The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has ruled that submission of Form-67 is not obligatory to claim foreign tax credit (FTC).

The bench of Sudhir Pareek (Judicial Member) and S. Rifaur Rahman (Accountant Member) has marked that filing Form-67 is a procedural or directory provision and is not a compulsory requirement. Thus, a breach of procedural norms does not destroy the substantive right to claim credit from the FTC.

A resident assessee who has credit for the amount of any foreign tax filed in a country outside India via deduction or otherwise will be demanded to deliver the statement in Form 67 on or before the due date set for providing the income return.

The taxpayer has furnished the ITR for the AY 2020-2021, declaring total income and tax obligation as NIL, concerning a claim for tax credit u/s 90/91 of the Income Tax Act, 1961. The AO has disallowed the foreign tax credit for non-compliance with a procedural provision, i.e., filing of Form-67 with ITR, by allocating an intimation order u/s 143(1) of the Income Tax Act of 1961 against the return furnished via the taxpayer, assessing tax liability.

On January 21, 2022, taxpayer filed the Form 67 including a rectification application asking for the acceptance of filing Form 67; but the taxpayer has obtained an order levying the tax obligation. The taxpayer has again obtained an order u/s 154 exhibiting the tax obligation post-rectification application submission.

The assessee preferred an appeal before the CIT (A), who, post regarding the submissions, dismissed the appeal of the taxpayer and supported the action of the AO based on the thing that requisite Form No.67 was not filed within the stipulated time. The CIT (A) has kept the order of the AO on the foundation that the taxpayer has losses to file Form 67 within the deadline, along with the filing income tax return.

However, it is agreed that filing Form 67 was not furnished including the income tax return, the same was filed belatedly on 21st January 2022 and is on the record. It was argued by the taxpayer that both lower authorities failed to admire the fact that the requisite filing of Form 67 is a procedural and directory requirement and is not obligatory. The substantive right to claim credit from FTC does not get destroyed via the breach of procedural norms.

The tribunal mentioned that taxpayers deserved to get permitted with the FTC even if Form 67 was filed by the taxpayer after the due date of filing the return, and not authorizing foreign tax credit by AO (CPC) was nothing but a mistake apparent on the record.

The orders of the authorities below have been set aside by the tribunal and restored the case to the file of the AO with the order to validate the claim of the taxpayer concerning the foreign tax credit under the statute post considering or accepting Form 67.

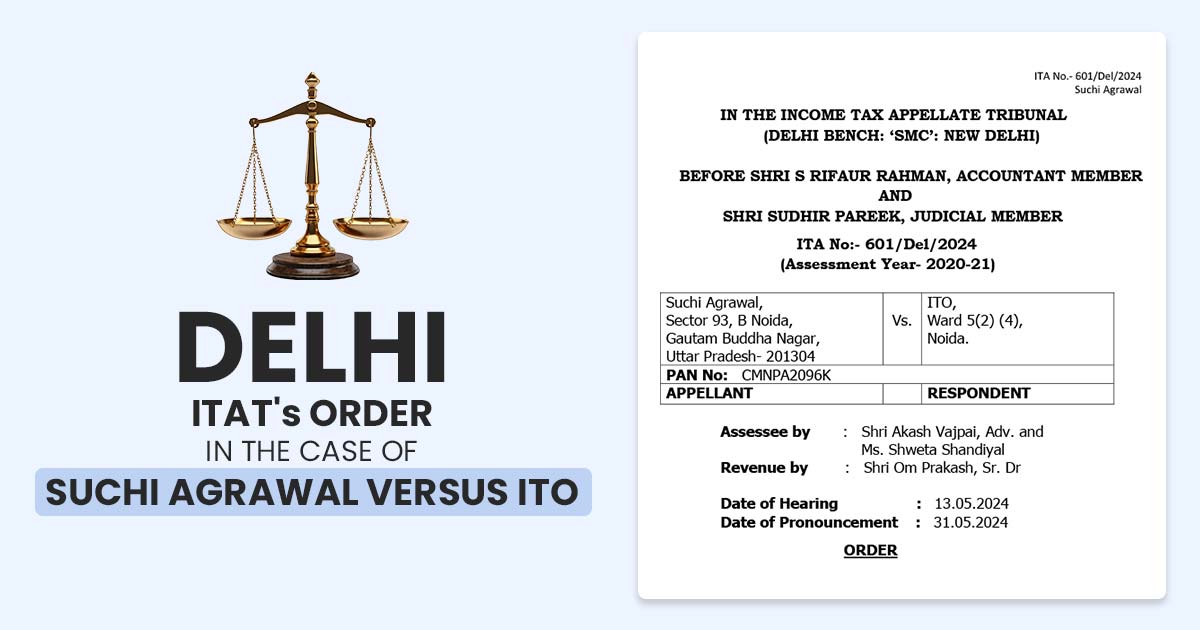

| Case Title | Suchi Agrawal Versus ITO |

| Case No. | ITA No:- 601/Del/2024 |

| Date | 31.05.2024 |

| Counsel For Assessee | Shri Akash Vajpai, Adv. and Ms. Shweta Shandiyal |

| Counsel For Revenue | Shri Om Prakash, Sr. Dr |

| Delhi ITAT | Read Order |