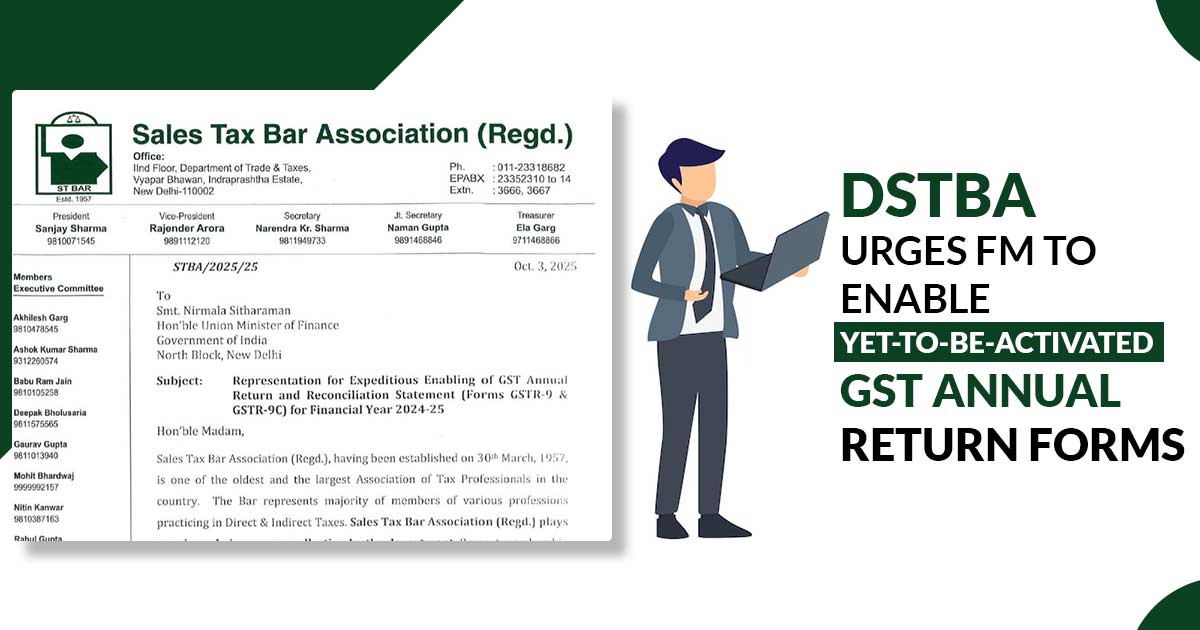

The Delhi Sales Tax Bar Association, a well-established group of tax professionals in India, has approached the Union Finance Minister with an important request. They are asking for the quick setup of the GST Annual Return (Form GSTR-9) and Reconciliation Statement (Form GSTR-9C) for the financial year 2024-25 on the GST online platform. This will help make the tax filing process smoother for businesses and individuals.

As per the representation, the regulatory structure controlling annual returns u/s 44 of the Central Goods and Services Tax Act, 2017, read with Rule 80 of the CGST Rules, 2017, which makes the annual return filing and its reconciliation with audited financial statements through Form GSTR-9C a mandatory compliance.

As per the Bar, such provisions are significant for both self-certification by taxpayers and verification by authorities to ensure accuracy of tax paid, prevent revenue leakage, and maintain transparency.

The Association, quoting the existing practical hardship, cited that even after various months that have passed since the close of FY 2024-25, Forms GSTR-9 and GSTR-9C are still not enabled on the GST portal.

As such forms are needed from the beginning of the succeeding fiscal year, the delay has caused issues since taxpayers are not able to reconcile the GST returns with timely audited financial statements.

According to the Bar, timely coordination of GST filings with the Income tax audits is crucial because of overlapping due dates, warning that delays in enabling forms are causing confusion, duplication, and risk of inconsistent regulatory disclosures.

The Bar requested the Finance Ministry to direct GSTN to enable GSTR-9 and GSTR-9C for FY 2024-25. The timely availability of such forms is a case of administrative convenience as well as statutory necessity, as taxpayers could not be forced to adhere without operational mechanisms.

Read Also: Easy Guide to RCM (Reverse Charge Mechanism) in GST

The Bar association with almost 2,000 members who are advocates, chartered accountants, and tax practitioners, carry a crucial part that its members play in assuring the financial compliance and revenue collection. A number of its members have been promoted to positions in the judiciary and tribunals, such as the Delhi High Court, Supreme Court, ITAT, and GSTAT.

Read More