The assessment for Assessment Year(AY) 2009-10 has been set aside by the Delhi Bench of Income Tax Appellate Tribunal (ITAT) as of the jurisdictional error u/s 153C of the Income Tax Act,1961.

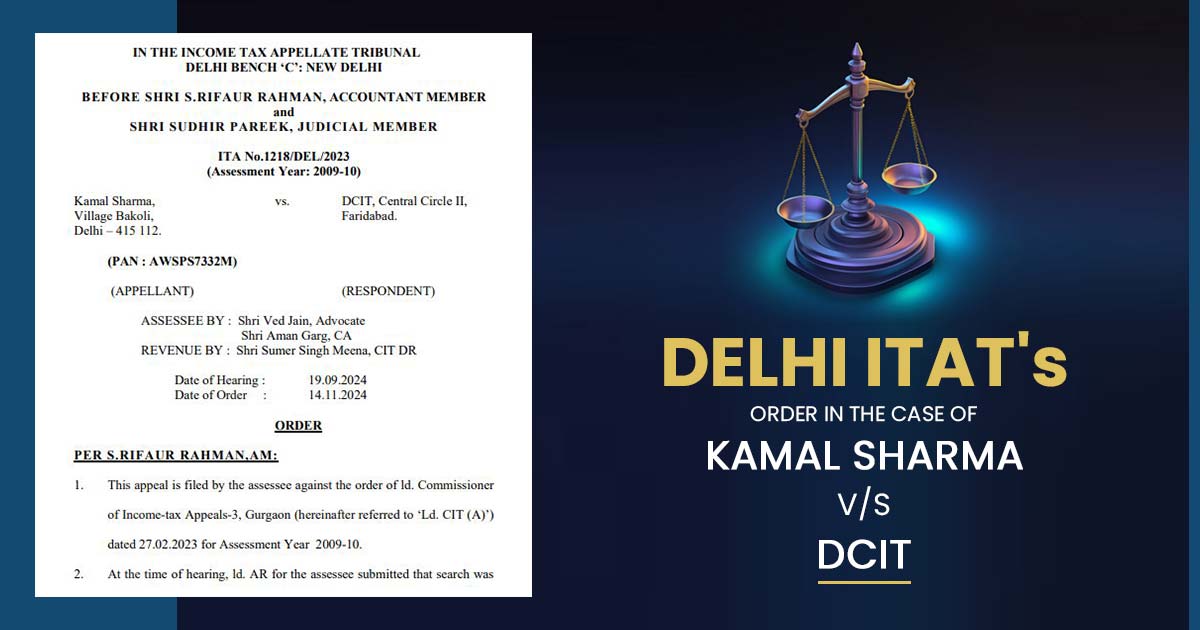

The petitioner/taxpayer Kamal Sharma, has contested the plea against the order on 27.02.2023 passed by the Commissioner of Income Tax(Appeals)[CIT(A)] for the AY 2009-10.

It was cited by the taxpayers’ counsel that a search has been undertaken in the matter of Sunstar Group dated 19.12.2013 and a notice under section 153C was furnished dated 20.01.2016 founded on the discovered materials. He said that the considered search for the objective of section 153C was for AY 2016-17.

U/s 153C the notices were furnished for the 6 assessment years before the search year, wrapping AYs 2010-11 to 2015-16. As the assessment for AY 2009-10 was lapsed, the counsel claimed that it was beyond jurisdiction, quoting distinct ITAT decisions to support the claim.

Section 153C of the Act permits the Assessing Officer (AO) to furnish a notice for the assessment of a person (other than the one investigated) if the materials pertinent to them are discovered in a search. Before the search year, the notice can cover up to 6 years. The AO should obtain the seized material and a satisfaction note from the AO of the investigated person to move.

The two-member bench comprising Sudhir Pareek(Judicial Member) and S.Rifaur Rahman(Accountant Member) analyzed the submissions along with the presented material. It marked that a search in the matter of Sunstar Group was undergone dated 19.12.2013 and u/s 153C a notice was issued dated 20.01.2016. The related assessment year was discovered to be AY 2016-17 as the satisfaction note was recorded before the issuance of the notice.

It was marked by the tribunal that the 6-year duration covered under section 153C is applicable before the AYs 2010-11 to 2015-16. As the notice for AY 2009-10 was not within the jurisdiction it followed prior judgements and set aside the assessment for AY 2009-10.

The filed appeal of the taxpayer was permitted.

| Case Title | Kamal Sharma vs. DCIT |

| Citation | ITA No.1218/DEL/2023 |

| Date | 14.11.2024 |

| Assessee | Shri Ved Jain, Shri Aman Garg |

| Represented | Shri Sumer Singh Meena |

| Delhi ITAT | Read Order |