Advisory No. 605 has been issued by The GSTN dated October 3, 2023, and announced the availability of the e-Invoice JSON download feature on the GST e-Invoice Portal.

It is very exciting news for all taxpayers that the GST e-Invoice JSON download functionality is now live on the GST Portal. To help you make the most of this feature, we have outlined the key steps below:

Steps to Download e-Invoice in JSON Format

Step 1: Log in

- Open the e-Invoice Portal at https://einvoice.gst.gov.in

- Log in using your GST Portal credentials.

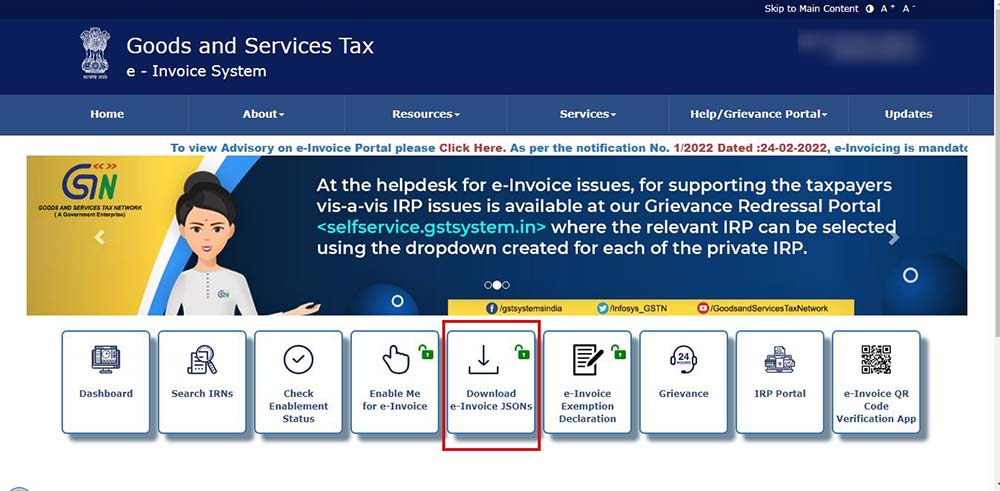

Step 2: Go to the ‘Download E-invoice JSONs’ Section

- On the Home page of the portal, you will find the “Download E-Invoice JSONs” section, which consists of two tabs: “Generated” and “Received.”

- The “Generated” tab is for GST e-Invoices generated by you, while the “Received” tab is for e-Invoices received by you.

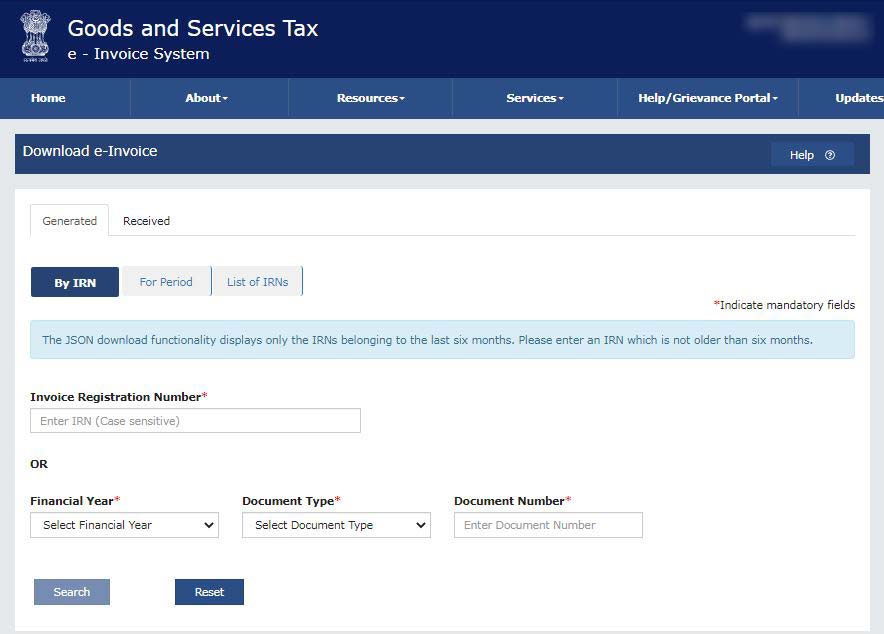

Step 3: Find e-Invoice (By IRN)

- Click on the “By IRN” tab to find a particular e-invoice.

- Enter the IRN (Invoice Reference Number) or choose the Financial Year, Document Type, and Document Number.

- Click on the “Search” button.

Step 4: View and Download

- After clicking on the search, you will see the specific IRN.

