Throughout this post, we have discussed how you can quickly rectify errors using Gen TDS/TCS software. After furnishing the TDS return with NSDL, one may see that there seems to be an error in the returns. The same error would be due to distinct causes, such as wrong deductions, challan information and incorrect PAN details of a deductee. As per the case, the TDS/TCS return would need to be amended.

To amend the TDS returns, one is required to present the consolidated file and a justification report. The consolidated file is indeed called a ‘Conso file’, which is kept inside the information of the deductions built in the specific quarter, and the justification report poses the details on the errors in the furnished TDS return. After you post both files, follow the procedure below to amend the TDS returns through Gen TDS/TCS software with version 2.26.1.1 coded by SAG Infotech Private Limited.

- How to File a Correction Statement in form 24Q and form 26Q

- How to Do Pan Correction in the Correction Statement

- Correction of Deductee Name, Sec Code, & Amount in the Correction Statement

- Steps to Add a Challan in the Correction Statement

How to File a Correction Statement in 24Q and 26Q

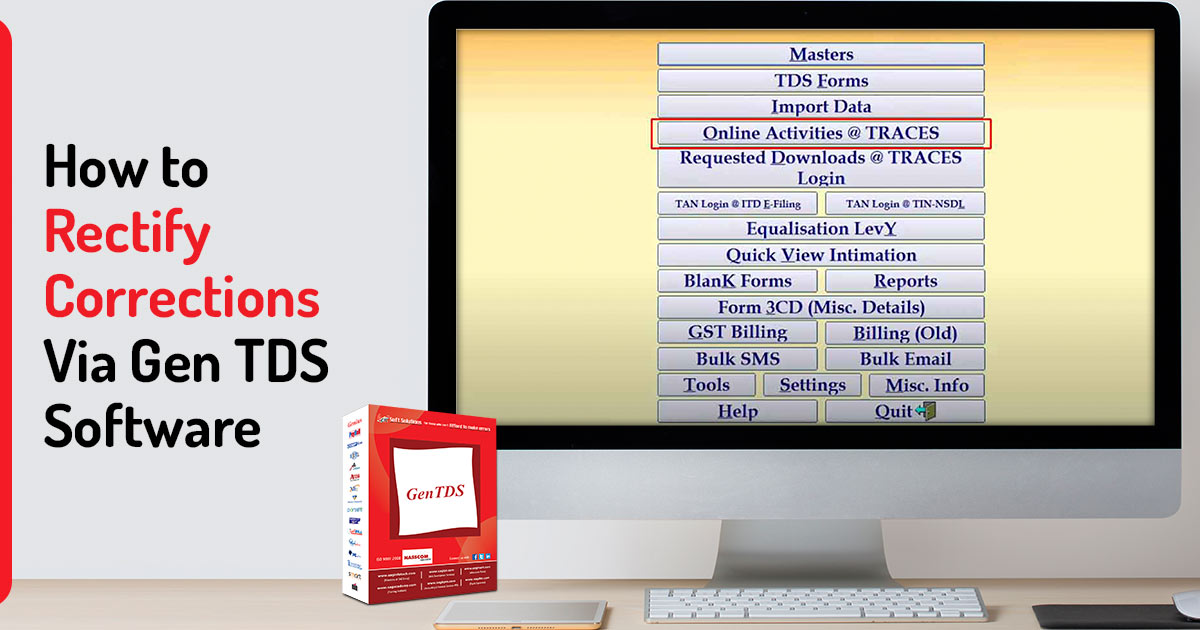

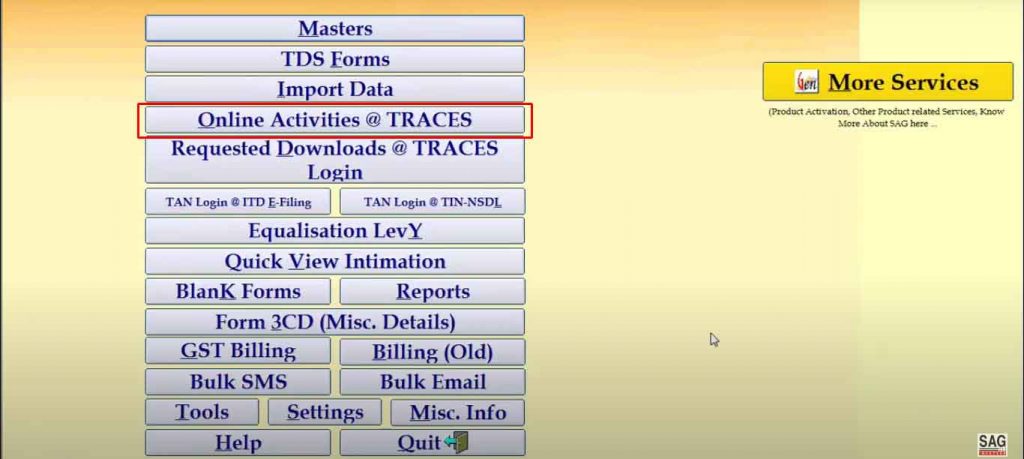

Step 1: Open the TDS e-filing software on your desktop/laptop.

