For businesses and professionals, timely tax compliance is a significant obligation. In between such obligations, the advance tax specifies a unique intricacy as it necessitates accurate income estimation and periodic instalment payments during the financial year. Taxpayers earlier have relied on manual calculations, Excel spreadsheets, or professional advisory services, which take much time and may cause errors.

The Income Tax (IT) software has changed the world. It has facilitated the advance tax computations into an efficient, rapid, and accurate procedure. The same technology takes advantage of advanced algorithms and data integration to reduce the error margins and optimise tax planning.

Comprehending Advance Tax

Advance tax, commonly referred to as “pay-as-you-earn” tax, is a method of income taxation that obligates partial payments during the financial year, rather than a lump sum at year-end. The same approach applies to individuals, freelancers, businesses, and corporations whose projected tax liability exceeds a predetermined threshold.

It is important to comply with the specified due dates for advance tax payments since the failure to perform the same can incur penalties and accrue interest charges, emphasising the significance of accurate computation and timely remittance.

Manual Calculation Challenges

When done manually, advance tax calculation involves:

- Evaluating annual income from multiple sources (salary, business, capital gains, rent, etc.)

- Adjusting for deductions, exemptions, and rebates

- Computing the correct tax slab rate

- Considering the tax already paid through TDS or TCS

- Dividing the remaining tax into quarterly instalments

An error in data entry or calculations can result in either underpayment or overpayment, both of which can affect the statutory compliance. In this, the IT software becomes crucial, which furnishes automation and precision that mitigate such risks perfectly.