- To download the signed e-invoice, click on “Download PDF” (available for a single active IRN).

- Alternatively, you can also select “Download E-Invoice JSON” to download the e-invoice in JSON format.

Read Also: Step-by-Step Guide to Generate E-invoice Under GST

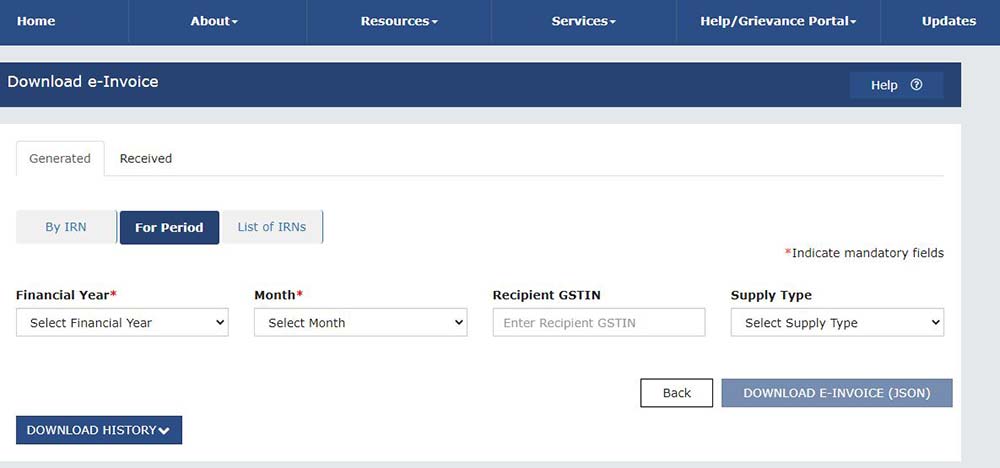

Step 5: Bulk Download (By Period)

- In order to download e-Invoices in bulk for a specific period, select the “For Period” tab.

- Select the Financial Year and Month.

- Click “Download E-Invoice JSON”, it will download all e-Invoices in JSON format for that month.

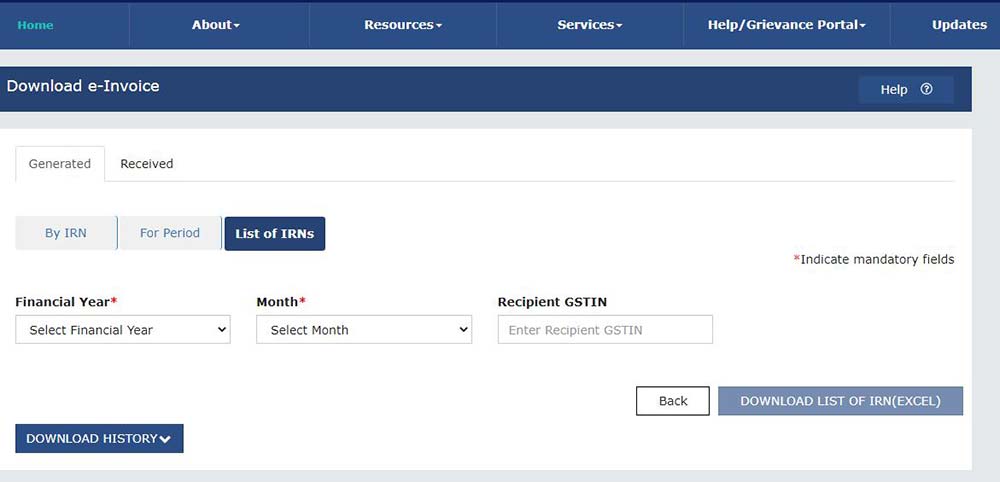

Step 6: Excel Format e-Invoice List (By Period)

- To obtain an e-invoice list in Excel format for a specific period:

- Go to the “List of IRNs” tab.

- Select the Financial Year and Month for which you want to download e-invoice.

- Click “Download E-Invoice (Excel).”

Step 7: History of Downloading

- The requested e-invoices will remain in the downloading history for only 2 days. After 48 hours, a fresh request needs to be initiated.

- Furthermore, through this functionality, you can download all e-Invoice from all six IRPs (Invoice Registration Portals), i.e. complete data.

- For accessibility, you can download e-Invoice JSON files for a period of up to 6 months from the date of IRN generation.

- For a seamless process for all users, it is requested that taxpayers schedule their downloads during off-peak hours and avoid burdening the system with large requests during the initial days.

- Additionally, please be aware that this functionality is also accessible through GSP (GST Suvidha Providers) via G2B (Government-to-Business) APIs.