Step 2: After opening the Gen TDS software, select the ‘Online Activities @ TRACES‘ option.

Step 3: Now select the ‘Request Conso File’

Step 4: After selecting ‘Request Conso File’, move the cursor to ‘View Requested Download‘

Step 5: Now move to the next step, which is a login to show the ‘Requested Download‘ list for selection.

Step 6: After login, the details of the client can be chosen in the ‘Import Conso File‘ option to correct the client details.

Read Also: Best TDS Software for CAs & Professionals in India

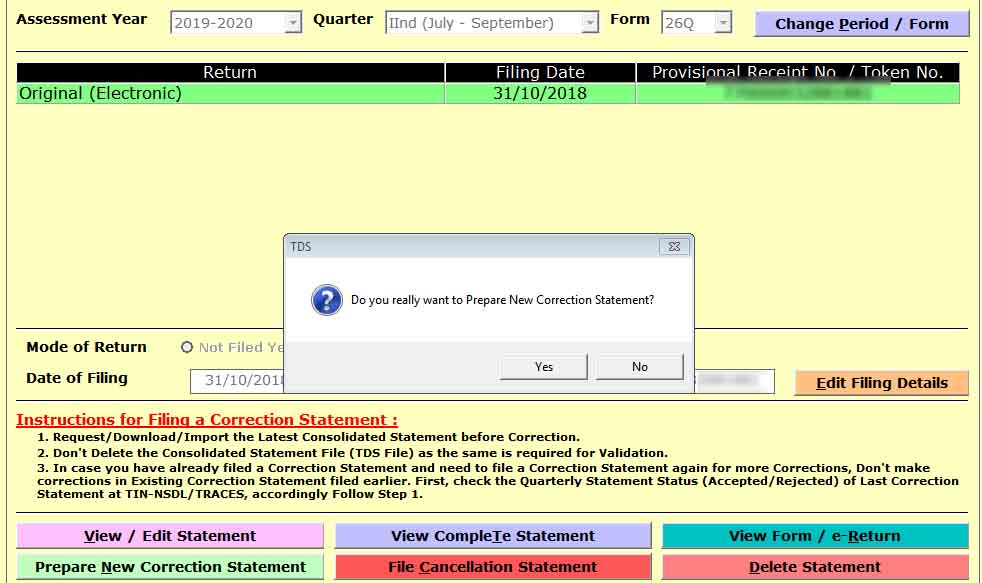

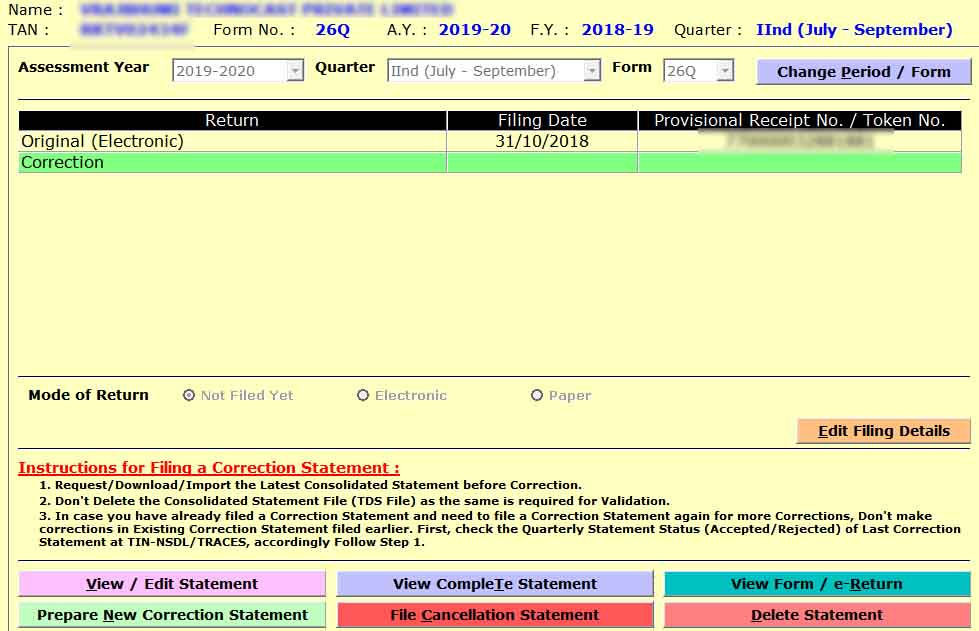

Step 7: Move on to the next step. After ‘Import Conso File‘, select ‘Prepare New Correction Statement’. Now choose this option, the Gen TDS software needs to confirm the option (Y/N) through a pop-up.

