All the registered taxpayers in India that are having an aggregate income of INR 5 crores or above must file the GSTR 9C annual audit form before the due date of 31st December for every FY to avoid any penalty & interest charges levied by the government.

GSTR 9C is basically a reconciliation statement or Audit Form that contains details about taxpayers’ gross and taxable turnover as per their accounting books, reconciled with the figures that were obtained after furnishing all their consolidated GST returns. The difference in the annual income or turnover along with the reason should be explicitly mentioned by the taxpayer.

Taxpayers whose annual income exceeds INR 5 crores and are bound to get their annual accounts audited under GST laws can file GSTR 9C manually via offline excel utility or by taking the help of a professional tax filing software like Gen GST.

Gen GST works as a smart invoicing and smart return filing software available in the Indian market that can be used by the taxpayer for filing of GSTR 9C annual audit form.

Some of the unique software features for the filing of GSTR 9C include Prepare GSTR 9C from GSTR-1, 3B, Purchase register (ITC register) & filed GSTR-9, Data Import from returns, excel, JSON etc., Maintaining Auditor’s Master & facility to import, Data Export into excel & JSON file, JSON Validation through the portal, E-file through EVC/DSC, etc.

Taxpayers can file the GSTR 9C annual audit form with the help of Gen GST return filing and billing software in a hassle-free manner. To get a detailed idea about the GSTR-9C filing procedure via Gen GST software, please check the video.

Steps to File GSTR-9C via Gen GST Software

GSTR 9C is an audit form that was introduced on September 13, 2018. It must be filed annually by taxpayers with a turnover limit of 2 crores up to FY 2017-18 & 5 crores from 2018-2019 and it must be certified by a CA. It is basically a reconciliation statement between the annual returns filed in GSTR-9 and the taxpayer’s audited annual financial statements. In GSTR 9C CA audit certification is mandatory up to FY 2019-20 and from FY 2020-21 no requirement for audit certification from CA.

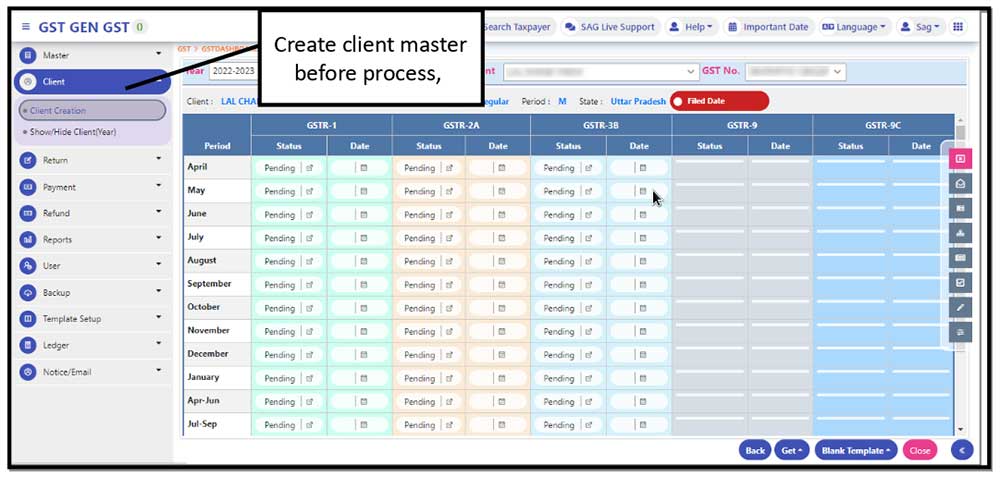

Step 1: Open the Gen GST software and create a ‘Master Client‘

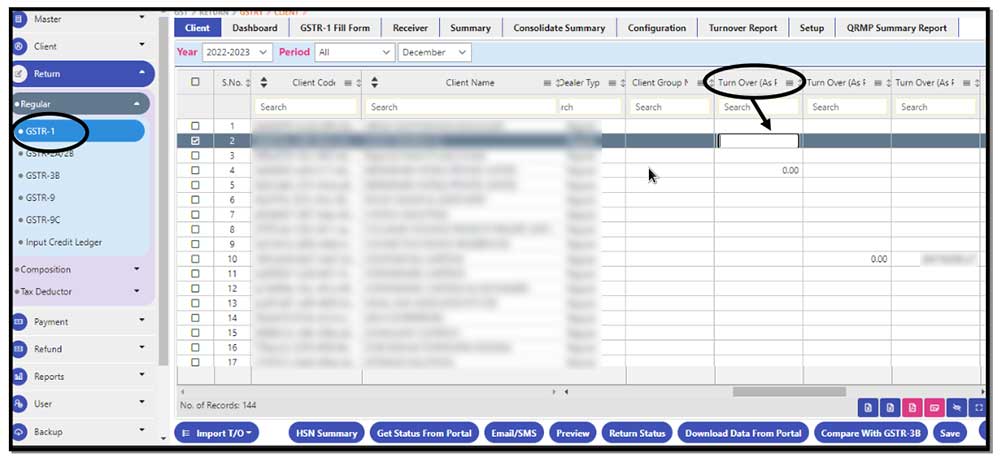

Step 2: After Creating a client, make sure that the user has already entered the ‘Turnover value in GSTR 1‘, then he can use the same client in GSTR 9C purpose. Select your client and mention the turnover figure in this tab click on save and proceed further.

