What is the Income Tax Return (ITR) 1 Form?

ITR 1 Form is filed by the taxpayers and the individuals being a residents (other than Not Ordinarily Resident) having a total Income up to INR 50 lakhs, having Income from Salaries, One House Property, Other Sources (Interest etc), and Agricultural Income up to INR 5 thousand. (Not for an Individual who is either a Director in a company or has invested in Unlisted Equity Shares). Also, to note down, from now onwards, as mentioned by the tax department, furnishing PAN and Aadhaar card details on the official website of the Income Tax Department is mandatory.

The income tax department has notified ITR forms for taxpayers based on their source of income in order to create a simple tax compliance structure. Therefore, you are required to furnish the return as per the source of your income.

- What is the ITR 1 Form

- Eligibility To File ITR 1 Online

- Not Eligible for ITR 1 Filing Online

- Penalty if Miss ITR Filing

- Modifications in ITR 1 Sahaj Form

- Due Date for ITR 1

- File ITR 1 Via Gen IT Software

- Guide to File ITR 1 Online

- Medium To Online Furnish ITR 1

- File ITR 1 Online or Electronically

- File ITR 1 SAHAJ Form Offline

- ITR-1 SAHAJ Form Important Terms

- General Queries on ITR 1 Form

File ITR 1 Form Via Gen IT Software, Get Demo!

Latest Update in ITR-1 Sahaj Form

- The ITR-1 Excel-based utility (version 1.7), which includes e-filing under section 139(8A), is now available for taxpayers. Download Now

Read Also: Gen IT Software – Fastest & Easy Income Tax Return E-Filing Software

Eligibility To File ITR 1 Online For AY 2025-26

ITR-1 is filed by taxpayers whose income is up to Rs 50 lakhs from the following sources:

- If the income is from one house property (the case where losses of previous years are carried forward are not included in this ITR)

- If the source of income is a pension or a salary

- If the source of income is from other sources

- If the clubbed income of the minor or wife is shown, then ITR-1 can be filed only in case their source of income is mentioned in the above points.

- Long-term capital gain under section 112A can file ITR-1 if the gains are within the threshold limit, i.e. 1,25,0000 .there is no loss to be carried forward or set off under the capital gain head.

Not Eligible for ITR 1 Filing Online for AY 2025-26

- Such a person will have to file a return in ITR-2 or ITR-3, as the case may be.

- The taxpayer whose income is more than Rs 50 lakhs is not eligible to furnish this form.

- Non-residents and RNOR (Residents not ordinarily residents) cannot file ITR 1.

- Taxpayers who have two or more house properties are not eligible.

- Assessees having income under the business or profession head are not eligible.

- Taxpayers who have long-term or short-term capital gains except long term capital gain under section 112A provided capital gain not exceed 1,25,000.

- Taxpayers whose income from agriculture means is greater than Rs. 5,000

- The taxpayer who claims relief for foreign taxes paid or claims double taxation relief as mentioned in section 90/90A/91.

- ITR 1 cannot be used by residents having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India.

- Where TDS has been deducted u/s 194N

- If income tax is deferred on ESOP

Penalty if Miss the Income Tax Return Filing Deadline

As per amendment in finance act 2021 an individual is liable to pay a maximum INR 5,000 penalty after missing the 31st July deadline of ITR filing. In case an individual total income does not exceed 5 lakhs then a penalty of only INR 1,000 is applicable.

| Late Income Tax Return Filing Fee Details | ||

|---|---|---|

| E- Filing Date | Total Income Below INR 5,00,000 | Total Income Above INR 5,00,000 |

| Before Revised 16th September 2025 Due Date (Non-audit) and 31st Oct 2025 (Audit cases) | INR 0 | INR 0 |

| After 16th September 2025 (Non-audit) and 31st Oct 2025 (Audit cases) | INR 1,000 | INR 5,000 |

Modification Details in ITR 1 Sahaj Form

- INR 50,000 standard deductions

- No applicability to directors of any company

- No applicability on individuals holding unlisted equity shares of any company

- No changes in computation

- ITR 1 & ITR 4 offline availability for the senior-most citizens aged more than 80 years

- Section-wise return filing is segregated within the normal filing return and response to the notice

- Salary bifurcation will be done as the standard deduction, entertainment allowance and professional tax

- The Pensioners column has been added in the nature of employment

- Details of Employer like TAN of Employer (mandatory if tax is deducted), Name of Employer, Nature of Employer), Address of Employer, Town/City, State, PIN/ ZIP Code has been inserted under the head income from salary.

- Deletion of details of Return of Income filed in response to notice u/s 153A and 153C.

- A new deduction of 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2),

80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U has been added in the deductions column.

- A new deduction of 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2),

- The point of the amount of rent which cannot be realized has been inserted under the head house property.

