For the appointment of Cost Auditor in the company, Section 148 of the Companies Act 2013 read with the Cost (Records and Audit) Rules 2014 states the following:

Each company referred in item (A) of rule 3, i.e., of Regulated sectors which have the total yearly turnover of INR 50 crores or more of the company from all its products and services during the immediately ended (previous) year and the total turnover of the individual product or products or services, for which cost records are required to be maintained under Rule 3, is INR 25 crores or above.

Each company referred in item (B) of rule 3, i.e., of Non- Regulated sectors which have a total annual turnover of 100 crore rupees or above from all its products and services during the immediately ended financial year and the total turnover of the product/products or service/services for which cost records are required to be maintained under the rule 3 is INR 35 crores or above.

Companies shall appoint a cost auditor within 180 days from the commencement of FY. The Cost Auditor will be appointed by the Board as per the recommendation of the Audit Committee if any.

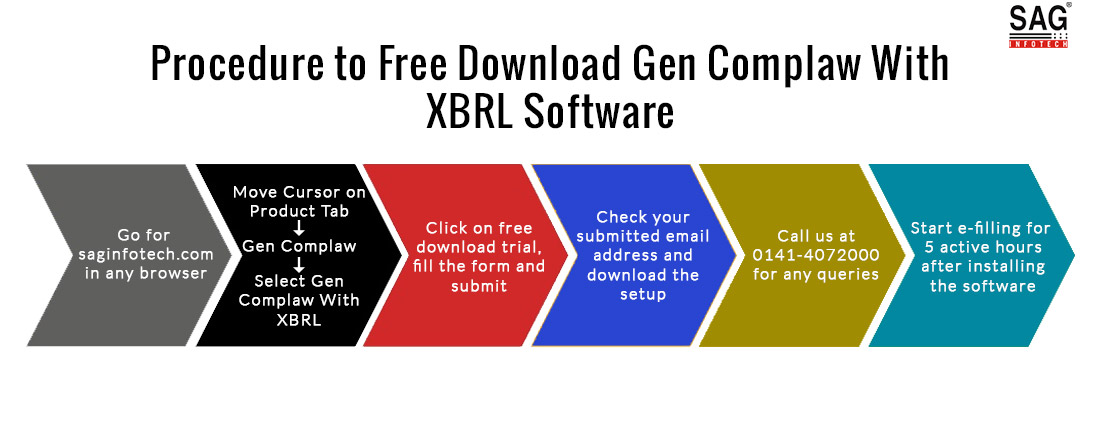

Similar: Easy to File CRA & Annual Forms with Gen Complaw with XBRL Software

The audit committee will also recommend the cost auditor’s remuneration, and the board will approve it, and then the same will be confirmed by the shareholders of the company.

The qualifications, disqualifications, obligations, rights, and duties, applicable to the auditors of the company so far, will be applicable to the cost auditor too, The company will be responsible to give all assistance and facilities to the appointed auditor under this section so the cost auditor can audit the cost records of the company properly.

Each and every company that comes under these rules including all units and branches will have to maintain cost records for each of its financial years in Form CRA-1 on a regular basis for a monthly/ half-yearly/ quarterly/ annual basis.

The company shall notify the cost auditor concerning his appointment and shall file a notice of such appointment with the Central Government within 30 days of the board meeting in which such appointment is made or within 180 days of the beginning of the financial year, whichever is earlier, in Form CRA-2, via electronic mode.

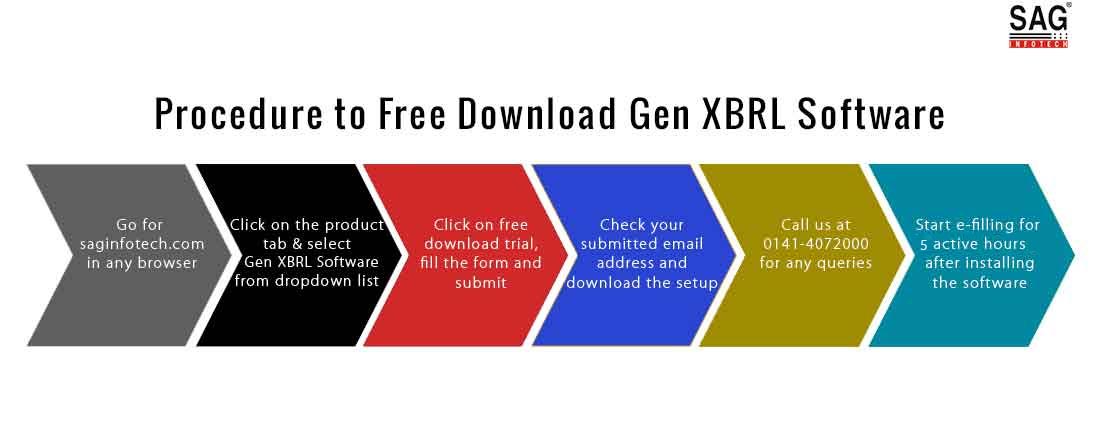

Recommended: Free Download XBRL Software for Return Filing FY 2020-21

A casual vacancy for the post of Cost Auditor, whether due to removal, resignation, or death. shall be furnished by the Board of Directors within a period of 30 days of such event of this type of vacancy and the company is responsible to notify the Central Government using Form CRA-2.

The audit report of the cost records will be submitted by the cost auditor to the board of directors of the company. A cost auditor, conducting an audit of the cost records of a company, shall submit the cost audit report in Form CRA-3 within 180 days from the end of a Financial year, along with his or her reservations or qualifications or comments or suggestions, if any.

The company will have to notify the Central Government within a period of 30 days of receipt of the report, in eXBRL format using Form CRA-4.