Who Must File e-Form DIR-3 KYC?

As per MCA’s recent announcement, any director who was allotted a DIN by or on 31st March 2018 and whose DIN is in approved status, will have to submit his KYC details to the MCA. Further, this procedure is mandatory for the disqualified directors too.

From the Financial Year 2019-20 onwards, it is mandatory for every director who has been allotted a Director Identification Number (DIN) on or before the end of the financial year and whose DIN is in approved status, will have to file form DIR-3 KYC before the 30th September of the immediately next financial year.

There are two type of e- form DIR-3 KYC:-

DIR-3 KYC: If a director has been allotted a DIN for the first time, they must file DIR-3 KYC before the due date for that financial year and an existing director who needs to update their personal details, such as mobile number and email ID, etc.

DIR-3 KYC Web: If a director who has already filed DIR-3 KYC or DIR-3 KYC Web in the previous year and there is no change in the details of the director, simply file the DIR-3 KYC Web version.

DIR-3 KYC e-Form Purpose

The main objective of DIR-3 KYC is to ensure that the particulars of data maintained in the MCA database are accurate and updated annually. This enhances the accountability and transparency of these companies.

Who is Responsible for Submitting the e-Form DIR 3 KYC?

Directors are required to submit their DIR-3 KYC details to the MCA.

- Any individual who has been allotted DIN on or before 31st March of a financial year and whose DIN is in approved status.

- Every director who holds DIN, even if the person is not a director in any company.

Details Required to Furnish In DIR-3 KYC

- Full name, Father’s name

- Nationality

- Resident Address with proof

- Permanent account number

- AADHAR No.

- Passport no., if any

Documents Needed to File DIR-3 KYC

- PAN Card

- AADHAR Card

- Passport if any

- Utility bill not older than 2 months

- Lease Agreement

- Other Optional Documents

- OTP sent to mobile number and email ID

Consequences of Non-Compliance With DIR-3 KYC

Consequences of non-filing of DIR-3 KYC lead to the deactivation of the director’s DIN. This means the individual will not be able to act as a director or be appointed or reappointed in any company until KYC is completed & reactivating of DIN imposes a penalty of Rs 5000.

Process to File DIR-3 KYC e-Form via Gen Complaw Software

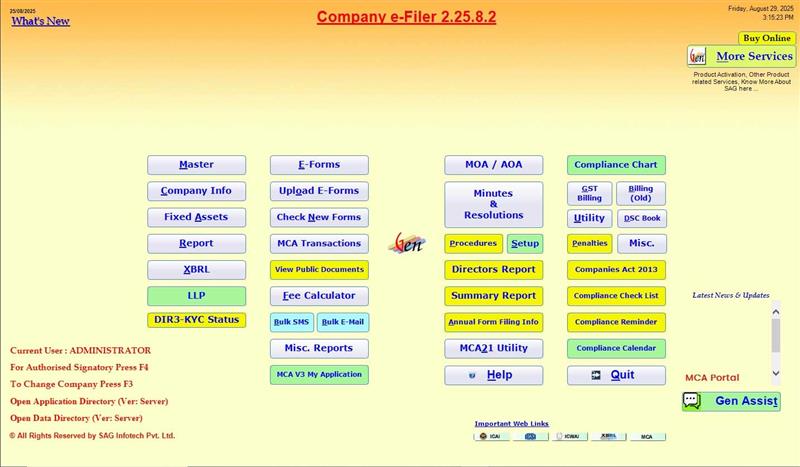

Step 1: Install Gen ROC Software on your PC and select ‘Master’ from the main page, then select the ‘Director’ option as shown.

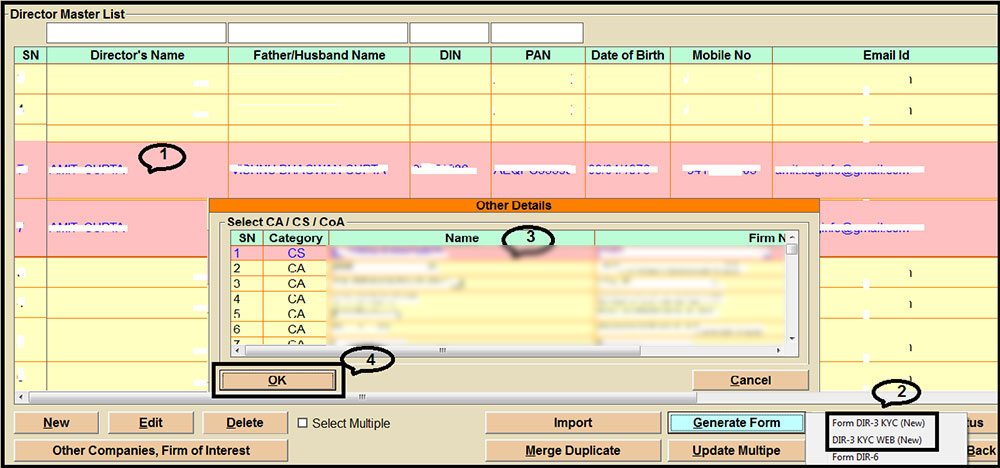

Step 2: A list of director will be displayed, select the ‘Director’ whose DIR-3 KYC need to be filed.

Step 3: Click on the generate form option and from the dropdown select the relevant option i.e ( form DIR-3 KYC).

Step 4: Select an appropriate professional to certify the form and after then click on ok to proceed.

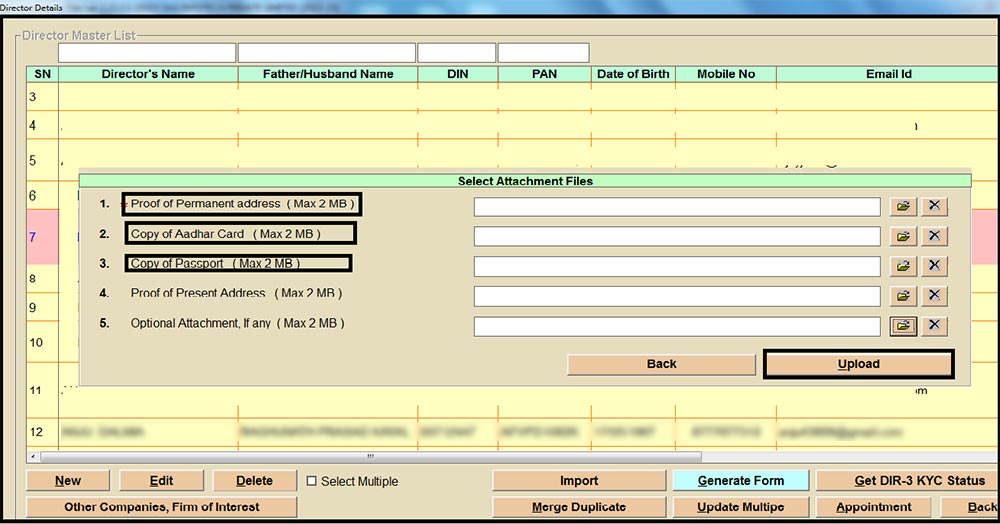

Step 5: Attach the required documents.

Step 6: Select the Upload Option.