- The individual income from one house property, salaries and other sources summing up to 50 lakhs, this condition retains its place even after changes

FY 2024-25 Due Date for Filing ITR 1 Online

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- Every year, ITR 1 has to be filed on or before 31st July of the following year. After that, a late fee under section 234F is levied

- Applicable Due Dates of Income Tax Return Filing

Guide to File Income Tax Return (ITR) 1 Online:

ITR 1 is divided into 7 sections where:

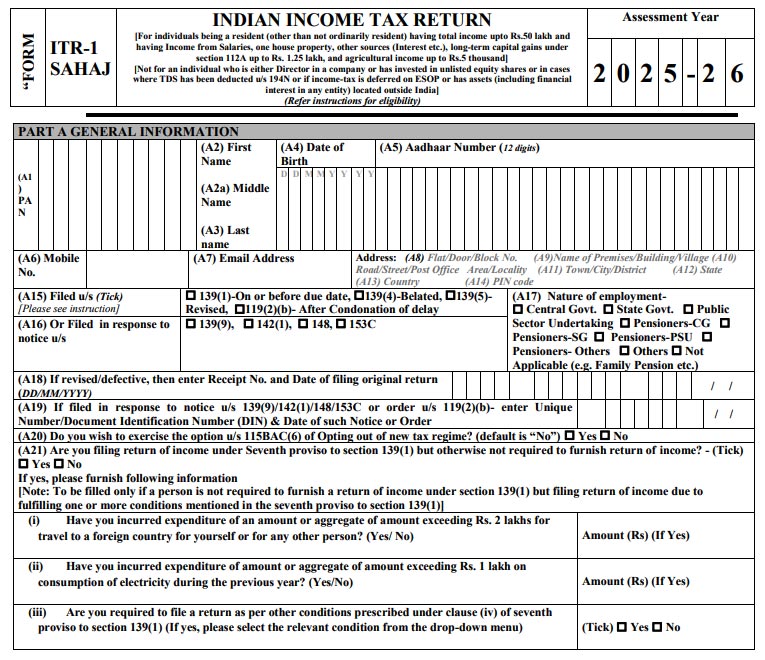

Part A – General Information

This tab includes details of the following general fields:

- PAN

- Name

- First

- Middle

- Last Name

- Date of Birth

- Aadhaar number

- Mobile. No

- E-mail Address

- Address

- Filed u/s

- 139(1)-On or before the due date

- 139(4)-Belated

- 139(5)-Revised

- 119(2)(b)- After Condonation of delay

- Or Filed in response to notice u/s 139(9), 142(1), 148 and 153(C)

- Nature of employment

- Central Govt.

- State Govt.

- Public Sector Undertaking

- Pensioners-CG

- Pensioners-SG

- Pensioners-PSU

- Pensioners-Others

- Others

- Not Applicable(e.g. Family Pension etc.)

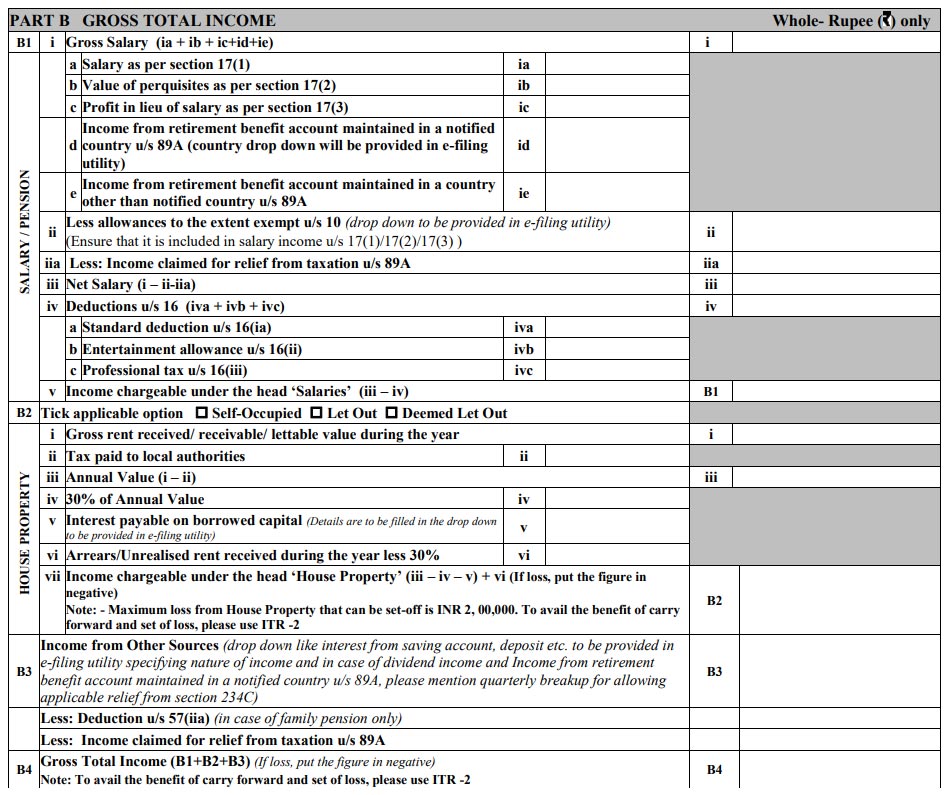

Part B – Gross total income

This tab includes details related to gross total income:

