Relying solely on data from Form 26AS (Income Tax) without corroborating evidence was insufficient to verify service tax liability, the Delhi Bench of the Customs, Excise & Service Tax Appellate Tribunal (CESTAT) ruled.

The demand originally raised from the Show Cause Notice dated July 30, 2021, has been quashed by the bench of Dr. Rachna Gupta (Member-Judicial). From the limitation, the notice was barred, and no proof was there to reflect the suppression or fraud by the company, the tribunal cited.

Read Also: CESTAT Kolkata Rejects Tax Demand, No Verification By Dept for the Amount Noted in Form 26AS

After a departmental audit shows disparities between the income declared by the company in ST-3 returns and its financial records for services associated with Erection, Commissioning and Installation (ECIS), and Maintenance or Repair Services (MRS), a dispute has arisen. A demand of Rs 25.66 lakh has been issued via the department in the service tax, including interest and penalties.

The demand, forcing the company to appeal to the Tribunal, has been carried by the Commissioner (Appeals), CGST Indore.

In the company’s financial data, all related financial data has been revealed and returns furnished in July 2019, the tribunal mentioned. Therefore, contradicting any allegation of suppression or fraud.

Earlier rulings that carried assumptions grounded on 26AS without thorough analysis, and could not constitute the only grounds for a demand, have been quoted by the tribunal.

Under the Finance Act, 1994, the Tribunal observed the misuse of the extended limitation period, stating that the SCN was time-barred since no willful misstatement or suppression by the appellant was there.

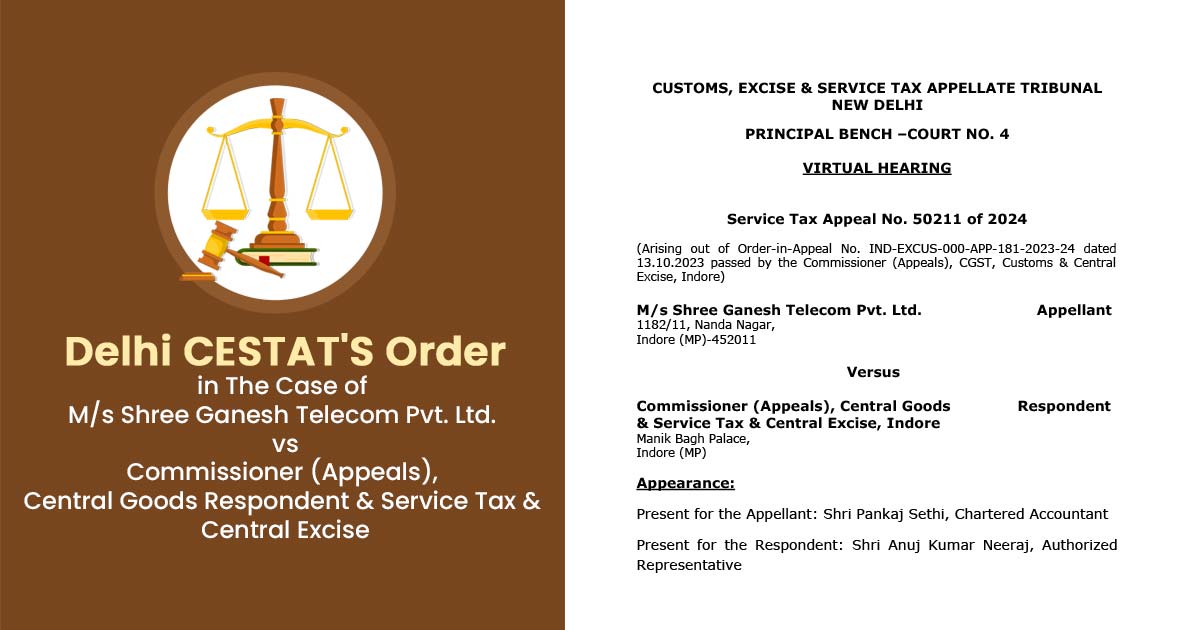

| Case Title | M/s Shree Ganesh Telecom Pvt. Ltd. vs Commissioner (Appeals), Central Goods Respondent & Service Tax & Central Excise |

| Citation | Service Tax Appeal No. 50211 of 2024 |

| For Appellant | Shri Pankaj Sethi |

| For Respondents | Shri Anuj Kumar Neeraj |

| Delhi CESTAT | Read Order |