The most prominent software in the market that files TDS returns easily is Gen TDS with an upgraded version 2.25.4.1; it includes all the required specifications that help in furnishing returns. Furthermore, Gen TDS software is an easier and user-friendly platform that is specially made to file the TCS along with TDS returns under the regulations of the TRACES in India.

The other special features of this TDS software can determine the TDS amount, calculate interest, along with a penalty of late fine fees and determine the TDS return as well. It is a government-approved software for the assessee.

The software is giving its full hardship to come out as the most acknowledged software throughout the leading brands and urged to be recognised in furnishing the software. In the financial year 2012-13, it came in the leading rank in the allowed Gen TDS return filing software list of the Indian government.

Need a Free Demo of TDS Return Filing Software

Process of Furnishing TDS Returns via Gen TDS Software

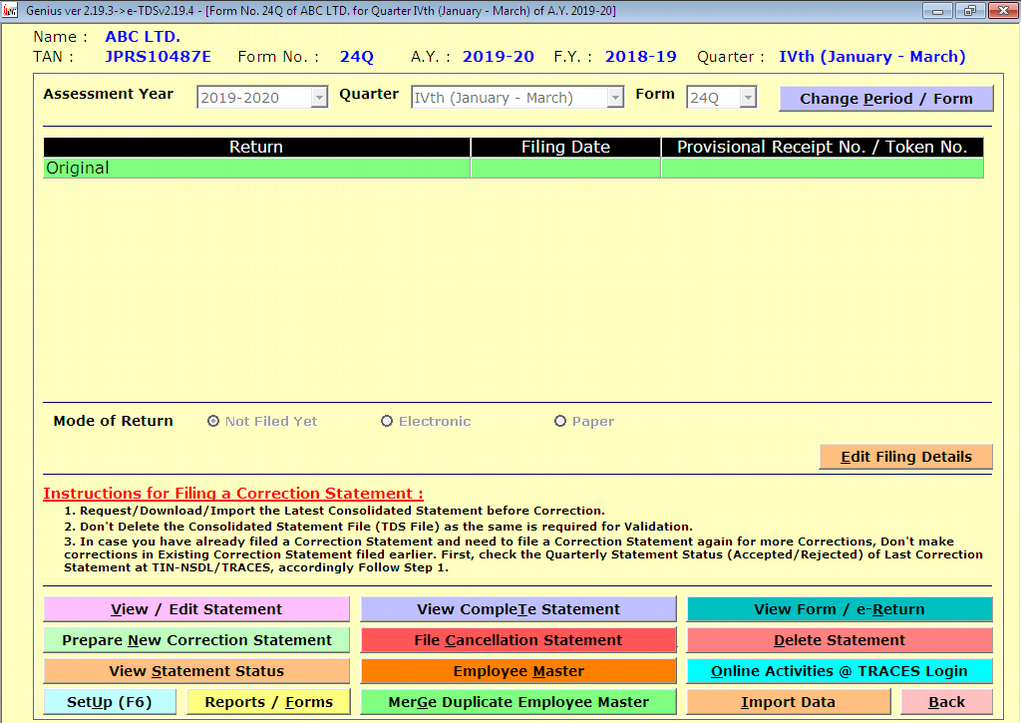

Step-1 The users should click on the TDS Forms option from the above-provided list. Post that the users should opt to view and edit the statement.

