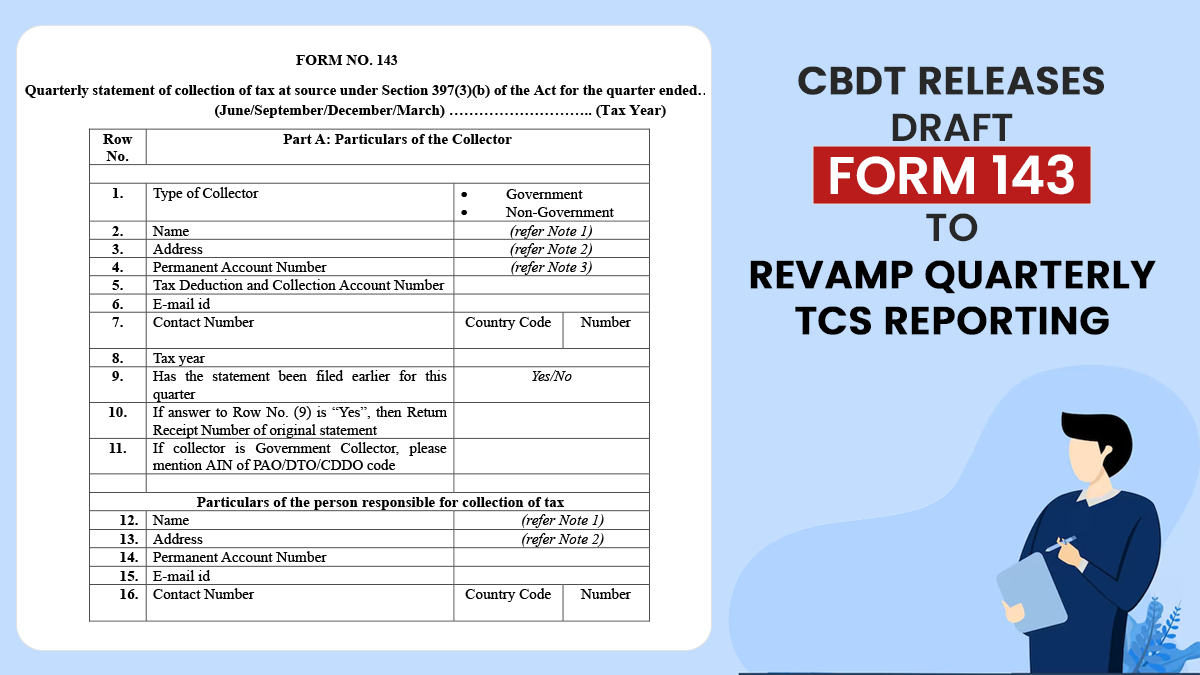

Draft Form No. 143, a new format for filing quarterly statements of Tax Collected at Source (TCS) under Section 397(3)(b), has been rolled out by the Central Board of Direct Taxes (CBDT).

The proposed form aims to ease reporting liabilities for Government and Non-Government collectors, and improve clarity and traceability of tax collection transactions.

When Form No. 143 is Applicable

Form 143 must be filed by every person obligated for collecting tax at source for each quarter ending:

- June

- September

- December

- March

The form applies to collectors dropped under different provisions of Section 394 and Section 397 of the Income-tax Act, 2025.

Design of Draft Form 143

The draft form is classified into two sections:

Part A: Details of the Collector

This section captures:

- Type of collector (Government / Non-Government)

- Name and address

- PAN (mandatory for non-Government collectors)

- TAN

- Contact details

- Tax year

- Whether the statement is original or revised

- AIN (in case of Government collectors)

It needs details of the person accountable for TCS compliance.

Read Also: Quick to Understand Differences B/W TDS & TCS Under I-T Act

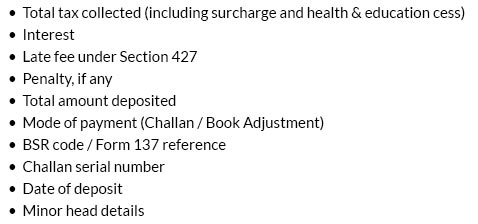

Part B: Tax Collection, Deposit, and Payment Details

This section comprises:

Read More: How to Quickly Correct Errors Via I-T Challan Feature, Check

The DDOs of the Government must cite amounts remitted via PAO/CDDO/DTO, while others must report challan-based deposits.

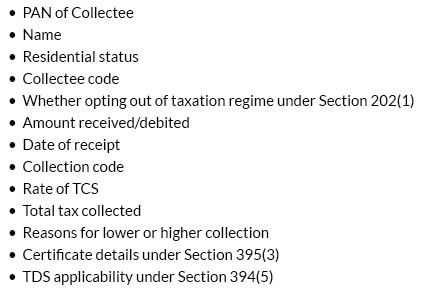

Annexure: Collectee-wise Breakup of TCS

One of the most detailed elements of Draft Form 143 is the Annexure, which mandates collectee-level reporting.

The annexure needs disclosure of:

This granular reporting shows a compliance-based approach that has the purpose of improving data reconciliation through TIN 2.0/TRACES systems.

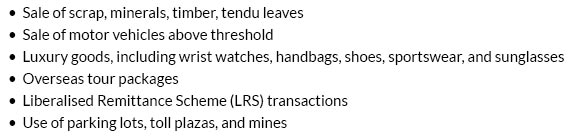

Updated Collection Codes u/s 394

The draft form comprises a list of collection codes, which includes transactions such as:

Each transaction type is mapped to a particular section code (e.g., 1068 to 1092).

Compliance Highlights

The form integrates new references to provisions such as Sections 394, 395, 397, 400, and 402 under the Income-tax Act, 2025.

How Businesses and TCS Collectors Are Affected

The rollout of Draft Form 143 shows:

Businesses dealing in luxury goods, overseas tours, LRS remittances, scrap, minerals, and specified goods should revisit their TCS reporting systems to align with the proposed format.

Read Also: CBDT Releases New Draft Form 130 for Consolidated TDS Certificate U/S 395

Closure Draft Form No. 143 describes a structured and compliance-driven upgrade to the quarterly TCS reporting procedure under the Income-tax Act, 2025. With detailed collectee-wise disclosures and expanded transaction codes, the new format is ready to make transparency and legislation stronger in TCS administration.

Stakeholders must analyse the draft and prepare for execution once formally notified.

PDF Format of Draft Form 143