A Penalty Order claimed by the Revenue has been dismissed by the High Court of Andhra Pradesh at Amaravati noting that Form GST MOV 07 issued u/s 129(3) of the Central Goods and Services Tax Act, 2017 ( CGST Act ) specifies the provision of seven days time to issue a reply towards a Show-Cause Notice (SCN) issued for the identical purpose.

HC noticed while adjudicating a writ petition submitted by Sfc Environmental Technologies Limited, an entity furnishing environmental technology solutions, particularly for sewage treatment and municipal solid waste treatment.

An order was being placed by the applicant for specific elements from a manufacturer based in Telangana, for delivery to their facility in Karnataka. In the transit, the goods were apprehended in Andhra Pradesh and within the seizure and confiscation procedure which has been prevented during the penalty payment.

As per that, an SCN was been issued to the applicant dated 29.10.2024 to show cause as to why the previously imposed penalty must not be confirmed. A response has been issued via the applicant for the Show Cause Notice(SCN) dated 31.10.2024 arguing that a legal time duration of 7 days is present to the applicant to provide a response in these matters.

But the revenue has finished the proceedings in the said time and sent the notices of the personal hearing after that while validating the amount of penalty that has been imposed on the applicant before.

The revenue in the proceedings towards the Andhra Pradesh High Court has challenged the writ petitions maintainability against orders of seizure and confiscation, directing to the decision of the Supreme Court in The State of Uttar Pradesh & others vs. M/s. Kay Pan Fragrance Pvt. Ltd. (2020).

Read Also: No Penalty U/S 129(3) When There is Clear Evidence of Intentional GST Evasion

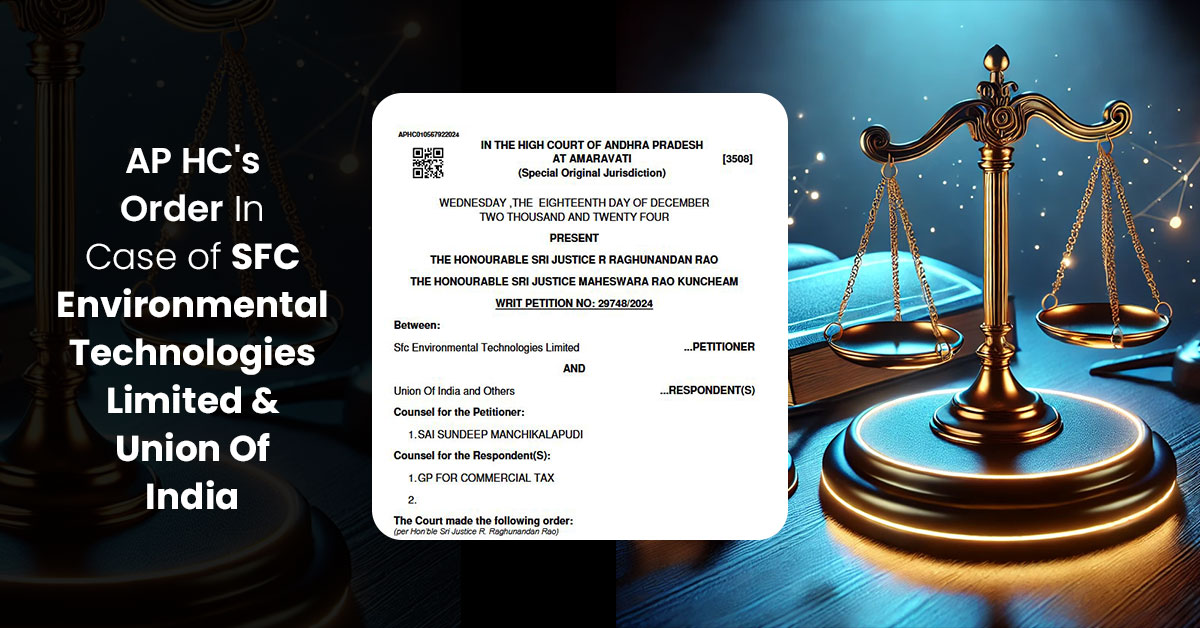

The Division Bench comprising Justice R Raghunandan Rao and Justice Maheswara Rao Kuncheam noted the non-applicability of Kay Pan Fragrance to the existing matter as the main contention that the applicant raised quoting the breach of principles of natural justice and non-provision of the minimum period of 7 days to file a reply to show cause notice.

It was noted by the bench that the SCN has been provided dated 29.10.2024 and the penalty order was passed dated 05.11.2024 before the lapse of the 7 days time limit as given to the applicant by Form GST MOV 07 issued u/s 129(3) of the CGST Act, 2017.

The Andhra Pradesh High Court after marking a procedural breach coupled with the breach of principles of natural justice in giving enough chance has set aside the penalty order on 05.11.2024 and remanded the case back to the revenue to pass the significant orders post furnishing the due chance to the applicant to make their matter effective.

| Case Title | Sfc Environmental Technologies Limited & Union Of India |

| Citation | Writ Petition No: 29748/2024 |

| Date | 18.12.2024 |

| Petitioner by | Sai Sundeep Manchikalapudi |

| Respondents by | GP for Commercial Tax |

| AP High Court | Read Order |