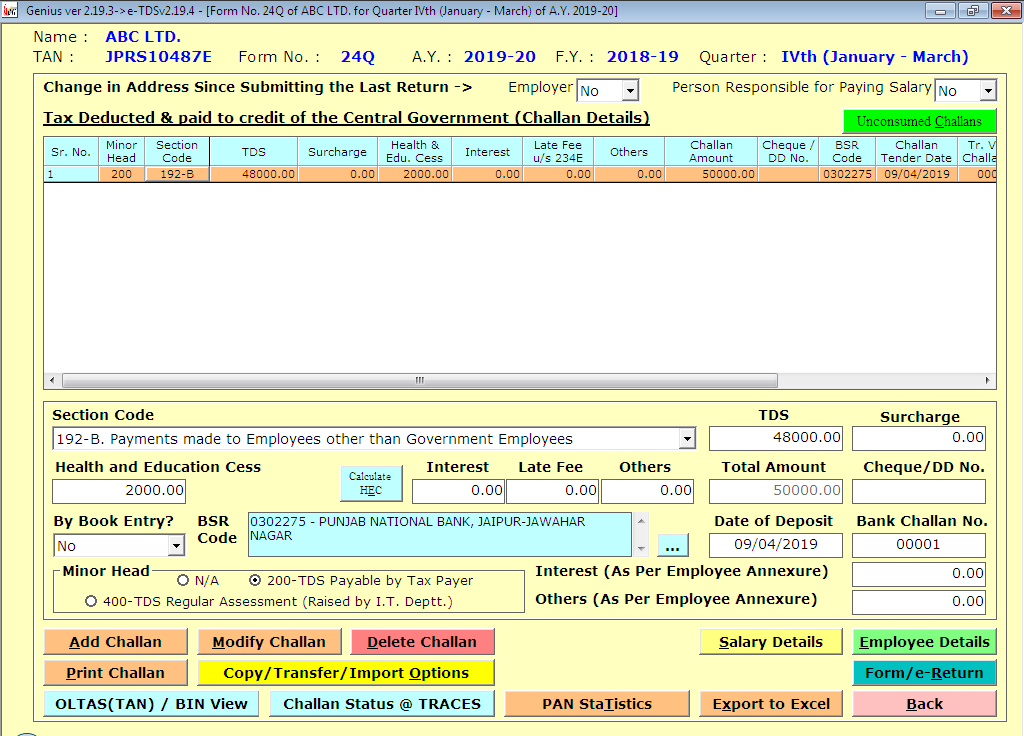

Step-2 In this process the users should give their information related to challan by clicking the Add challan option. For simple use, you might import the unused challans from the traces.

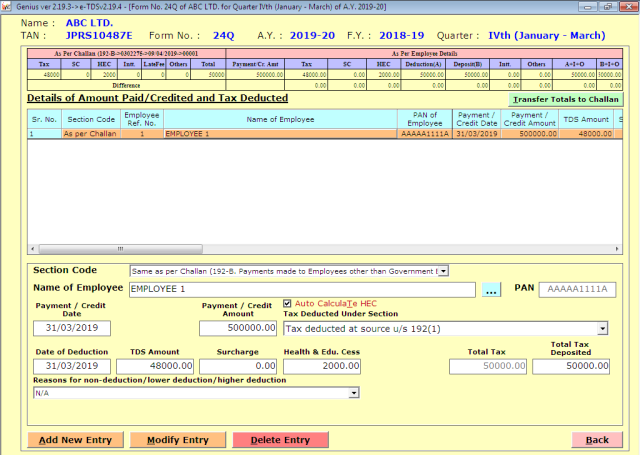

Step-3 The users should give the employee details which are mentioned on the specific challan by tapping on the “Employee/Deductee Details” option.

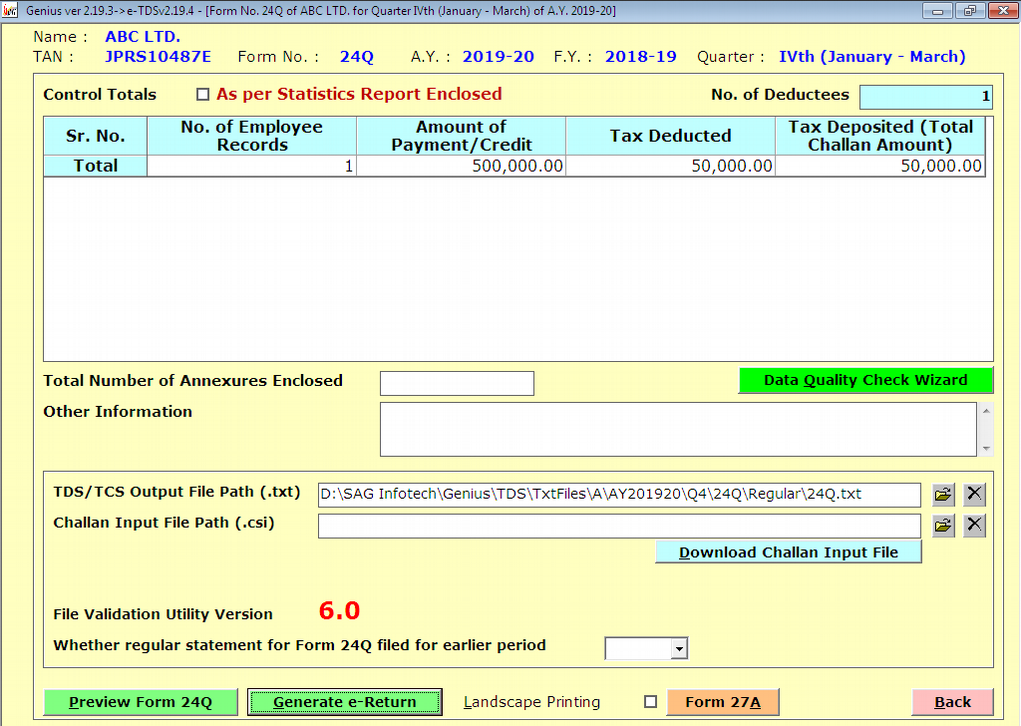

Step 4: When the user inscribes the information related to the employee, then he/she should return to the main page by tapping on the View Form/E return option.