Step 8: Once you select the (Y/N) option under the ‘Prepare New Correction Statement‘, your new correction statement will be updated by our Gen TDS e-filing software.

How to Do Pan Correction in the Correction Statement

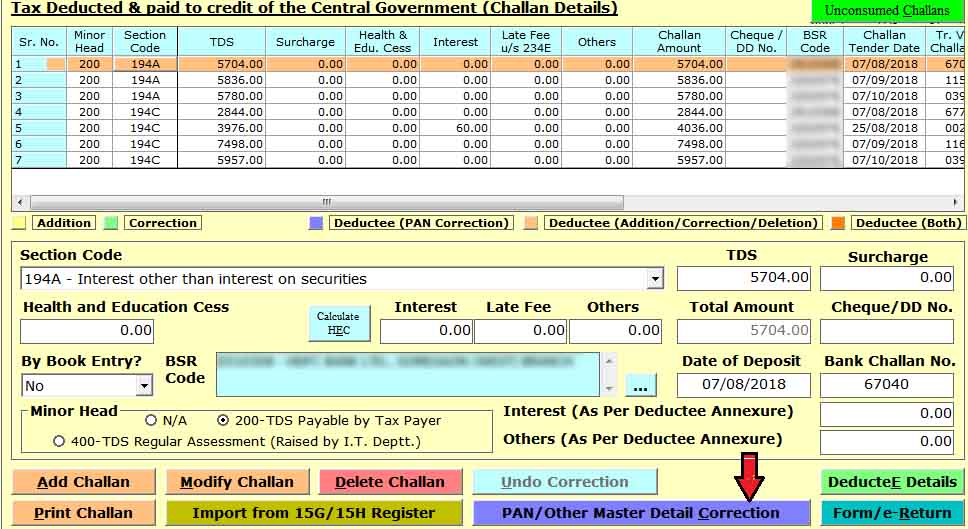

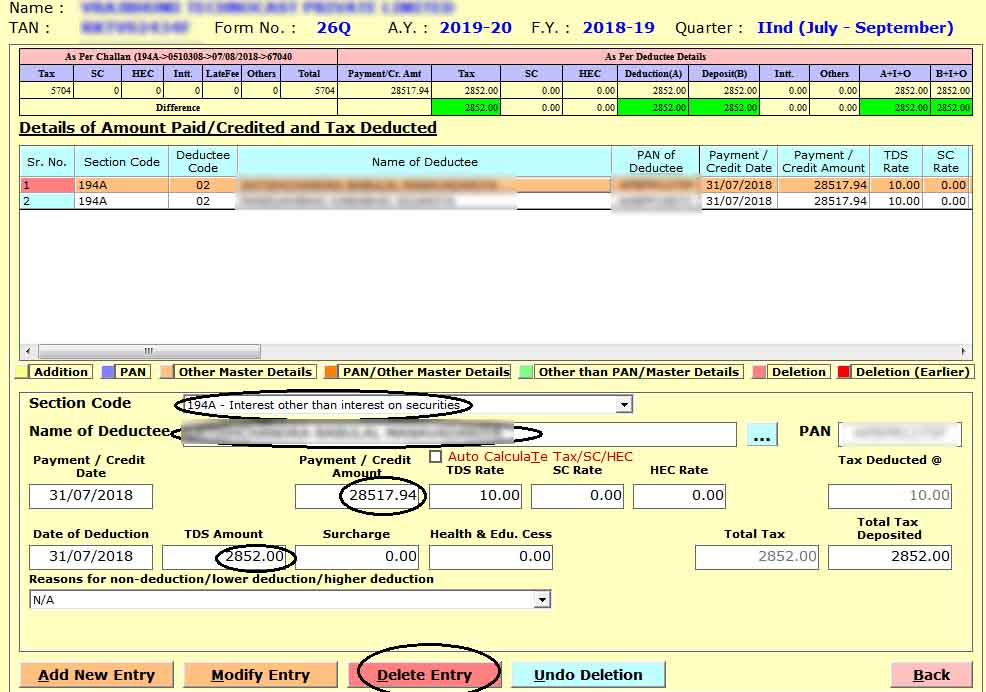

Step 1: Select the PAN/Other master details correction button to edit details.

Step 2: Move the cursor to the edit master details to update the PAN/other details.

Correction of Deductee Name, Sec Code, & Amount in the Correction Statement

Step 1: Import a Conso file when the correction statement is available.

