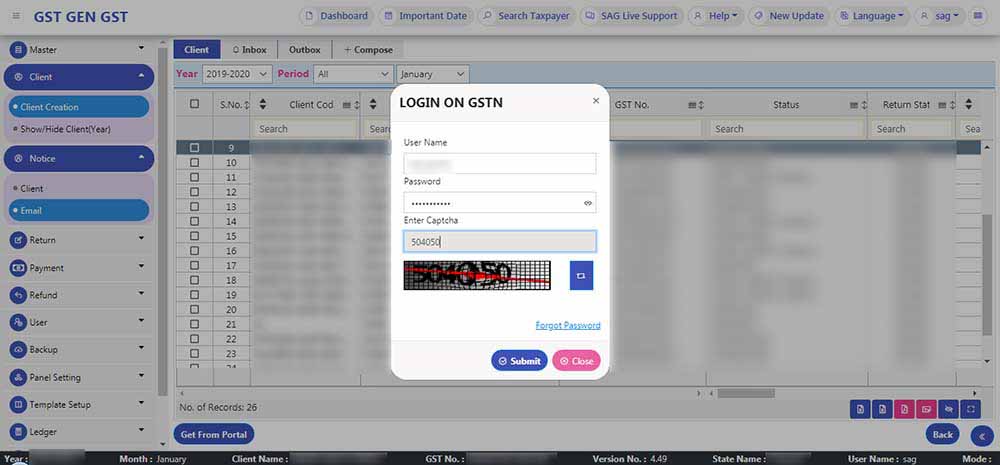

Step 1: The facility is available in our Gen GST cloud software, where the receiver & supplier can receive & compose their mail.

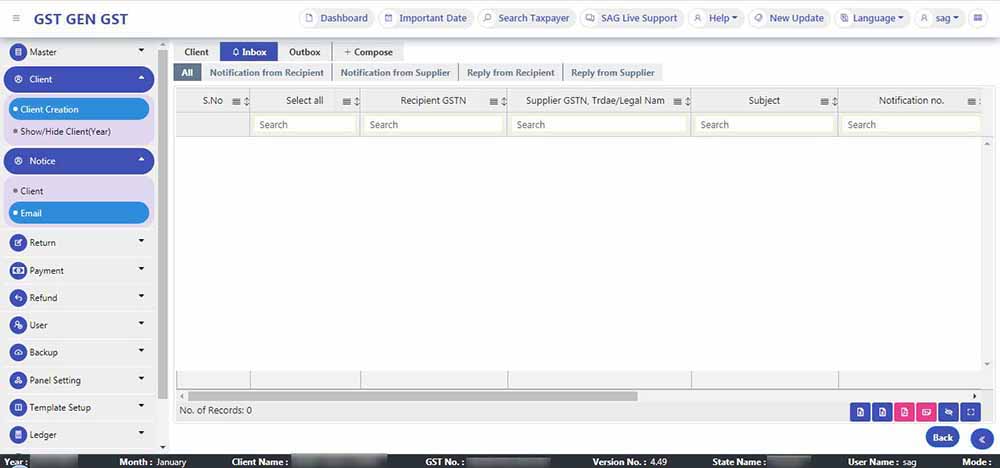

Step 2: After that, if you have any inbox messages then it will be reflected in this inbox screen. Inbox consists of 5 tabs