Part B1: Salary/Pension

- Details of Employer like TAN, Name, Nature& Address of Employer

- Salary details

- All the allowances which are exempted

- All the value of perquisites

- Net salary

- Deduction in u/s 16

- Income chargeable under the head ‘salaries’

Part B2: House Property

- Gross Rent received

- Tax paid to local authorities

- Annual value

- 30% of the annual value

- Interest payable on borrowed capital

- Arrears/unrealized rent less than 30%

- Income chargeable under head ‘house property’

Part B3: Income from Other Sources

- Less Deductions u/s 57 (iia)

- Less Income Claimed for relief from taxation u/a 89A

Part B4 – Gross total income (B1 + B2 + B3)

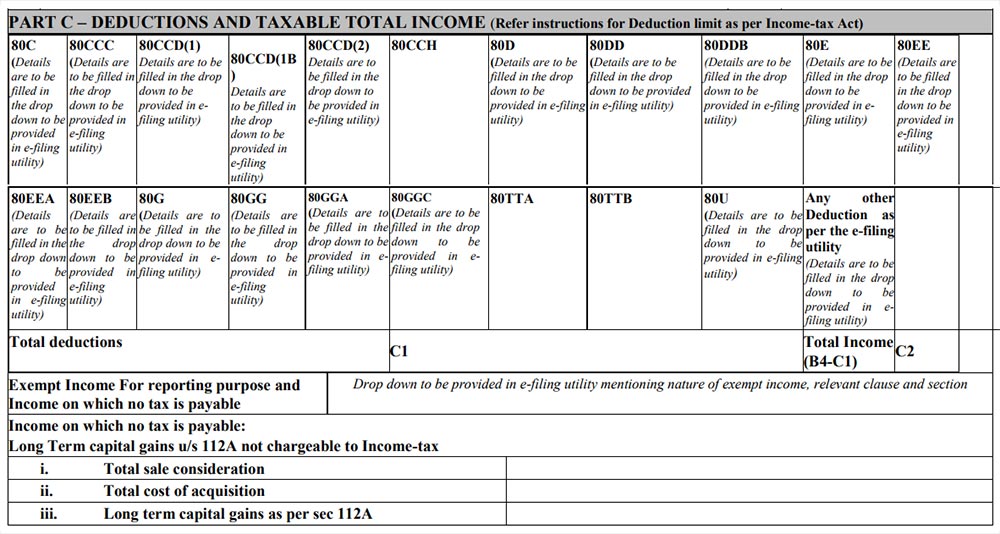

Part C – Deductions u/c VI-A and Taxable total income

This tab includes all the deductions and the taxable total income

Here, the deduction limit will be as per the Income Tax Act

- 80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80GG, 80GGC, 80U

- Value of Total deduction

- Total income (B4 – C1)

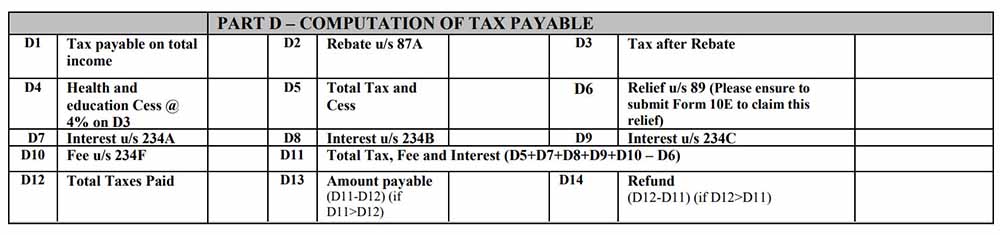

Part D – Computation of tax payable

This tab includes all the valuation of tax payable

- D1 Tax payable on total income

- D2 Rebate u/s 87A

- D3 Tax after rebate

- D4 Cess on D3

- D5 Total tax and cess

- D6 Relief u/s 89(1)

