In this article, we discuss the GSTR-9 offline utility (v2.1) in Excel format, provided by the government GST portal.

The GSTR-9 is an annual return form for all regular taxpayers, which they must file at the end of every year. The GSTR 9 annual return form consists of all the transactional details of the whole year, including CGST, SGST and IGST paid details.

The due date for the GSTR 9 is31st December 2026 for the FY 2025-26 due to various tax experts wanting more time to file the annual return.

Read Also: How to download GSTR 9C Offline Utility in Excel Format

Quick to File GSTR 9 Annual Return Via GST Software

Download GSTR-9 Offline Excel Utility

The government released the Excel-based GSTR 9 offline utility for all taxpayers to help them file their returns offline. Here is the link to download the offline utility.

Note: Also, be cautious that the file is not corrupted.

How do I know if downloaded GSTR_9_Offline_Utility.zip file is not corrupt?

Match one of the values provided in your downloaded file with the ones mentioned below. If there is an exact match, then your file is not corrupted. Else, download again.

Where do I find the values?

Windows : (Run from windows power shell)

Get-FileHash <<FileUrl>> -Algorithm <<SHA256>>

Eg: Get-FileHash C:\Users\Test\Downloads\GSTR_9_Offline_Utility.zip -Algorithm SHA256

Your unique values:

SHA256:2EED1D0AFBACC0B315AB7917322E213FB0592AE241FA6A07D652B136C41E8CD8

System Requirements

For better utilisation of the tool, one must install all these on their system:

- Operating system Windows 7 or above.

- Microsoft Excel 2007 & above

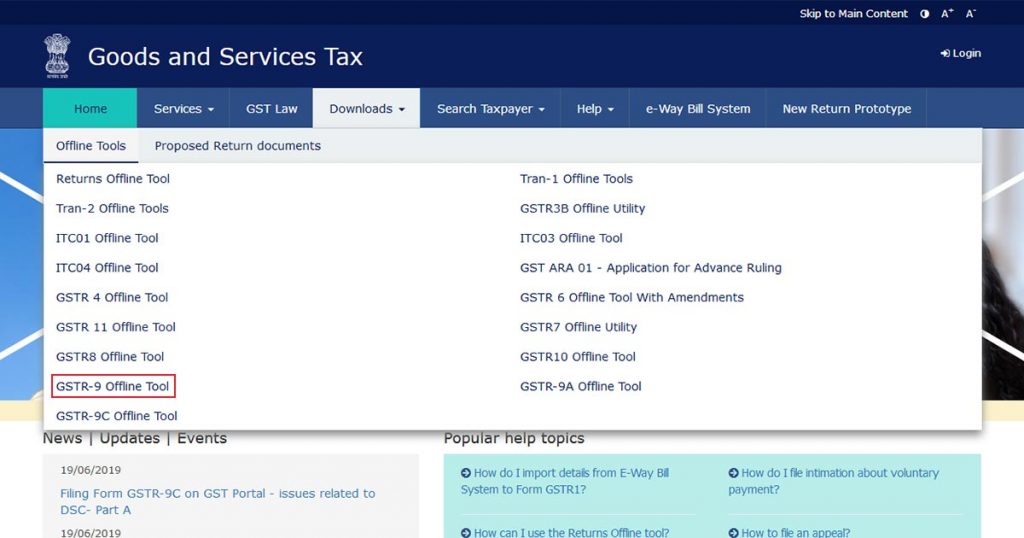

Steps to Download Excel GSTR 9 Offline Utility

- Visit GST.gov.in

- Tap on the download tab on the main menu

- Then select the offline tools and tap on the GSTR 9 offline tool from the given list

- A pop-up window opens with the download link in the initial sentence

- After tapping on the link, the automatic download will start the folder in Zip format

- Now, extract the Zip folder and get your filing done

Simple GSTR 9 Filing By Gen GST Software

- Make GSTR 9 from GSTR 1, 3B, 2A & purchase register (ITC register)

- Reconcile tax data from the accounting books, portal & returns for matching

- Compare data month wise, return-wise, invoice-wise, & rate wise

- Match data at the beginning entry level

- Import Data from JSON, returns, excel, etc

- Data Export into Excel & JSON file

- E-file through EVC/DSC & JSON Validation through the portal

General Queries on GSTR 9 Offline Utility

Q.1 – Describe about GSTR-9 Offline Utility?

