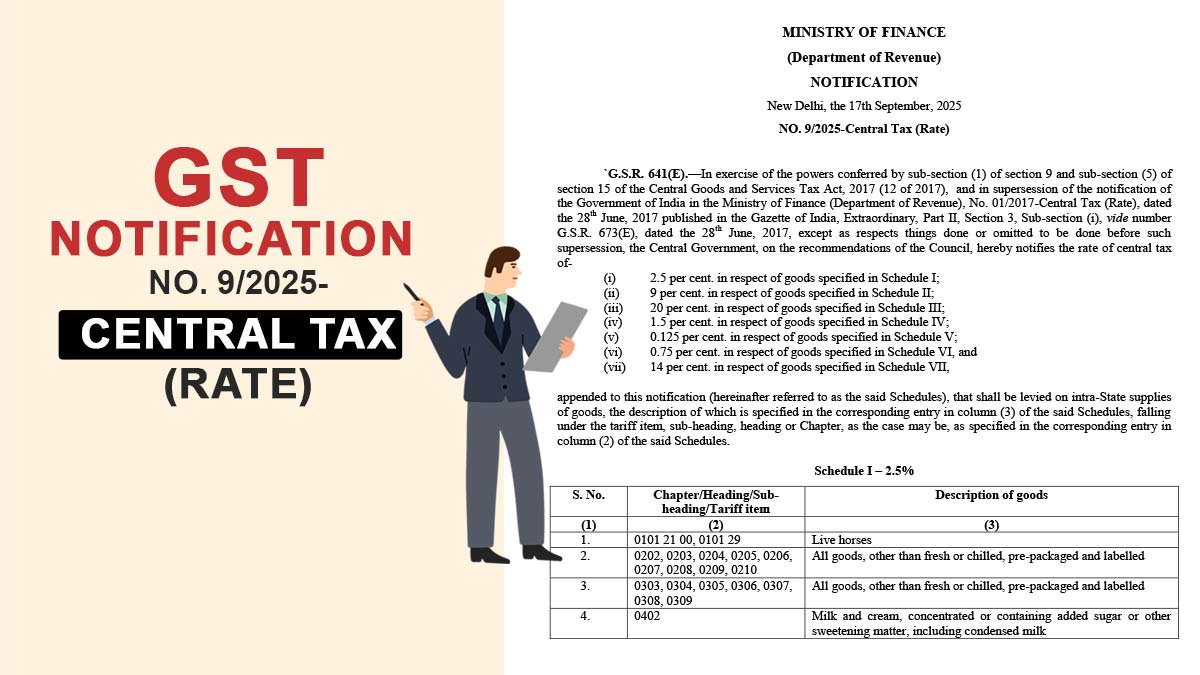

On Wednesday, the Ministry of Finance released a Gazette notification that updates the Goods and Services Tax (GST) rate framework in accordance with the Central Goods and Services Tax Act of 2017. This revision aims to enhance the efficiency and clarity of the GST system.

The revised rate schedule supersedes the notification of June 28, 2017, replacing the former rules and introducing a simpler rate structure for 7 schedules.

The government announced that recent changes to the Goods and Services Tax (GST) were implemented based on recommendations from the GST Council. As of September 3, the council has replaced the previous four-slab tax system, which included rates of 5%, 12%, 18%, and 28%, with a more streamlined two-rate structure.

This new system features a 5% tax rate for essential goods and an 18% standard rate applicable to the majority of goods and services.

From 22nd September, the revised rates shall come into force

Under the revised structure, goods are grouped into 7 schedules, each with a different central tax rate:

- 2.5% on goods in Schedule I

- 9% on goods in Schedule II

- 20% on goods in Schedule III

- 1.5% on goods in Schedule IV

- 0.125% on goods in Schedule V

- 0.75% on goods in Schedule VI

- 14% on goods in Schedule VII

HSN (Harmonised System of Nomenclature) / tariff-item codes specify which goods come within each schedule. Pertinent to each schedule, detailed HSN chapters, headings, and subheadings are listed in the government’s GST portal. For example, under Schedule I, certain chapters like 0202-0210 (pre-packaged and labelled fresh/other goods) are included.

For instance, Schedule I includes specific chapters such as 0202-0210, which cover pre-packaged and labelled fresh and other goods. This detailed categorisation helps in the efficient administration of goods and services tax.

This notification delivers an explanation to businesses and streamlines compliance by lessening the peculiarities of product classification.

Given below is the notification that furnishes the updated GST rate applicable to distinct products under distinct HSN codes.