- D7 Interest u/s 234A

- D8 Interest u/s 234B

- D9 Interest u/s 234C

- D10 Fee u/s 234F

- D11 Total tax, fee, and interest

- D12 Total tax paid

- D13 Amount payable

- D14 Refund

- Exempt income

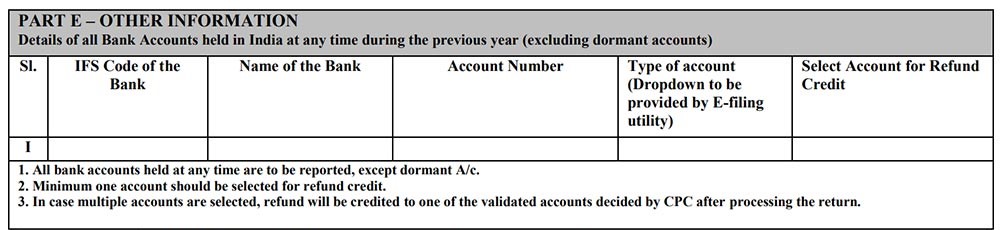

Part E – Other Information

This tab includes banking details

- IFSC Code of the bank

- Name of the bank

- Account Number

- Select Amount for Refund Credit

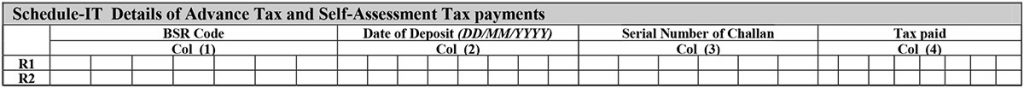

Schedule-IT: IT Details of advance tax and self-assessment tax payments

- BSR code

- Date of deposit

- Serial number of challan

- Tax Paid

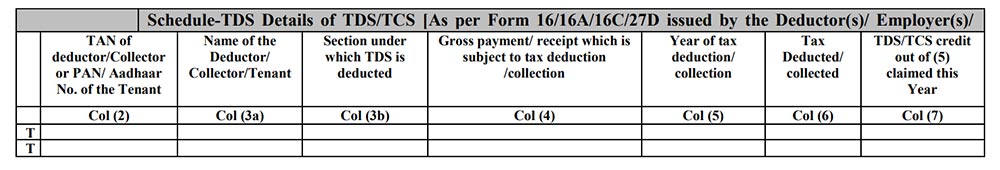

Schedule-TDS: TDS details of TDS/TCS

- TAN of deductor/ PAN of tenant

- Name of deductor

- Gross payment

- Year of tax deduction

- Tax deducted

- TDS/TCS credit

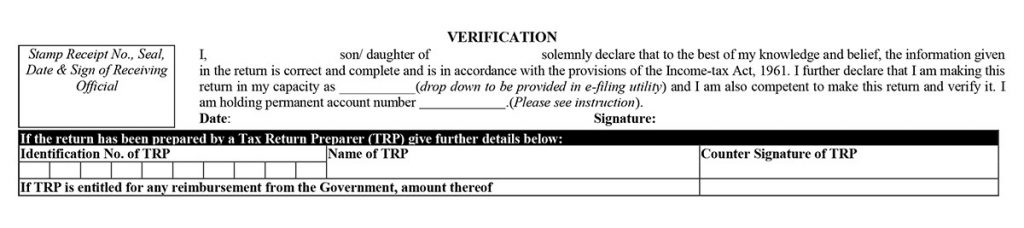

Verification

The taxpayer has to verify and self-attest the form at the last by signing the verification content after entering all the details such as name, parent name and PAN details.

Medium To Online Furnish Income Tax Return 1 (ITR)

An ITR-1 form can be furnished either in online or offline mode. In online mode, either XML needs to be uploaded or the client can directly login to the income tax portal and select the submission mode as “prepare and submit online”. In the case of online filing, some data can be imported from the latest ITR or form 26AS.

Also, super senior citizens (Age of 80 years or more) are exempted from the online filing of ITR.

Offline here means to furnish the return form in paper format.

File ITR 1 Online or Electronically:

- While furnishing ITR-1 online, feed the details and e-verify the return using EVC via Bank

Account/Net Banking/Demat Account/Aadhar OTP or - Feed the details using an electronic medium and send a physical copy of ITR V to the Centralized Processing Centre (CPC), Bengaluru through speed post or normal post.

When you furnish the ITR-1 return form using electronic medium, the receipt will be seen in the inbox of the registered email ID. It can also be downloaded from the official income tax website manually. After downloading the acknowledgement, you need to sign the form and then send it to the CPC office, in Bangalore before completing 30 days from the e-filing date. On the other side, it is not required to send the ITR V to the CPC if the EVC/OTP option is used.

File ITR 1 SAHAJ Form Offline

- If the age of the person is 80 or more years during the respective tax period or in the previous year.

Important Terms To Understand In ITR-1 SAHAJ Form for AY 2025-26

Notice Number: Notice Number is required to be mentioned when the taxpayer furnishes the return in answer to the notice issued by the Income Tax Department.

Revised Return: There is an option of re-file, so if you have made certain mistakes, you can rectify them again. For FY 2024-25, the taxpayer can furnish the revised return on or before 31 December 2025.

