The government launched a feature for filing the NIL GST Returns in Form GSTR 3B through SMS on Monday. The feature was added to make the tax compliance easier for the assessments. The assessees can now file their return through SMS instead of filing them online by logging in to their accounts on the common return filing portal every month.

The feature will prove to be beneficial for over 22 lakh assessees. The assessees with NIL tax liability can avail the benefit of the feature from now on to file the GST returns Form GSTR 3B

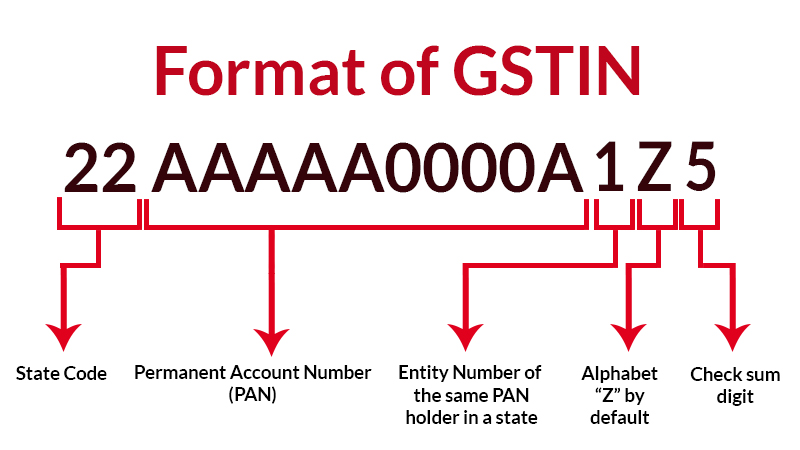

The assessees availing the benefit of the feature and filing the returns through SMS can track the status of the return easily through the portal of GST (Goods and Services Tax) by logging in to the GSTIN (GST Identification Number)

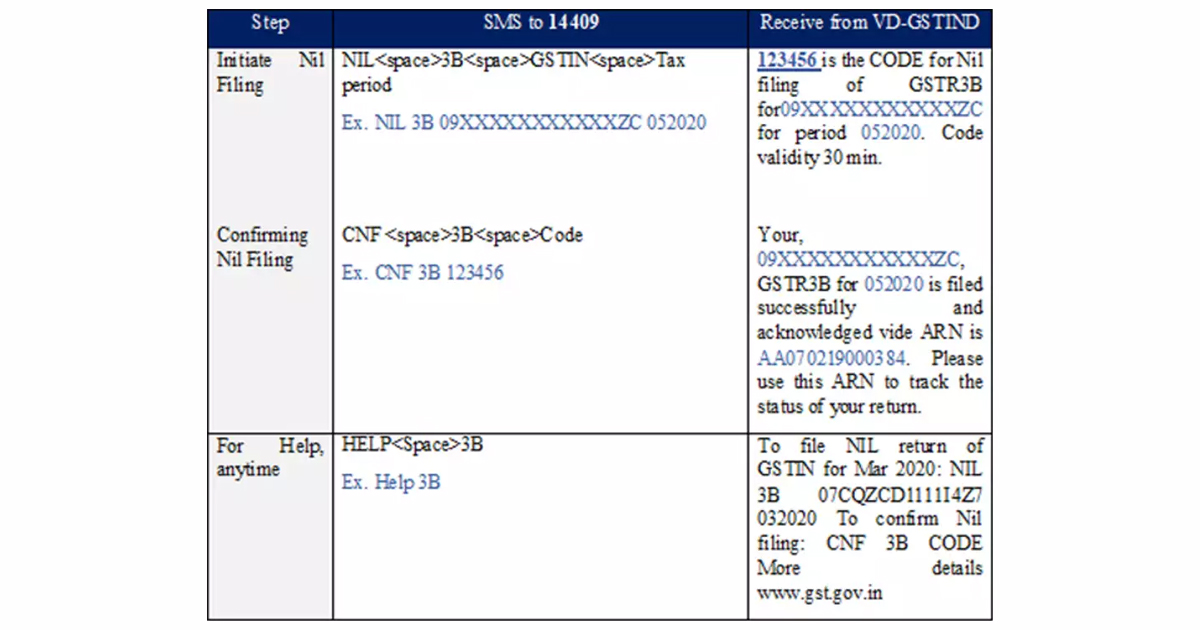

The Procedure to File the Return will be as Follows

“This is a good move by the Government to ease the compliance burden for taxpayers with nil liability. India ranks a lowly 115 out of around 190 countries in ease of paying taxes, and such initiatives are definitely needed to make the compliances easy, less time consuming, and in line with global best practices,” said Harpreet Singh, Partner, KPMG India.