The government has announced a new feature into the GST system which will allow all the taxpayers to change the mobile number and email id of the particular taxpayers himself within the GST system.

The complaint earlier came in the scanner that most of the time authorized personnel who were designated for the application of registration had used their own contact details at the time of registration.

The finance ministry mentioned in the statement that, “the intermediaries who were authorized by them to apply for GST registration

This particular reason had let the government take such a technical step allowing taxpayers for modification in the contact details i.e. mobile number and email id.

Step by Step Procedure to Change Email ID & Mobile Number on Portal

- The taxpayer will have to reach the applicable jurisdictional Tax Officer for the password of GSTIN allowed of his business

- To check jurisdiction of the particular taxpayer one can log in to https://www.gst.gov.in where the jurisdiction allotted will be displayed in red text

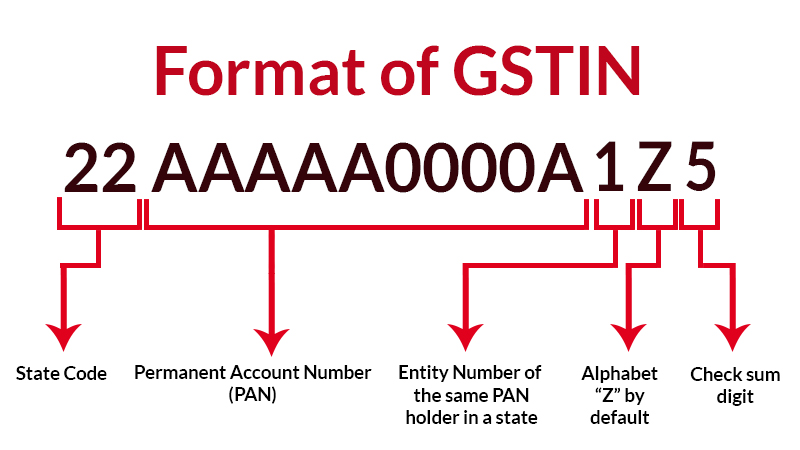

- The documents will be mandatorily required for the validation of its business according to its GSTIN

- The tax officer will cross check the details and validate if the person is a stakeholder in the given GSTIN of business

- The authentication will be done further after the tax officer will upload the documents on the GST portal

- Now the tax officer can modify the mobile number and email id of the taxpayers

- After the documents uploaded, the officer will reset the password for the GSTIN

- The given email id will receive the username and temporary password

- The login link can be used for the further modification of the password on GST portal login page https://www.gst.gov.in/

- Finally, the taxpayer after login with a temporary password will be asked to change the username and password

The said procedure can be used for changing the old username and password by the taxpayer.

Sir, Once I shared my gst id and password to someone,now he change email address and mobile number,now I can’t access my account.is there any solution for this?I complained to gst office also but they do nothing.tell me about this.

You can raise ticket on GST portal, they somehow will provide you with any solution regarding this

Changing Mobile Email address

Already in vogue for nearly a year, surprised to see this as shown as a new facility implemented just now.

Good

sir please new update my phone & whatsapp sms update

Hi sir pls tell me how can I deposit my GST without support, my advocate, because he is always demanding me a lot of money

Go to GST portal (gst.gov.in)-> Services-> Payments-> Create challan

Enter GSTIN and tax amount in their relevant heads and pay using the modes available.

Please suggest how to change the email I’d and mobile number of the authorized signatory if I know my GST portal user I’d and password

No such facility is provided by dept., you first need to add new signatory with updated mobile no. and email id and then need to delete old signatory.