Advance Tax: If the tax on other income is above Rs. 10,000 in a year, the assessee is required to calculate and deposit the advance tax. This advance tax is to be paid on a quarterly basis such as in, June, December, September and March.

Annexure-less Return: Annexure-less return which means it doesn’t require affixing any documents with the ITR-1 Form.

Let’s Go Through ITR-1 Return Filing FAQ’s

Q.1 What documents one needs to submit while filing tax returns?

No document is needed to be submitted while filing income tax returns. However, one should keep basic documents like Form 16, shreds of investment evidence, and so on ready with him/herself. Because in some cases when the income tax department sends notice, these documents are required to be presented before the tax authorities on a later date.

Q.2 – What are the heads under which Pension and family pension are taxable?

Income from salary’ is the head for levying a tax on pension whereas family pension is taxable under the head ‘Income from other sources.

Q.3 – Who is eligible to file return via paper form rather than e-filing an ITR?

YEvery income tax assessee has to mandatorily e-file income tax returns. However, there are some exceptions to the standard rule wherein they can submit paper ITR forms and they do not have to file the ITRs online. They are as follows:

- At present, Super senior citizens who are above 80 years of age.

Q.4 – What amount will attract tax if the value of the gift is more than Rs. 50,000?

When the value of the gifts received from friends on any event except the wedding during a year is Rs 50,000 then the whole amount will attract tax under the head ‘Income from Other Sources’ head.

Note: Gifts are taxed on the total value of all the gifts received in the year and not on the value of the individual gifts.

Q.5 – How bank accounts are reported in ITR-1?

Details of savings and current accounts which are held during any time of the previous year must be reported in Part E of the ITR form which seeks – other information. The account number must comply with the Bank’s Core Banking Solution (CBS) system. However, one need not provide details of dormant accounts which is not working since 3 years.

Q.6 – Can ITR-1 be filed in case of exempt agricultural income?

Yes, one can file ITR-1 when the agricultural income is not more than Rs 5000. But when it exceeds Rs 5000, one needs to file ITR 2.

Q.7 – Is it necessary to file an ITR if the annual income does not exceed Rs 250,000?

No, it is not necessary to file an ITR if the annual income is less than Rs 250,000. But in this case, a ‘Nil Return’ should be filed to upkeep a record which is an employment proof required while applying for a passport or loan.

Q.8 – Does dividend income from Mutual Funds need to be included in it?

Yes, dividend income from mutual funds should be included under the head ‘Exempt Income(others)’ as it is an exempt income u/s 10(35).

Q.9 – Can I file ITR-1 if I have a House Property loan?

Yes, you can file ITR-1 if you have a house property loan.

Q.10 – Should I file ITR-2 or ITR-1, if my maximum exempt income is more than Rs. 5,000? What much amount of income will be considered as exempt income?

ITR-2 has to be filed if the amount of aggregate exempted income is more than Rs. 5,000. Some incomes are tax exempt as per Section 10 of the Income Tax Act. A few examples of exempt income are as follows:

- Income from Agriculture

- Long term capital gain on listed shares and securities (Section 10(38)

- Gratuity, Pension and Leave encashment are exempt u/s 10 of the Income Tax Act.

- Maturity amount of LIC (Section 10 (10D)

Q.11 – Can I file ITR-1 if I have a Rental Income?

Yes, you can file ITR-1 if you have a rental income. Refer our guide for the step-by-step process.

Q.12 – Should Interest Income be mentioned under the head ‘Income from Other Sources ‘ while filing ITR-1 when TDS has already been subtracted?

Yes, Interest Income should always be mentioned under the head ‘Income from Other Sources’ even when tax has already been subtracted by the bank.

Q.13 – Do I still need to furnish my Bank Account details in the ITR if there is no refund due to me?

Yes, furnishing the bank details in the ITR is mandatory, regardless of refund is due or not. It is mandatory because many taxpayers pay more taxes than their tax liability. So, to enable the Income Tax Department to send refunds on time, bank account details need to be furnished.

Q.14 – How can I download the Income Tax Return Form?

Income tax return forms are available on the official website of the Income Tax Department. Simple steps to download forms are as follows:

- Go to the Income Tax Department website

- Click the option ‘Form/Downloads’ on the homepage.

- Choose the option of ‘Income Tax Returns’ from the drop-down menu.

- Now you will be redirected to the ‘Income Tax Return’ webpage. Now download the form which is appropriate according to your source of income and A.Y.

Q.15 – What is the meaning of ITR XML file?

ITR XML is a kind of file format which is generated when you file the important data of your ITR in an offline utility.