Form GSTR-9 is an yearly compliance that is to be fulfilled by every registered taxpayer including SEZ units and developers. There is an Offline Utility on the GST Portal that helps in preparation of GSTR-9 form for every single FY. This offline utility helps the taxpayer to fill in the details of his purchases, sales, refund claimed, ITC claimed, demand, etc. After complete entries are made the Form is converted into the JSON file and is uploaded to the main GST Portal

Q.2 – What are the features in Form GSTR 9C that will benefit the taxpayers?

Features that beneficial for the taxpayers:

- While filling Form GSTR 9, the offline utility can be used to enter the details from Table 4 to Table 18. Without internet connection

- Tools to validate the data entries are already incorporated in the offline utility. This eliminates the chances of any error while uploading the JSON file on GST Portal

Q.3 – Is it possible to file Form GSTR – 9 using Offline utility?

No, Form GSTR 9 cannot be filed using Offline Utility. After loading all the details in the form using the offline utility one must make sure to convert the file into JSON format and upload it on the giant portal

Q.4 – What data can be entered in GSTR 9 with the help of offline utility?

Taxpayers can enter the details from Table 4 to Table 18 using offline utility:

- Table 4 – Summary of Inward/Outward supplies made during the FY

- Table 5 – Summary of the non-taxable outward supply made during the relevant FY

- Table 6 – Summary of ITC claimed during the relevant FY

- Table 7 – Summary of ITC that is reversed or ineligible ITC during the relevant FY

- Table 8 – Summary of other ITC claimed during the relevant FY

- Table 9 – Details of the taxes paid (including penalties or additional charges, interests) during the relevant FY

- Table 10 – Summary of the transactions reported in the next FY

- Table 14 – Summary of differential tax i.e. the tax paid on transactions reported in the next FY

- Table 15 – The complete data related to refunds or demands claimed during the relevant FY

- Table 16 – Summary of supplies acquired from the composition taxpayers, supplies deemed u/s 143 and details of goods sent for approval during the relevant FY

- Table 17 – Summary of HSN wise outward supplies done during the relevant FY

- Table 18 – Summary of HSN wise inward supplies acquired during the relevant FY

Q.5 – Is login to GST portal required for downloading the Form GSTR – 9 offline utility?

No, it is not mandatory for the taxpayer to log in to the GST portal for acquiring the GSTR 9 offline utility. One can simply go to ‘Downloads’ and get access to the utility without login

Q.6 – Is there any particular system or OS required for using GSTR-9 Offline Utility?

The offline utility for GSTR 9 preparation works undeniably well on Windows 7 or above and MS-Excel 2007 or above

Q.7 – Can the GSTR-9 offline utility be used on smartphones?

No. GSTR 9 offline utility cannot be accessed via smartphones. The facility for now is only laptop/desktop friendly

Q.8 – Is it mandatory to download generated JSON file from GST Portal? If yes, then why?

Yes, it is necessary to download JSON file from the GST portal. JSON file thus downloaded helps in fetching the system-computed GSTR 9 data (based on GSTR-1 and Form GSTR-3B filed) that can be edited as well as fill in the details in Table 4 to 18 using the offline utility. Pre-loaded information in certain sections of JSON file cannot be edited (like table 6A – ITC claimed in GSTR 3B; Table 8A – ITC as per GSTR 2A; Table 3 and 5; Table 9 – except payable columns)

Q.9 – Is login to GST Portal necessary to download the generated JSON file?

Yes, the taxpayer must login to the GST portal to download the generated JSON file using GSTR 9 offline utility

Q.10 – Do I need to mention the data in all the worksheet (tables)?

Data in all the sections/tables is not mandatory. You can skip the grids for which no data is required

GSTR 9 download

Do taxpayers below 2cr have to file gstr9

No, taxpayer having annual turnover up to 2 crores is not required to file GSTR 9

No its not mandatory now for the taxpayers whose Turnover is less than 2 crore, but the tax payer can voluntarly file GSTR 9

Please contact only Tamil executive