The Central Board of Indirect Taxes and Customs (CBIC) said that the customs automated system notified Rs 1000 as the fees in managing the mismatch amid shipping bill and GST returns.

The board said to impose the fees (Customs Documents) Amendment Regulations, 2021 which seeks to further amend the Levy of Fees (Customs Documents) Regulations, 1970. The Revision will be Effected from 17th February 2021.

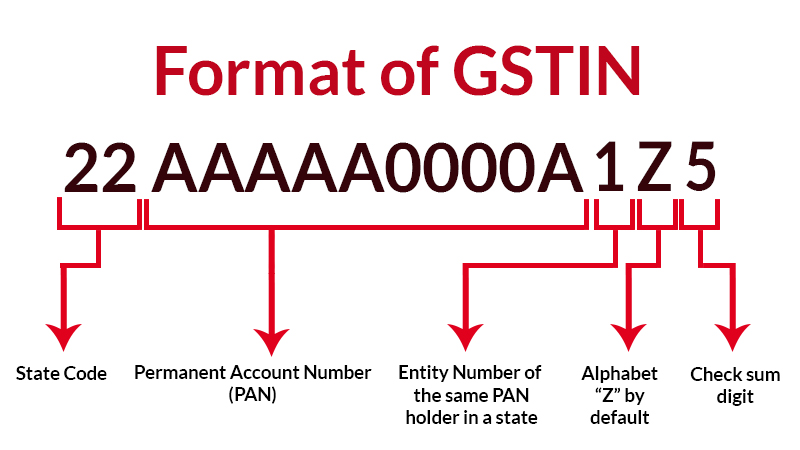

When the entity furnishing the shipping bills is the enrolled office as well as the entity who furnished the Integrated GST (IGST) is a manufacturing unit then mismatch happens in the GST identification numbers (GSTIN)

CBIC previously ruled that remembering the hardships faced by the exporters with respect to SB005 errors (mismatch in invoice information in shipping bill and returns), the board has opted to prolong the facility of the officer interface to shipping bills furnished up to April 30. But the exporters are said to arrange the export invoices provided to the customs and GST authorities for better processing of refund claims.

Please let me know which invoice we need to declare in GSTR 1 whether GST invoice (made at the time of factory to port) or actual export booking invoice (made after goods move from port to destination). both the invoice no is different.

This case one bill is a shipping bill and another is a tax invoice, they might be different but you should declare the total sum value in your GSTR-1, you may consult to GST practitioner for the same for better reference