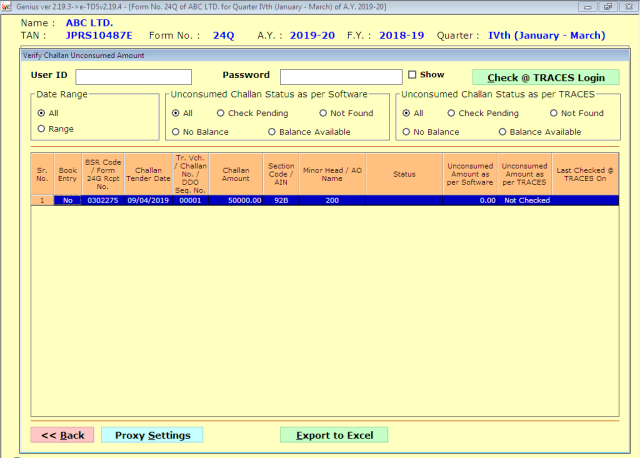

Step 5 To verify the challan status from the Traces & Olta then the customer should Tap on the “Generate e-return” option.

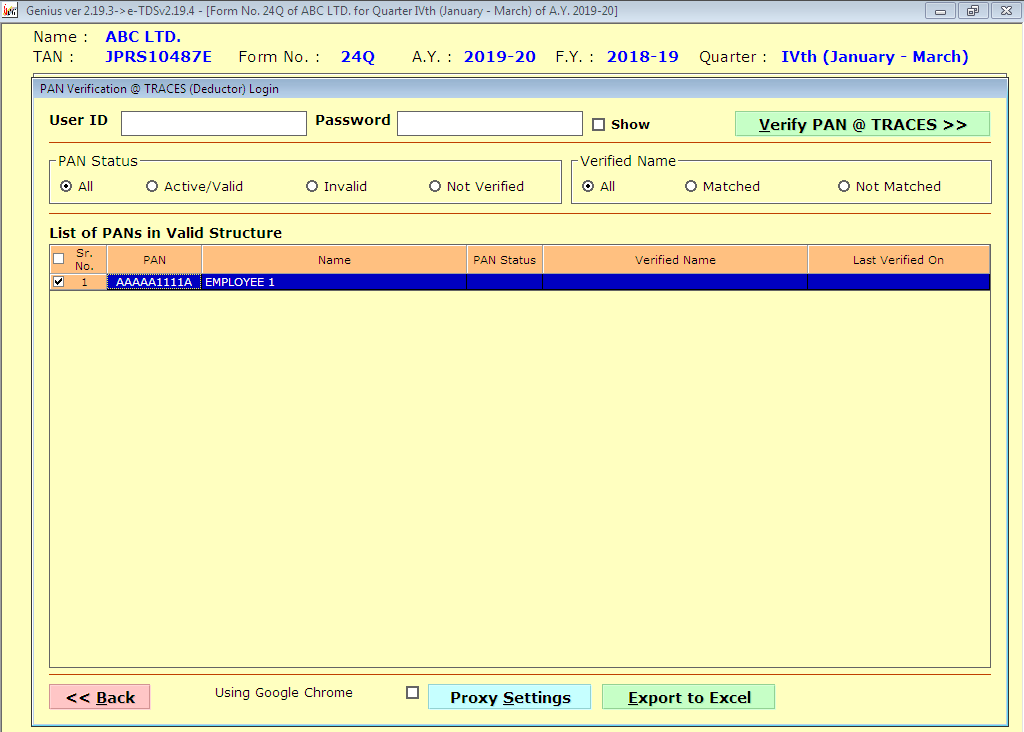

Step-6 The user might verify the PAN status of the deductees from the traces.

