The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) ruled that the actions taken by the Dispute Resolution Panel (DRP) under Section 144C of the Income Tax Act, 1961, do not supersede or prolong the limitation period outlined in Section 153 of the Income Tax Act, 1961.

Motorola Solutions India Private Limited submitted the appeal contesting the final assessment order passed via the Assessing Officer (AO) for the Assessment Year 2020-21. The case has arrived when the AO issued a draft assessment order proposing specific additions and subsequently referred the case to the DRP u/s 144C of the Income Tax Act, 1961.

The directions have been issued by the DRP after which the AO passed the final assessment order u/s 143(3) read with Section 144C(13) of the Income Tax Act, 1961. The taxpayer contested the validity of the final assessment order based on the fact that it had been passed after the specified time limit mentioned u/s 153 of the Income Tax Act, 1961.

The representative of the taxpayer, Advocate Himanshu S. Sinha and Advocate Utkarsh Mittal, said that the obligatory time duration mentioned under section 153 of the Income Tax Act, 1961, applies to cases supervised by Section 144C of the Income Tax Act, 1961. Thereafter, the proceedings before the Dispute Resolution Panel (DRP) are merely a part of the assessment procedure.

The Madras High Court, in a precedent, Commissioner of Income Tax v. Roca Bathroom Products Private Limited (2022), wherein it was held that Section 144C does not override Section 153 of the Income Tax Act, 1961.

For the Revenue, S.K. Jadhav claimed that the consumed time in DRP proceedings must not be included while calculating limitations. Also, the problem of limitation u/s 144C and Section 153 is pending consideration before the Apex Court in the case of ACIT v. Shelf Drilling Ron Tappmeyer Ltd.

Also Read: IT Section 153C Proceedings Require Both Incriminating Material and Dual AO Satisfaction

The bench of Yogesh Kumar U.S., Judicial Member, and Manish Agarwal, Accountant Member held that Section 144C does not function as a standalone provision overriding Section 153 of the Income Tax Act, 1961.

The Tribunal explained that the limitation period stipulated u/s 153 of the Income Tax Act, 1961, continues to apply even in cases where the draft assessment procedure u/s 144C of the Income Tax Act, 1961, is followed.

The court ruled that the DRP proceedings are part of the assessment process and cannot extend the statutory time limit. Additionally, the non-obstante clause in Section 144C(13) does not nullify or suspend the operation of Section 153 of the Income Tax Act, 1961.

The Income Tax Appellate Tribunal (ITAT) determined that the final assessment order issued was beyond the allowable time limits and therefore subject to cancellation.

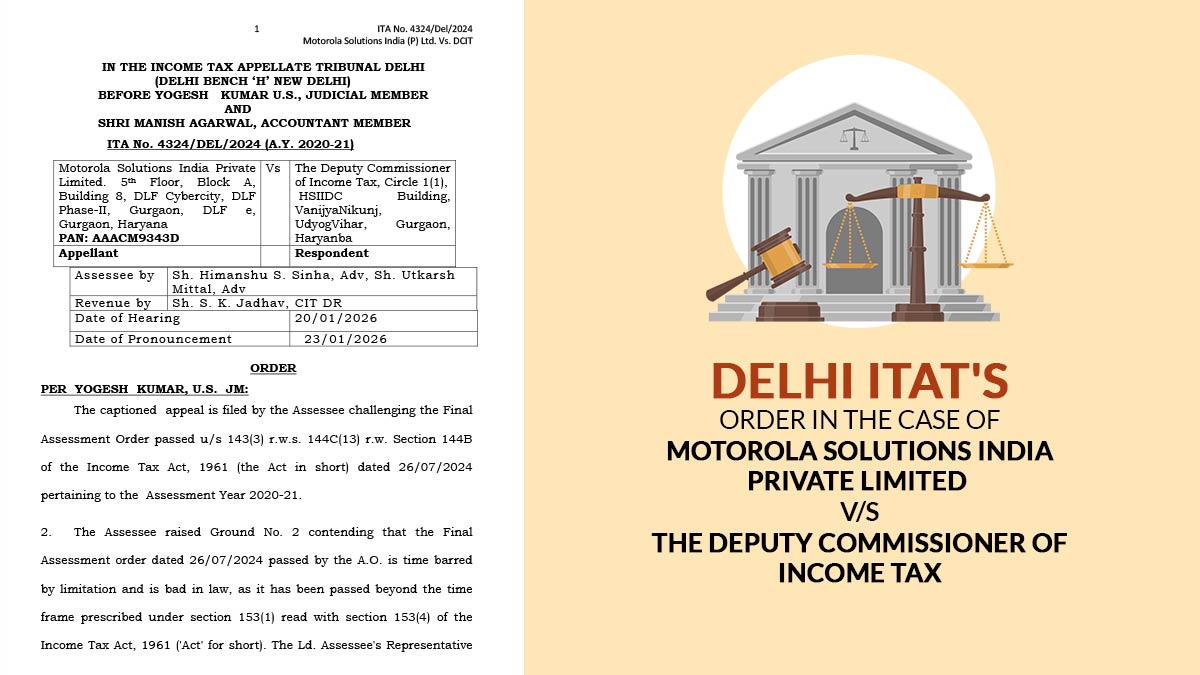

| Case Title | Motorola Solutions India Private Limited vs. The Deputy Commissioner of Income Tax |

| Case No. | ITA No. 4324/DEL/2024 (A.Y. 2020-21) |

| Assessee | Sh. Himanshu S. Sinha, Sh. Utkarsh Mittal |

| Revenue | Sh. S. K. Jadhav |

| Delhi ITAT | Read Order |