Step 3: After creating your client master select the Return option ⏩ Select Regular ⏩ Select GSTR 9C ⏩ a Select client

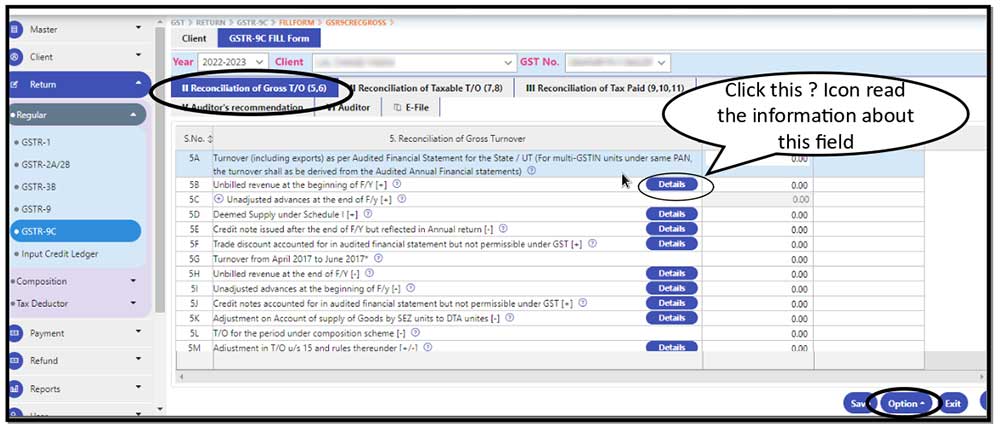

Note: Then click on GSTR 9C Fill out the form, and start entering the information one by one.

Step 4: Here is our first field which is ‘Reconciliation of Gross T/O‘ in this page you need to enter the detail about turnover, there is one Blue colour Details Tab. Where you get the information about the particular field, In the bottom corner there is one option Tab that is also available which help you to import the data from various option and export this information in excel.

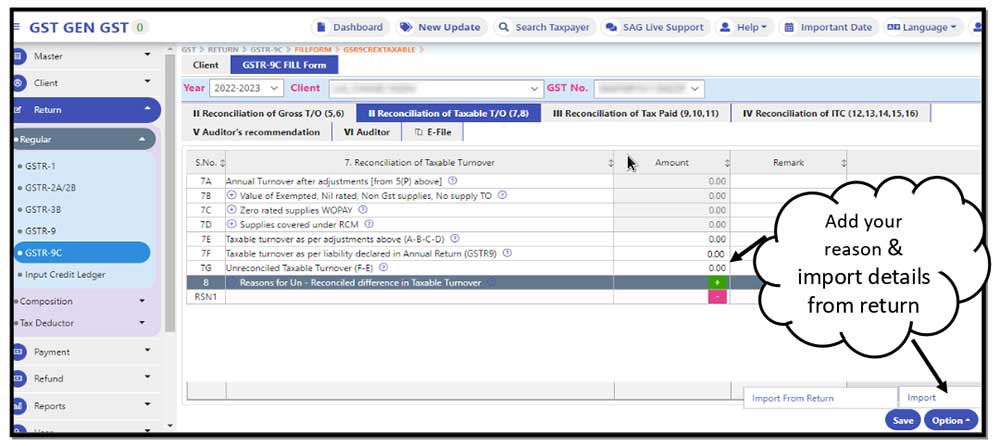

Step 5: Next field is for ‘Reconciliation of Taxable T/O’ here we give the option to inform details from the return and this plus icon tab shows you detailed information about the field. There is one green colour plus icon there, the user can add the reason for the un-reconciled difference in taxable turnover.