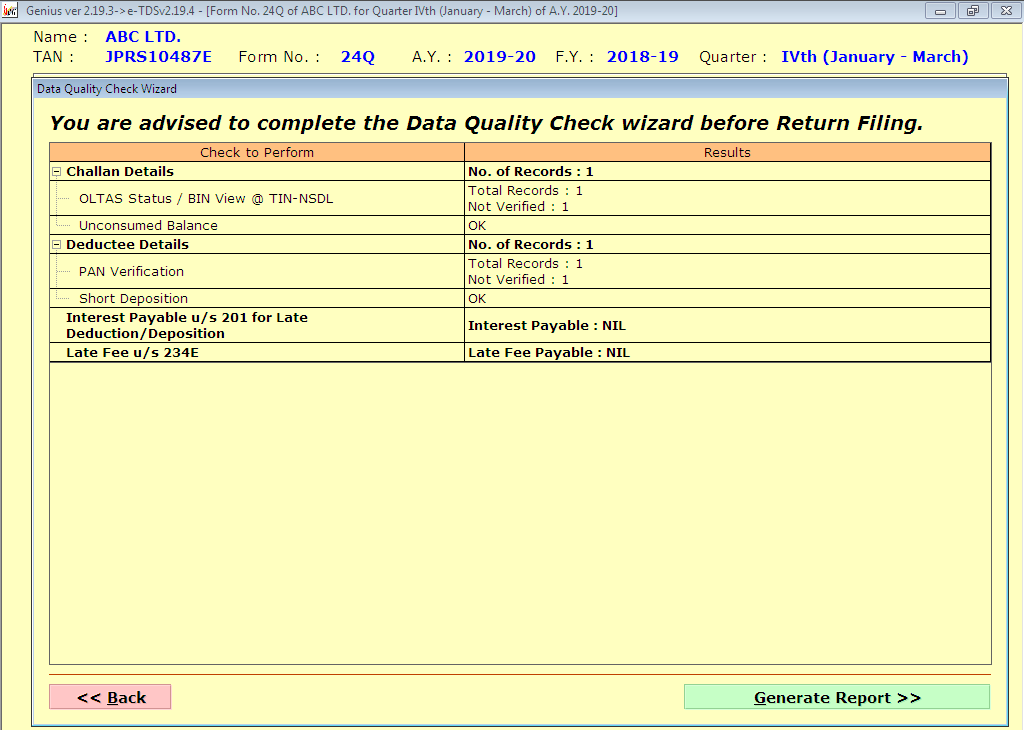

Step-7 The customer will be given a short report as presented in the section.

Read Also: Best TDS Software for CA & Professionals in India

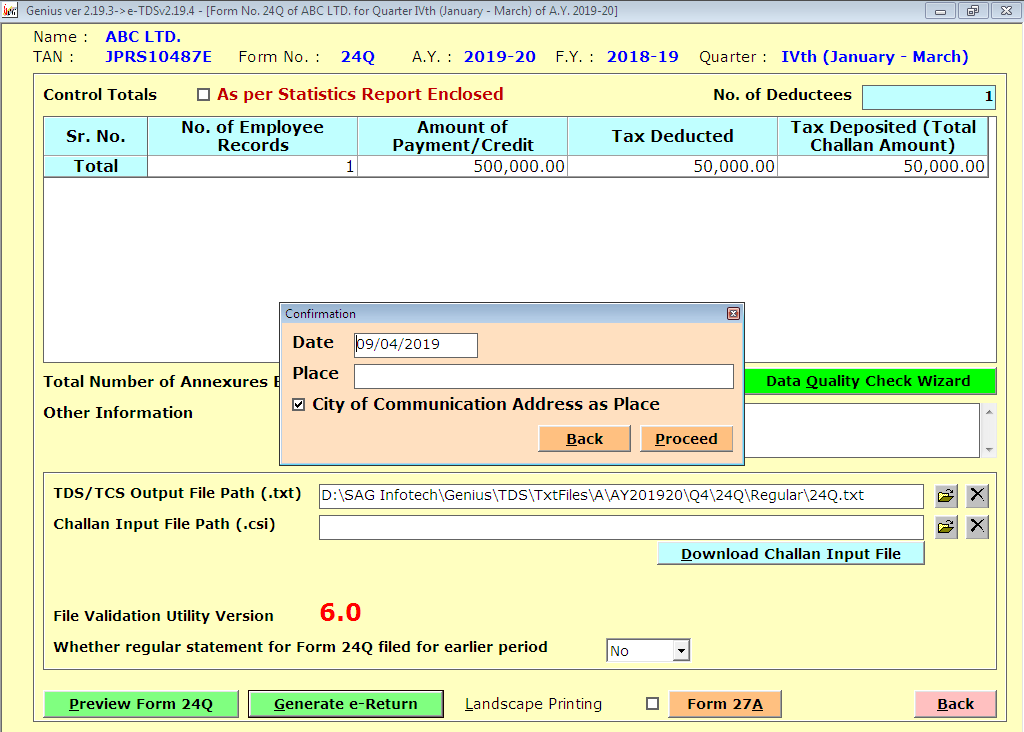

Step-8 In this step, the customer should tap on the Proceed option as given below and by tapping on the similar button, the FVU file shall be displayed, which might be uploaded through the customer online. The file might also be submitted manually through IN FC.

SAG Infotech Private Limited company provides free Gen TDS software for TDS returns filing for 5 active hours. Now file your TDS return on time with no error through the Gen TDS filing tool.