- All

- Notification from Recipients

- Notification from Supplier

- Reply from Recipients

- Reply from Supplier

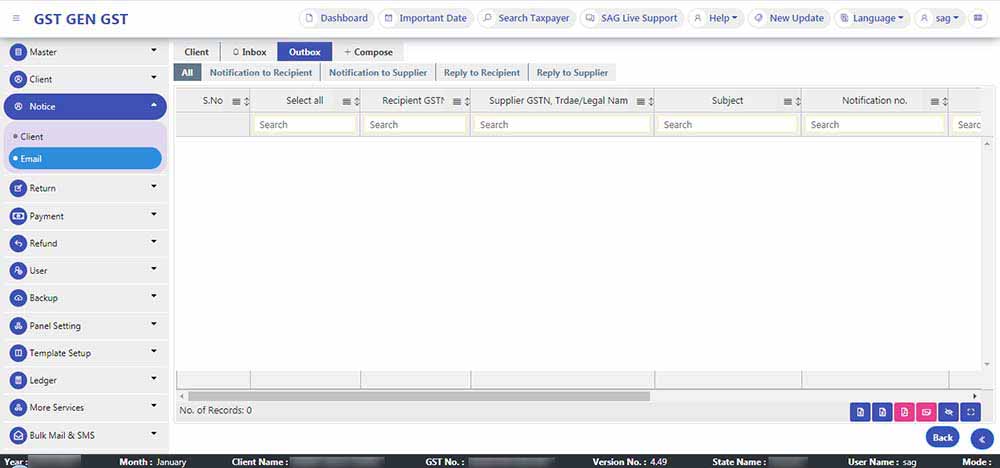

Step 3: In the same way, if you have any outbox message it will be reflected in the outbox screen. Outbox consist of 5 tabs:

- All

- Notification to Recipients

- Notification to Supplier

- Reply to Recipients

- Reply to Supplier

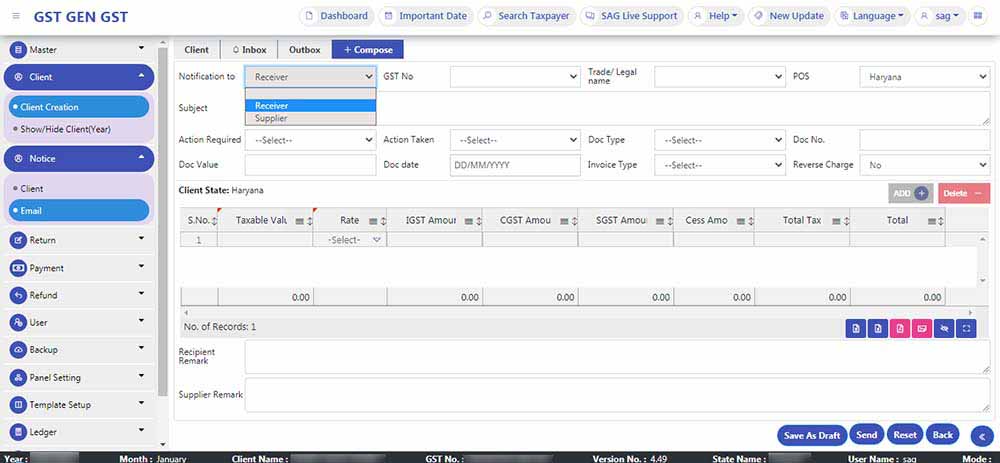

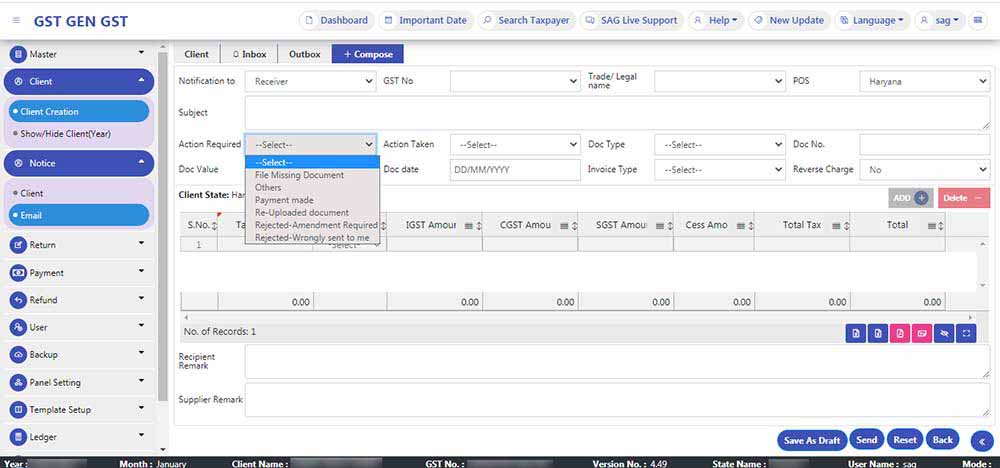

Step 4: If you want to compose mail then click on compose button. You have to select the Action required, filling all the mandatory fields & Remark

Step 5: After that, you can either save the details as a draft or send the same to the concerned parties

Read Also: Gen GST Software E-Mail and WhatsApp Facility for Reports