An updated guideline has been furnished by the income tax department to either exempt or lessen the interest that the taxpayer holds towards the late payments given a specific condition is satisfied.

The same adjustment has been proposed to facilitate the relief process, particularly for taxpayers who are facing financial difficulties.

What Says the Law for Taxpayers?

The assessees u/s 220(2A) of the Income Tax Act, who forget the due date to pay the demand notice amount are levied a 1% monthly interest on the overdue amount.

Senior tax officials in a matter can approve an exemption or reduction of the same interest if specific needs are fulfilled.

Who Can Be Authorised Waivers or Tax Reductions?

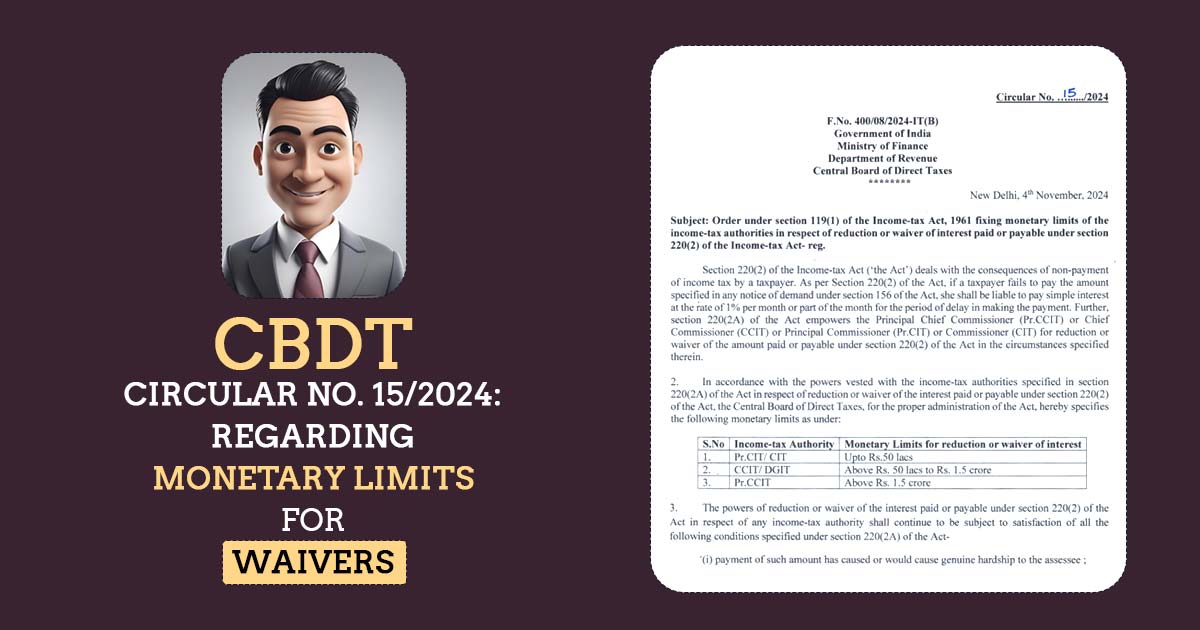

A circular has been furnished dated 4th November by the Central Board of Direct Taxes (CBDT) that cited the financial limits for exempting or reducing based on the rank of the tax official-

- Chief Commissioner (CCIT): Authorised to manage waivers or reductions on interest amounts between ₹50 lakh and ₹1.5 crore.

- Principal Chief Commissioner (PrCCIT): Can determine to exempt or reduce the interest amount of more than Rs 1.5 crore.

- Principal Commissioner (PrCIT) and Commissioner (CIT): Can approve the exemption or reductions towards the interest amount up to Rs 50 lakh.

Relief Conditions

Taxpayers must meet the below conditions to be entitled to a waiver or reduction in interest-

- Monetary problem: The payment of interest should lead to, or have led to, real financial difficulties.

- Uncontrollable Uncertainty: The delay should have been caused by factors beyond the taxpayer’s control.

- Association: The taxpayer is required to have fully cooperated during the tax assessment and any associated processes.

Tax experts cited that the same move is anticipated to speed up the processing of exemption or reduction applications since tax officers have a framework for making decisions.

Read Also: CBDT Rolls Out New Guidelines to Simplify Compounding of Income Tax Offences

Tax expert stresses the same structure surges clarity and efficiency by authorizing distinct levels of tax officials to make decisions more faster and more consistent.

Another tax expert mentioned that placing such fiscal limits allows the officials to handle the interest relief cases in a perfect way which assures the correct forecast and support for the assessees who are facing financial hardships.