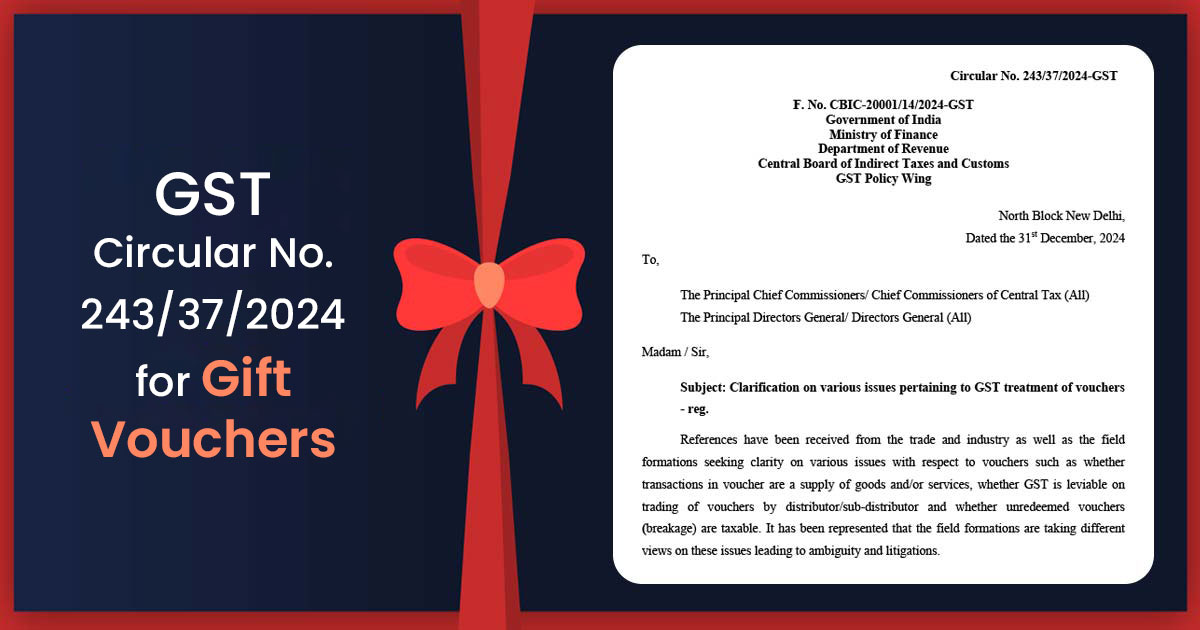

The Central Board of Indirect Taxes and Customs (CBIC) has stated in a recent announcement via circular number 243/37/2024 that gift vouchers and cards will not be charged Goods and Services Tax (GST).

It was mentioned by the Central Board of Indirect Taxes and Customs (CBIC) that the way the Goods and Services Tax (GST) applies to voucher transactions. The categorization of Vouchers shall be into two classes each with distinct GST implications.

Prepaid Vouchers Classified as Money

Prepaid vouchers, like gift cards and digital wallets, are considered prepaid instruments, by the Reserve Bank of India (RBI). Under the GST framework, these vouchers are regarded as money.

Consequently, the transactions comprised of prepaid vouchers shall not be regarded as the supply of goods or services for GST objectives.

They are considered as a payment method like cash.

Non-Prepaid Vouchers Considered as Valid Claims

Non-prepaid vouchers do not qualify as prepaid instruments. Such vouchers provide the holder the right to get particular goods or services and are categorized as actionable claims.

Likewise, the prepaid vouchers the transactions comprise such vouchers are within the GST as they are not regarded as the supply of goods or services.

GST Implications of Transactions Involving Vouchers

Irrespective of the type of voucher, the transactions comprising the voucher do not draw GST.

However, the goods or services that could be redeemed via the use of the vouchers might be within the GST.

GST Impact on Voucher Distribution Models

CBIC has furnished assistance on the GST treatment of the distribution of the voucher.

Two primary models for distributing vouchers are-

- Principal-to-Principal Relationship: The model contains the distributor’s purchase vouchers from the issuers at reduced costs and sells them to the sub-distributors or customers. As such transactions do not entitle the supply of goods or services as they are not within the GST.

- Commission or Fee-Based Options: On behalf of the voucher issuer the Distributors and agents in this model work, furnishing the marketing and assistance services in exchange for a commission or fee. The commission or fee is within the GST therefore the transaction is a service.

Read Also: GST Cir 242/36/2024: Place of Supply for Online Services to Unregistered Recipients

Other Services and Unused Vouchers

GST will apply to the distributors or service providers offering additional services like advertising or customer support to voucher issuers.

GST will be charged on the levied service fee, as per the applicable rates.

CBIC for the unused vouchers mentioned that if the vouchers lapse and proceed unredeemed (directed to as breakage) then no supply of goods or services arises.

Hence no GST is to be charged on the money from such unredeemed vouchers.

Tax experts further elaborate on the classification of vouchers under GST.

He cited that the vouchers are the pre-payment instruments that the RBI specifies which directs that they make an obligation to the supplier to accept them as payment for the goods or services. If a ₹10,000 voucher is bought by the customer from a store then the GST applies to the goods purchased not the voucher itself.

If the RBI does not cite a voucher as a prepaid instrument then the same shall be regarded as an actionable claim under the GST Act. No GST would be there on the actionable claims rather than the activities such as gambling.

Important: GST AAR: No Tax on Late Fees, Fines and Penalties Received by RBI from Institutions

What Does This Direct to Businesses?

It is required that the businesses comprehend that the sale or purchase of the vouchers is not levied to GST therefore any commissions or service fees pertinent to the voucher transactions shall be within the GST.

In the forthcoming budget amendments to the GST framework are anticipated objecting to clear any peculiarities in voucher taxation.