Step 2: After importing the Conso file, select the correction statement, then move the course to the modify-entry to change the details such as the section code, the name of the deductee, and the paid amount.

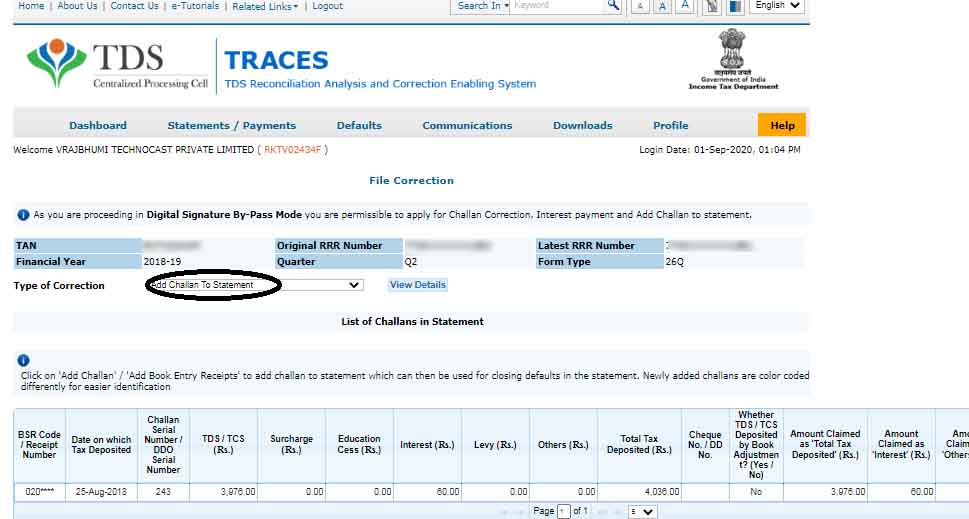

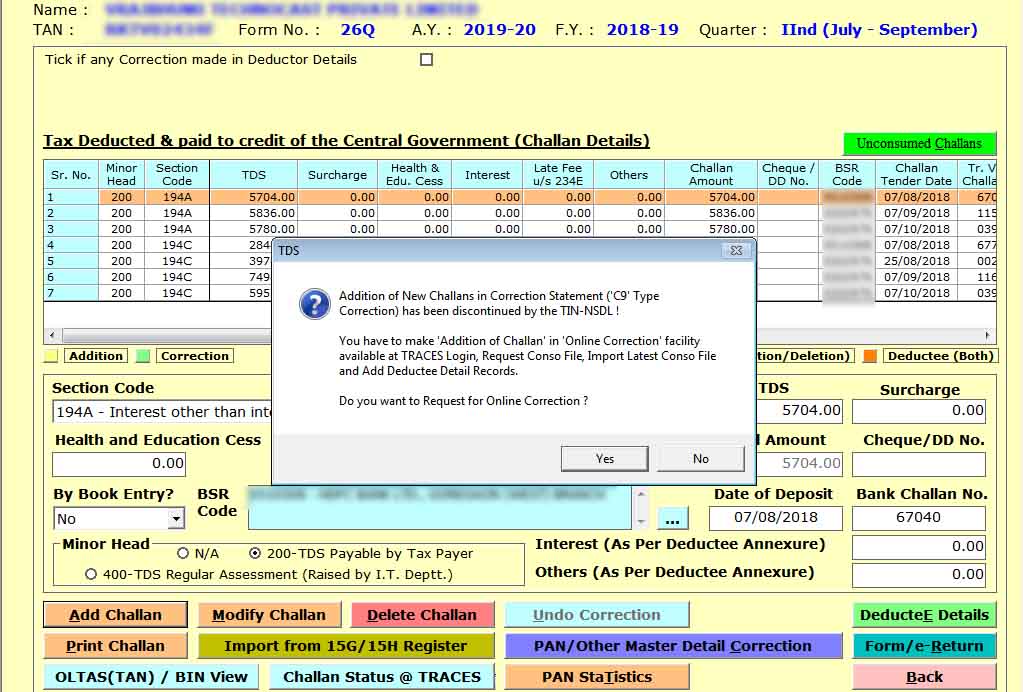

Steps to Add a Challan in the Correction Statement

Step 1: Move the cursor on the correction button while making the challan. If the client selects the correction button, our Gen TDS return e-fining software shows the pop-up related to ‘request for online correction’ for an update on the challan.

Step 2: After updating the challan, the client can click the status row as ‘Available’ or ‘In Progress’ to start the work on the correction.

Step 3: After checking the status, the taxpayer downloads the challan and adds the challan to the statement while selecting the row ‘type of correction‘ at the government’s official TRACES portal.