A notification was issued by the Ministry of Finance on September 17, 2025, outlining the deadlines for submitting appeals to the GST Appellate Tribunal, which is the authority that handles disputes related to the Goods and Services Tax (GST). This is part of the rules established in the GST law that was enacted in 2017.

Taxpayers can submit the appeals to the Tribunal up to 30th June 2026 concerning all cases where orders challenged were communicated before 1st April 2026. Appeals must be filed within the statutory period of three months from the date of communication of orders communicated on or after 1st April 2026.

On the GST council’s suggestions, the same notification has been issued that delivers a transitional window for the taxpayers to carry forward the legacy appeals to the newly operationalised Tribunal, while ensuring that a uniform limitation period is applicable to future appeals.

The notification cited that “In exercise of the powers conferred by sub-section (1) of section 112 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Government, on the recommendations of the Council, hereby notifies the 30th day of June, 2026, as the date upto which appeal may be filed before the Appellate Tribunal under this Act in respect of all cases where the order sought to be appealed against is communicated to the person preferring the appeal before the 1st day of April, 2026 and all appeals in respect of order communicated on or after 1st April, 2026 may be filed before the Appellate Tribunal within three months from the date on which such order is communicated to the person preferring the appeal.”

The appointment of 53 Judicial Members to the GSTAT has been approved by the Government of India. Among the new appointees is Justice (Retd.) Mayank Kumar Jain, a former judge of the Allahabad High Court, will join the Principal Bench in New Delhi.

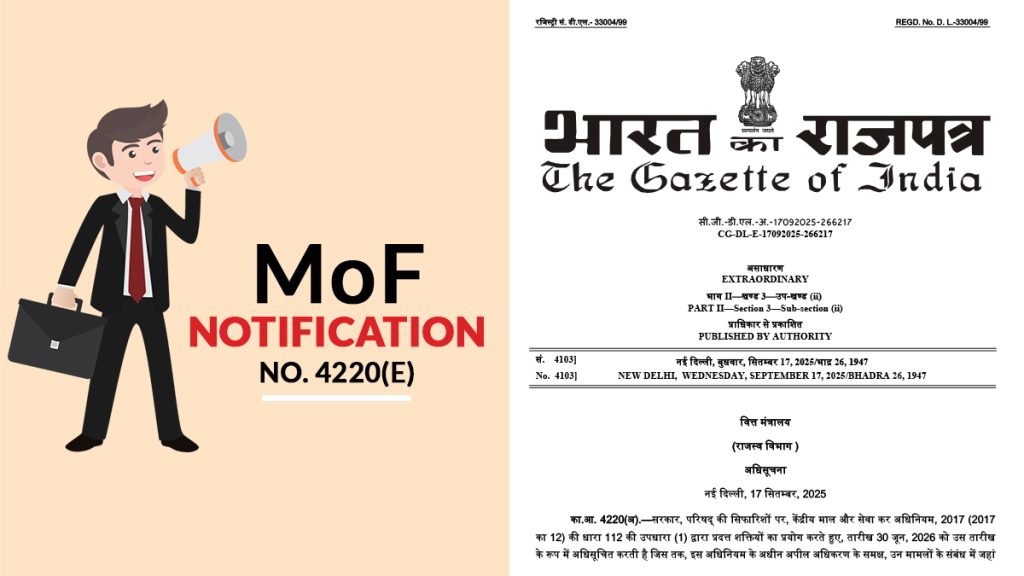

Read MoF Notification No. 4220(E)