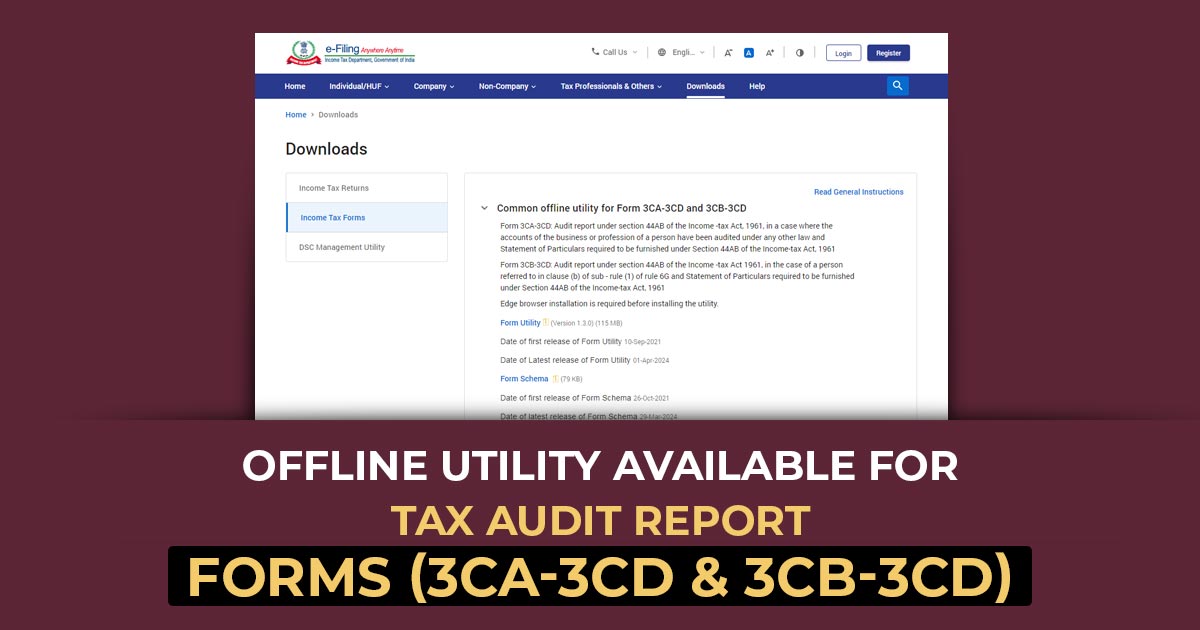

On April 1st, 2024, the income tax department released the latest common offline utility for Form 3CA-3CD and 3CB-3CD. On the date 10th September 2021, the department has listed the first version of the form utility.

Under Section 44AB of the Income-tax Act, 1961, Form 3CA-3CD is an audit report for the case in which the business or professional accounts of the individual get audited under any other law and a statement of the particulars needed to get filed under Section 44AB of the Income-tax Act.

Form 3CB-3CD is an audit report under Section 44AB of the Income-tax Act when the case of a person referred to in clause (b) of sub-rule (1) of rule 6G and Statement of Particulars required to be furnished under Section 44AB of the Income-tax Act.

Important: An Overview of New Amendments in Income Tax Section 44AB

The rules governing a group of taxpayers required to submit to an audit by a chartered accountant are outlined in Section 44AB. According to Section 44AB, the audit’s goal is to determine whether the taxpayer complies with all applicable sections of the Income-tax Law and has satisfied all other requirements. The audit of the taxpayer’s accounts performed by a chartered accountant in accordance with Section 44AB is frequently referred to as a “tax audit.”

Process to Download Offline Utility of Tax Audit Report Forms

- Visit the Income Tax website – https://www.incometax.gov.in/iec/foportal/

- Navigate to ‘Downloads’

- Click on ‘Income Tax Forms

- Click on ‘Form Utility’ under Common offline utility for Form 3CA-3CD and 3CB-3CD