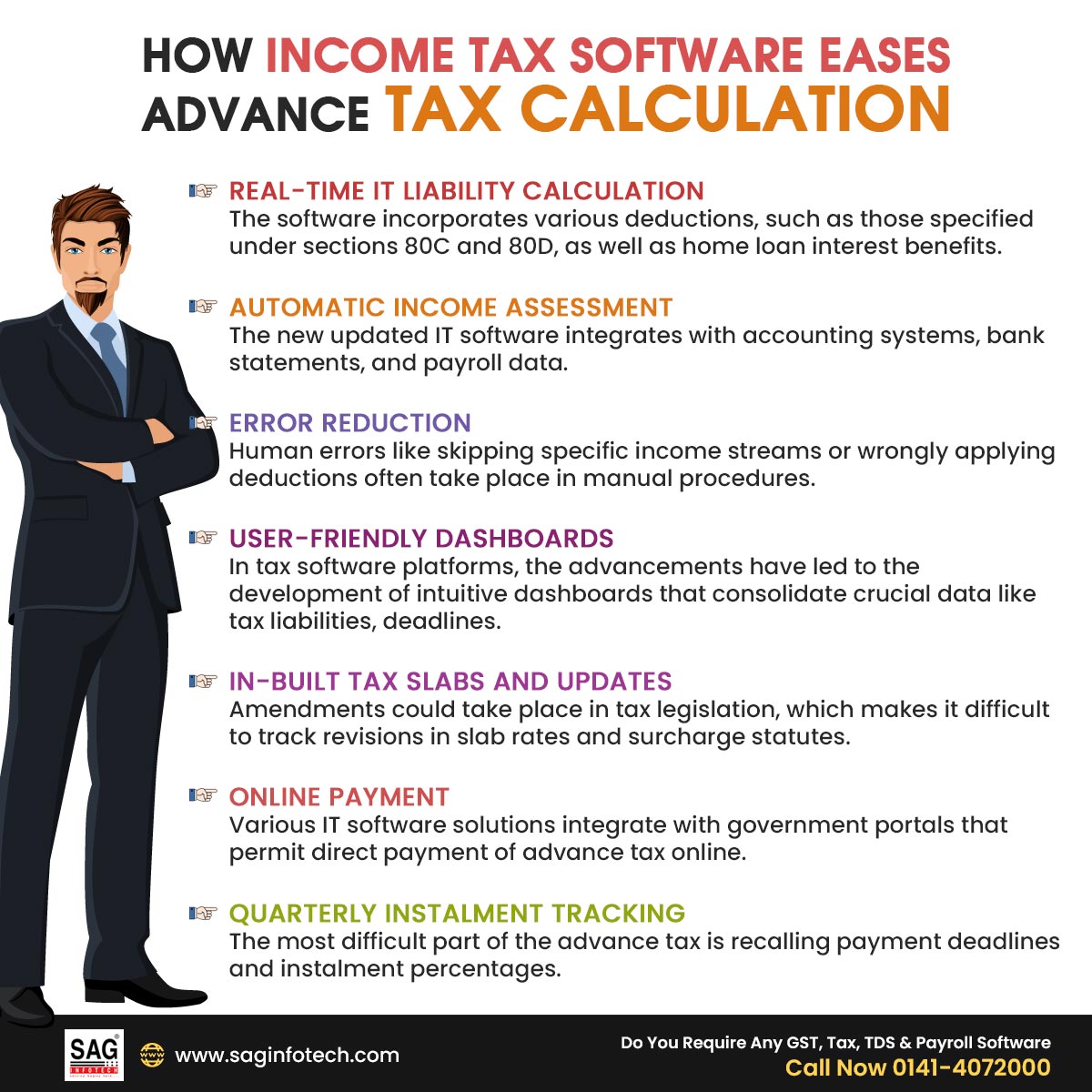

How Income Tax Software Eases Advance Tax Calculation

IT software makes advanced tax calculations easier by automating income estimation, applying the updated tax rules, and tracking instalments precisely. It saves time, lessens errors, and ensures seamless adherence.

Real-Time IT Liability Calculation

The software incorporates various deductions, such as those specified under sections 80C and 80D, as well as home loan interest benefits, to compute your overall tax obligation. It adjusts for any Tax Deducted at Source (TDS) that has been withheld earlier by employers or clients, delivering you with the net advance tax payable without the need for extensive manual reconciliation.

Automatic Income Assessment

The new updated IT software integrates with accounting systems, bank statements, and payroll data. The software, via such integration, can automatically capture income details, facilitating the calculation of taxable income. It can synchronise with GST data and expense records for businesses, providing an accurate financial overview.

Error Reduction

Human errors like skipping specific income streams or wrongly applying deductions often take place in manual procedures. Such risks shall be mitigated by the advanced IT software via executing checks that validate data entries, flagging discrepancies, and generating comprehensive reports before the finalisation of transactions.

User-Friendly Dashboards

In tax software platforms, the advancements have led to the development of intuitive dashboards that consolidate crucial data like tax liabilities, deadlines, and payment histories into a single interface. The same integration improves operational efficiency and infuses confidence in taxpayers towards their compliance protocols.

In-Built Tax Slabs and Updates

Amendments could take place in tax legislation, which makes it difficult to track revisions in slab rates and surcharge statutes. Advanced tax software is updated regularly to incorporate the latest provisions, ensuring that your advanced tax computations remain compliant with current legal standards.

Online Payment

Various IT software solutions integrate with government portals that permit direct payment of advance tax online. It eliminates the requirement to visit banks physically and lessens the paperwork.

Quarterly Instalment Tracking

The most difficult part of the advance tax is recalling payment deadlines and instalment percentages. Under Sections 234B and 234C, IT software generates reminders for each due date, computes the exact instalment amount, and helps avoid interest penalties.

Advantages of the Above Calculation

Utilising IT software for advanced tax management involves more than just performing calculations. It improves tax planning by furnishing insights into cash flow dynamics, projected liability assessments, and potential refund scenarios.

The same ability allows businesses to optimise resource allocation. Professionals and freelancers can achieve better visibility on quarterly tax reserves, leading to more accurate financial forecasting and strategic decision-making.

Closure: Advance tax calculation has become a much simpler process, reducing the need for estimations. By using advanced Income tax software for taxpayers can predict their income, calculate their tax liabilities, and manage their instalment schedules with ease.

Automating these processes improves compliance with tax regulations, reduces the risk of errors, and enhances time management. In summary, the advanced functionality of tax IT solutions transforms what was once a complicated obligation into a smooth and efficient workflow, benefiting both individual taxpayers and corporate entities.