Sir, I filled ITR1 for 2022-23 online. I reached up to Validation Successful no errors were found, on proceeding to Verification a message came something went wrong, please try later. what is the solution to this problem? I am trying daily since last week but getting the same message. Is it with some software problem or else? please reply /solution at the earliest

SIR, I AM A STATE GOVT. EMPLOYEE. I RETIRED IN OCT 2021. APART FROM MY REGULAR SALARY INCOME, I HAVE GOT PENSION INCOME TOO. I HAVE ALSO GOT RETIREMENT BENEFITS LIKE…..GPF, GRATUITY, LEAVE ENCASHMENT, GPF AND GIS IN THE FY 2021-22. MY QUESTIONS ARE

1) I UNDERSTAND THAT SALARY AND PENSION INCOME IS TO BE SHOWN IN SEC 17(1) OF SALARY IN ITR1.

HOW DO I SHOW OTHER RETIREMENT BENEFITS…IN WHICH SECTION OF SALARY?

IF THEY ARE TREATED AS SALARY, IN WHICH SEC. THE RETIREMENT BENEFITS ARE

EXEMPT?

2)I HAVE ALSO RECEIVED RS. 30000/- AS MEDICAL REIMBURSEMENT FROM MY EMPLOYER. IS IT TAXABLE?

IF TAXABLE, WHERE DO I SHOW THAT INCOME IN ITR1? IS ANY EXEMPTION ALLOWED FROM MEDICAL REIMBURSEMENT?

3) IS ANY TDS DEDUCTED FROM A GOVT. PENSION? IF YES, WHO IS THE DEDUCTOR?

OR THE PENSION IS PAID IN GROSS AND I HAVE TO PAY ALL THE TAX MYSELF?

A considerable amount is deducted from my salary every month as Overpayment amount. I have already paid income tax for the amount that I received. Can I get an relaxation of income tax of the for the amount of salary I paid back to the govt. institution? If yes, how I can claim for the last 2-3 years?

I use to fill the ITR 1 of my father, he is a state government employee.

I am finding this newly updated income tax website to be cumbersome.

At the part of inputting the self-assessment tax which my father have paid through the year through this salary account and not by filling any Challan.

I am not able to add the further tax that he have paid.

The entire amount paid and TDS deducted thereon has shown in form 26AS under Section 194JB. Please advise me which ITR number to be filed and under which column the above income will be shown in ITR.

The filing of ITR depends nature of income and source of income. Please read the instructions issued by the department for filing of itr

Dear Sir,

Mine 26 AS showing all deducted TDS but when I was filling all details when came across with Details of Tax Deducted at Source Tab, here it was showing only Deductor names with Zero amount, I mean actual TDS is not reflecting here & showing Rs 0

dear sir/madam,

my wife, aged 67 yrs Indian resident citizen, has received cash as inherited property during fy 20-21 subsequent to her father’s death. Father had fixed deposits, savings bank account in banks & this amount was shared equally among his children on his death. As I know, there is no income tax on the inherited property.

Apart from this, my wife’s other source of income is interest on FDs in banks & post office which is less than rs 3 lacs. Pls let me know

a) whether she should file the IT return

b) If so, which ITR is applicable

c) Is the inherited property taxable

d) In which column of ITR form receipt of inherited property to be mentioned

e) In which column of ITR form exemption to be mentioned

thanks

“Please contact CA/Tax professionals”

I am filling my ITR today i.e. 02-Jan-21 for AY 20-21. My primary source of income is a salary of more than 15 lacs and a source from deposits. I am filling ITR1 form but the challenge is there is an amount added under “D7-Interest u/s 234A”. Please suggest should I remove this amount and make it zero.

If your tax payable is more than Rs 1 Lac then Interest under section 234A will be charged.

Hi,

I am a salaried employee and my taxable salary is above 15 Lac. I have also earned Rs 60K as short term capital gain from the share market and Rs 2000 as intraday profit. Which ITR form should I fill?

Thanks.

If you don’t have any business income then you can file ITR 2

Can a pensioner with no house property and income below income tax limit file ITR-1?

I have a query. I have paid Rs 8797 for my health insurance (family floater) on 23 May 2019. Also, I paid Rs 9799 for health insurance and Rs. 4800 for a preventive checkup in May 2020. How can I fill the details in schedule DI and schedule D? I also get to know that there is a restriction in claiming for 1 Apr to 31 July 2020 period, I can only claim an equal amount or lesser amount than the amount invested during 1 Apr 2019 to 31 Mar 2020. is it true?

nice blog

Filing ITR1 using Java utility. While updating all bank details in the Sheet tax paid and verification, after adding a row and filling the bank detail the same is not getting saved and the file is getting hanged. Could you kindly help me to solve the issue, please?

It may be some department error in the Java utility, so please contact the department or wait for the department to resolve this error of utility.

Can you tell me is CBDT started processing the ITR-1 for AY 20-21.

Please contact to Income Tax Portal regarding this matter.

I have filed my IT return in July 2020 for FY 2019-20 (AY 202-21).

