On a strict basis, the Registrar of Companies has announced a notice of de-registration of all those companies listed under the non-compliance matter. All the companies which have not filed returns under the ROC in previous three years are back-lashed by the department, and the department has started case filing against all the companies including shell companies which the reports suggest that there are nearly one-third of them in total 11 lakh companies registered.

Till now, the tax department has sent notices to around 4 lakh such companies in the concern of non-compliance in registration. According to the sources, in the year 2013-14 and 2014-15, the companies didn’t filed returns with the Registrar of companies nor the companies filed returns in the 2015-16 year for the same process which has given the clue to the Ministry of corporate affairs to initiate actions against these companies.

The relaxation is only for 30 days and after that government can write off all those companies from the ROC list. Ministry of Corporate Affairs has also ensured that the de-registered companies can not transact and will publicize the names of the companies, therefore. According to the reports, there were 14.6 lakh companies in the March 2015 in which there were around 10.2 lakh companies active.

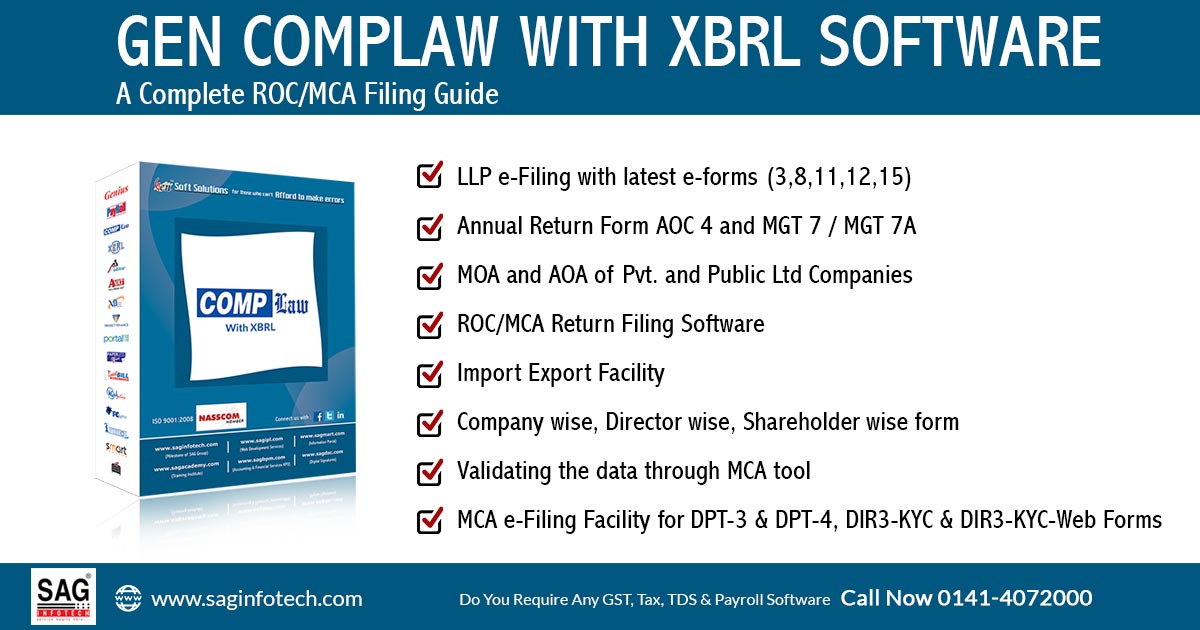

SAG Infotech offers perfect software tools for avoiding such kinds of situations and has been offering Gen Comp Law: MCA e-Filing Software with XBRL to file the relevant details and registration under the companies act, Ministry of Corporate Affairs.

Source: http://www.mca.gov.in/Ministry/pdf/ROCJaipur_08042017.pdf