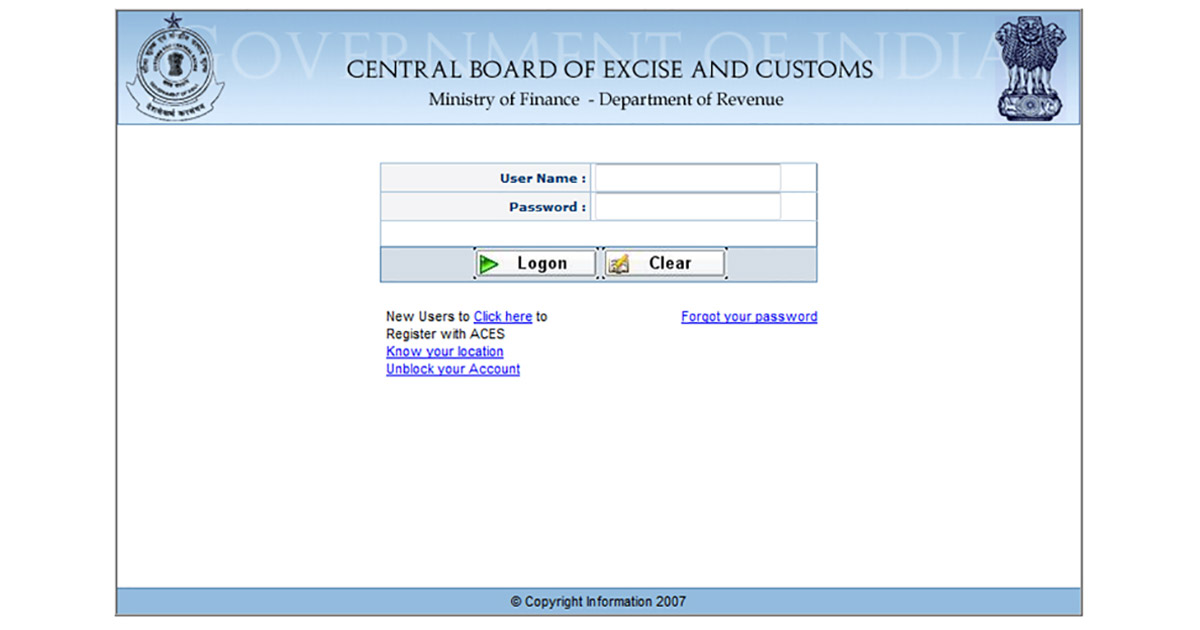

Gen Service Tax is a free trial program developed by Sag Infotech Pvt. Ltd. via, which you can avail the service of filing your returns for a maximum of 10 hours. This handy tool provides you the facility for preparing your service tax returns, upload your ST-3 returns and online registration to ACES. The best part of this software is the time limit it is providing. You do not need to worry even if you have done your work only for half an hour, still you get 9.5 hours remaining in your account to carry on from where you left before.

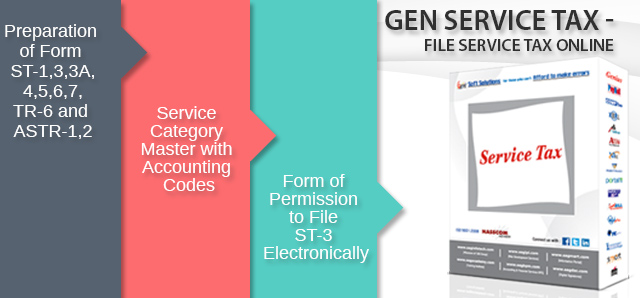

The product delivers you major features and benefits. Some of them includes online Registration of ST-1, Amendment in ST-1, Master Data Import from ST-1, Preparation of ST-3, Filling of ST-3 in Offline and Online Mode, E-Payment and printing of GAR-7 Challan. Moreover, the Gen Service Tax composes CENVAT registers with a periodic CENVAT summary and Auto Calculation. Of Interest, Late Fees and Penalty. ST-3 form can be easily prepared by the user via modes like excel or XML. After filling the form online, he can generate acknowledgement and return form of the same via our software.