I want to do some corrections/amendments and want to revise my return, please let me know when I can file a revised return? Can I file a revised return today?

Devinder Singh

Yes, you can revise your return for FY 2019-20

HI,

I am a salaried employee and my taxable salaried income is below then Rs.5 lac in FY 19-20. I have invested in mutual funds.

In FY 19-20 I have shifted some funds from one scheme to other, on which I get LTCG in Rs.6614(without indexation) & LTC loss of Rs.2531/- (without index)in other funds.

My Question is this which ITR should I File it ITR 1 or ITR2.

Thanking You,

Sumit

You have to File ITR-2.

I’ve an LTCG of about Rs 3000 for a salaried employee. I’m given to understand that if LTCG < Rs 1 lakh, Form ITR 1 can be used but with LTCG mentioned under sec 10(38). My question is, i do not see where this can be updated on ITR 1. Please clarify. Thank you.

ITR 2 is to be filled for LTCG income as it is tax-free not exempt.

While filing ITR-1, at the time of submission, an error message is saying “If the employer category is other than pensioners or not applicable, the maximum amount that can be claimed for u/s 80CCD(1) is 10% of salary. I am not claiming in 80CCD(1). Please guide

While filing ITR-1, I am facing an issue of 80CCD(1) “If the employer category is other than pensioners or not applicable, the maximum amount that can be claimed for u/s 80CCD(1) is 10% of salary. I am only claiming in 80C, not in 80CCD(1), still the error. The nature of employment is others. Kindly guide.

Exempted income of PPF maturity amount not mentioned in the list of exempt income. Please clarify. Thanks.

Please put this amount in others in exempt income.

What should I do if I forgot to pay the self-assessment tax before submitting ITR 1? I made the payment later (after submitting the ITR 1 online). Thank you.

Sir, Deduction for interest paid on housing loan under section 24(1) is not available in ITR-1 for AY 2020-21?

Yes, you can claim Interest paid on house loan under section 24(1) in ITR-1 for AY 2020-21.

SIR SECTION 24 IS NOT SHOWING IN ITR-1 FOR AY2020-21

Yes, Same for me as well I am unable to see section 24 in the ITR 1

Section 24 is B2-iv no point and will get automatically calculated after entering the amount in gross rent received and tax paid to local authorities

Sir,

I have retired on 31/10/2019 from Govt. Service. I have drawn my Monthly Salary up to Oct. 2019 and pension for the rest of the months for the FY 2019-20. In addition, I have drawn GPF, Gratuity, Leave Salary, and Group Insurance.

Now, 1) What are the inclusions in my Salary as defined in Sec. 17(1)

2) What are the exemptions from Salary U/S 10

3) Is GPF included in Salary or It is to be shown separately as EXEMPT INCOME in ITR1

4) What will be my category…..Is it “Govt. Employee” or “Pensioner”?

PLEASE CONTACT TO DEPARTMENT

मै 4/2019 मे सेवा निवृत्त हो गया मैने जो पैसा मिला एवं छोटी एफ डी को तोड़ कर बडे एमाउंट की एफ डी करवा ली उसी बैख मे किन्तु फामं 26एस मे उक्त एमाउंट पाटं ईSFT Transactionमे Type of Transaction SFT-005मे दिख रहा है उसे मे आयकर रिटर्न मे किस जगह उल्लेख करू। कृपया जानकारी दे मेरे मेल पर।

Are exempt incomes ie army disability pension need to sow in ITR 1 although the pension disbursing agency is not sowing this?

please reply the above ?

Hi SAG Infotech,

I had filed my ITR 1 on June 8th and its almost 45 days and the refund is still not processed and still says the E verification is done, pls let me know what would be the issue and by when can I get the refund.

Thanks in advance

Thanks for the valuable info. How can I download the ITR-1(SAHAJ)and fill up online?

Please visit on https://www.incometaxindiaefiling.gov.in/home

I find your blogs very useful. I do not understand the purpose of TDS. Please explain why is it there? Who is required to fill that in the ITR1?

Please reply. Thank You

Which ITR form to be file for AY:2020-21 if the assessee having income from other source appx 1.5 Lac.

Type of ITR form depends upon your other heads of Income, However if you have only other source income than you can file ITR 1

What should I understand by income from other sources? my income mainly as an adviser/consultant.

If you are giving consultancy as your Business then it should come under the head Business/ profession otherwise as Other Sources.

Is it mandatory to show investments between 01/04/2020 to 31/07/2020 in Schedule DI of IT act for the public sector undertaking bank employees? or will the investments be included electronically at the year-end, so that we can claim the deductions as usual while filing ITR?

If you are claiming deduction of investments made between 01/04/2020 to 31/07/2020 in ITR of AY 2020-21 itself then you have to show the investments in Schedule DI.

Even I have the same question.