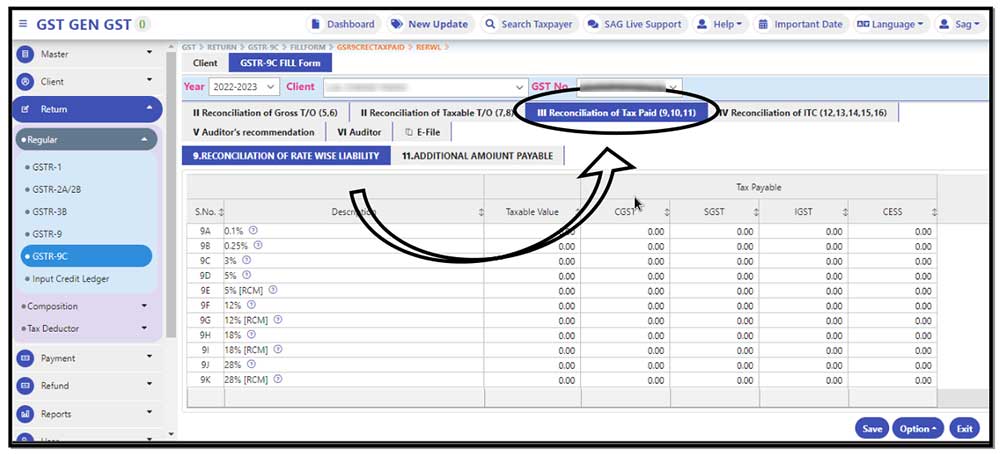

Step 6: On this page, the user can enter the detail about the ‘Reconciliation of Tax Paid‘ and there are two conditions that come under this:

- Reconciliation of Rate-wise Liability

- The Additional Amount is Payable

Other than that in the bottom corner there is an option for importing the data from return.

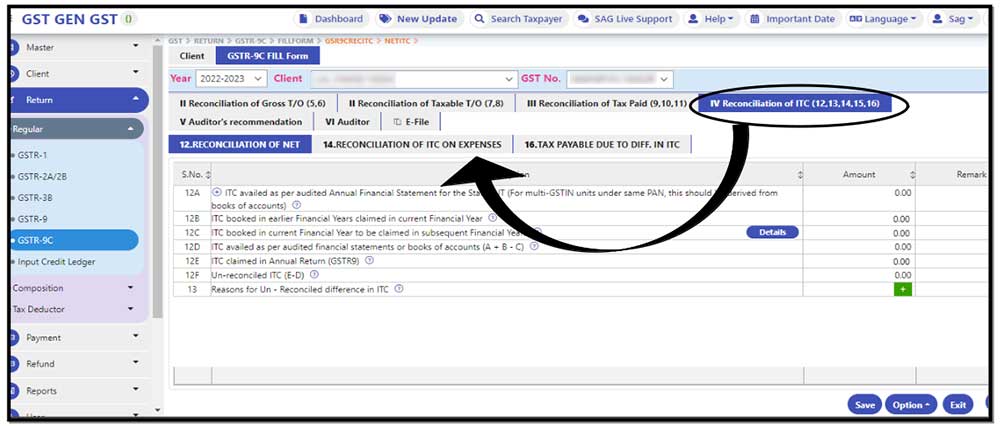

Step 7: This required information about the ‘Reconciliation of ITC‘. There are a total of 3 points under the description.

- Reconciliation of NET

- Reconciliation of ITC on Expenses

- Tax payable due to Diff in ITC.

There is one more option in the Green tab where the user can mention the reason for Un-reconciled diff in ITC and the import from return option is also available

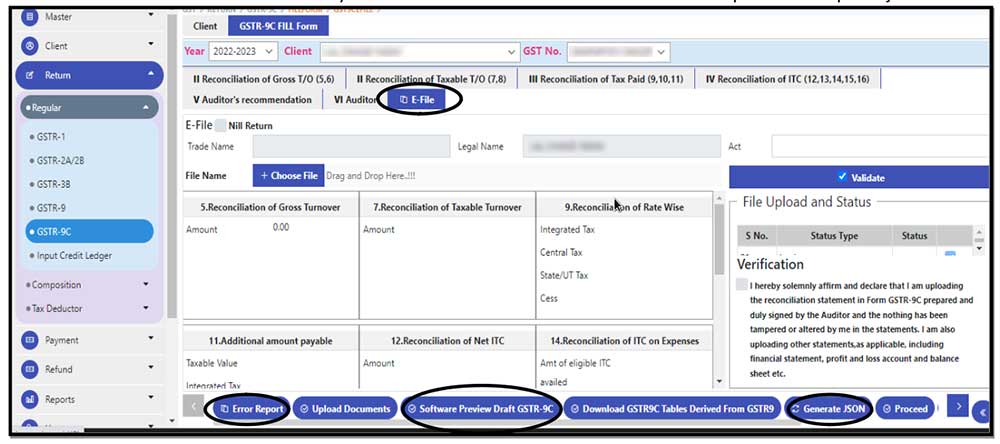

Step 8: This is the last and final process which is ‘E-File‘. Here we give you options by which the user can generate the JSON file and the software generate the error report while the JSON file prepare, Software gives you the option to download the preview Draft of GSTR 9C. Once crosscheck your all information validate the file and click on proceed to upload JSON.