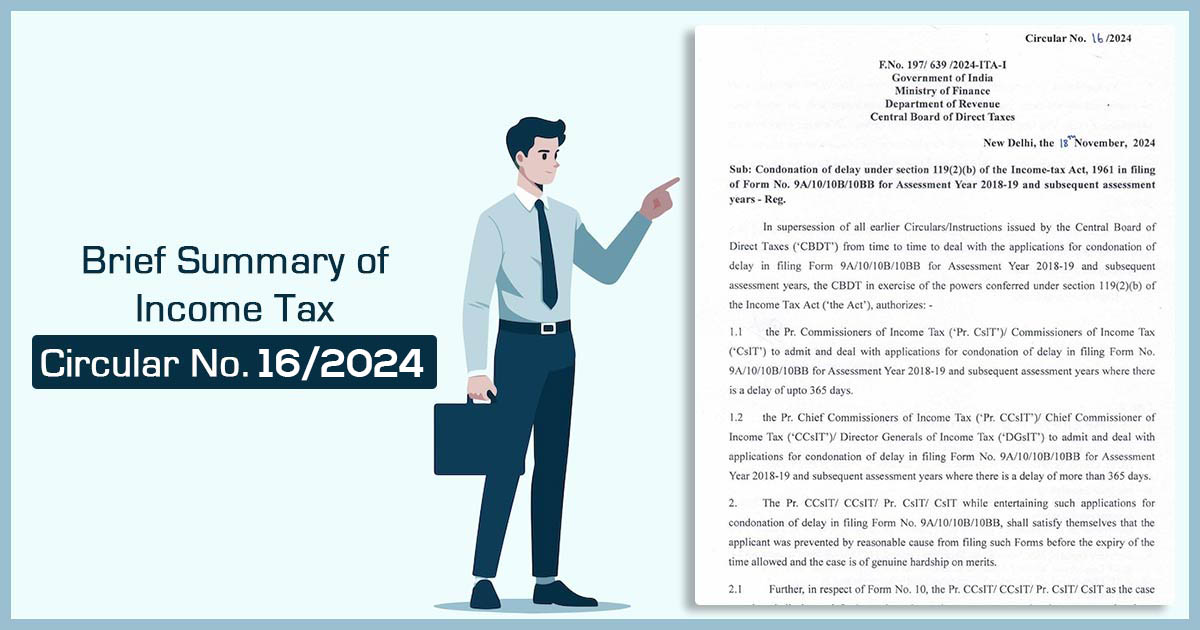

To address the condonation of delay in submitting required income tax forms, Circular No. 16/2024 dated November 18, 2024, has been issued by The Central Board of Direct Taxes (CBDT).

These required income tax forms are- Form No. 9A, 10, 10B and 10BB for the Assessment Year (AY) 2018-19 and the following assessment years. The circular, released following Section 119(2)(b) of the Income Tax Act, 1961, proposed extending filing deadlines for taxpayers who encountered reasonable challenges in doing so.

Crucial Information of the Circular Taxpayers Need to Know

Forms Included

- 9A: This form is to apply for the option given under Section 11(1), applicable for income for charitable or religious purposes.

- 10: This form is the statement of total collected income under Section 11(2).

- 10B: This form is for audit reports under Section 12A(b) for charitable/religious trusts.

- 10BB: This form is for audit reports for institutions demanding exemption under Section 10(23C).

Who Are the Applicable?

- Assessment Year 2018-19 and following years.

- Taxpayers with reasonable challenges in filing these forms now want condonation for delays.

What Are the Legal Provisions?

An exemption is allowed under Section 119(2)(b), which gives CBDT power to condonation delays to eliminate taxpayers’ challenges.