Can I ignore the schedule DI part section in ITR-1? I have investments under the 80C category which I’m doing monthly but I am willing to showcase the investment done in April – July 2020 in next year’s ITR filing. Is this possible?

If you have not claimed deduction in FY 2019-20 then you can claimed it in FY 2020-21

AY 2020-21 ke liye kya ITR-1 fill karte time ZIP CODE fill karna zaruri hai jabki humne PIN CODE already fill kar rakha hai aur agar zaruri hai toh fir ZIP Code kya hoga hamara.

Zip Code is not required when the PIN code is filled.

Very helpful.

I have retired in April 2019 from a PSU insurance sector (Govt. of India Undertaking) and have got retirement benefits accordingly. Which ITR form shall i file .

Also please let me know whether whole amount of Leave encashment as received on my retirement is tax exempted If it exceeds Rs. Three lakh. if so, under which section of Income Tax. Thanks

Leave encashment received by Central or State Government employee at the time of retirement or resignation is fully exempt. Leave encashment received by any non-government employee is exempt subject to the provisions of section 10(10AA)(ii).

AY 20-21 is not available in the drop-down menu at the E-filing site. WHEN ITR1 FOR AY 20-21 WILL BE AVAILABLE AT EFILING SITE

No ITR forms have been issued till now for AY 20-21. Maybe ITR will be made available up to end of May 2020.

Dear Sir/Mam,

AY 20-21 is not available in the drop-down menu at E filing site as on date, what to select for filing IT Return for FY 2019-20. Please guide.

Yes, Sir AY 2020-21 is not available at the E-filing site as on date. You have to wait for the update from the department/government regarding the filing of IT Return for the FY 2019-20

instructions for filling ITR-1 Sahaj is not found which may be given for download. Also the acknowledgment page.

AY 20-21 is not available in drop down menu at E filing site

Yes sir, at the E-filing Site AY 2020-21 is still not available

Dear Sir/Madam,

For the FY 2019-20, in ITR1, I am not able to enter the professional tax amount. There is no cell/column available to enter this amount. What shall I do?

Please clarify that whether you are a salaried person or pensioner

Why gross total income is not showing in ITR-1?

Gross Total Income Column is given in ITR-1 in column B4

I am a salaried person having capital gains from shares. Which ITR form shall I file?

ITR-2 is applicable in your case.

Return ITR fast karna hai

Want to know in which column House Building Loan Refund to be shown so that tax benefit can be claimed and under which section it is applicable.

For repayment of the housing loan principal amount, you can claim deduction under section 80C

For repayment of housing loan principal amount, you can claim dedcution under section 80C

Is it necessary to disclose PPF bank account no? and pension bank accounts no. in ITR form in the bank details section

You have to disclose only current and savings bank account details at the time of return filing.

I am Pension holder of WB StateGovt and aged around 68yrs. and my total income comes around Rs.3.4lac. After SD it will come to Rs.2.90lac. Whether it is necessary to file ITR for AY 20-21. It may mention here that I had files ITR every year since my retirement.

Is it necessary to disclose PPF bank account no. and pension bank accounts no in ITR form in the bank details section. Because the source of income from pension account and investment are in PPF.

On your website, it is mentioned that a person cannot use ITR 1 if he has a taxable capital gain. That means below threshold limit of one lac is non taxable and can be shown in itr1

SHOW LONG TERM CAPITAL GAIN /LOSS in which form and page

Under section 112A LTCG below one lac is exempted. Why it cannot be shown in ITR 1 as exempt income. Please advise.

Kindly note that the threshold limit of Rs. 1 lac is not an exempted income since it is not governed by the provisions of section 10.

As per sec 112A, it is only for the purpose of tax calculation that this Rs. 1 lac will not be included and only the income over and above Rs. 1 lac will be taxed.

I have income from a pension, bank interest and Rs. 18000 as long term capital gain from shares stt paid. Which ITR form for ay 19-20 should I use. LTCG is non-taxable. As per instructions person having capital gain cannot use itr1. Please clarify.

SINCE THE EXEMPTION U/S 10(38) HAS NOW BEEN WITHDRAWN, SO EVEN IF YOU MAY NOT BE LIABLE TO PAY TAX (BECAUSE OF GRANDFATHERING OF SECURITIES OR AVAILING THRESHOLD LIMIT) ON LTCG, ITR-2 IS APPLICABLE.

I can show this exempted LTCG in the exempt income section of ITR1. Will it be wrong?

Kindly note that the threshold limit of Rs. 1 lac is not an exempted income since it is not governed by the provisions of section 10.

As per sec 112A, it is only for the purpose of tax calculation that this Rs. 1 lac will not be included and only the income over and above Rs. 1 lac will be taxed.

Thank you Sir

ITR 2 is applicable in your case.

Hame online itr filing ki jankari chahiye

Please read this article carefully