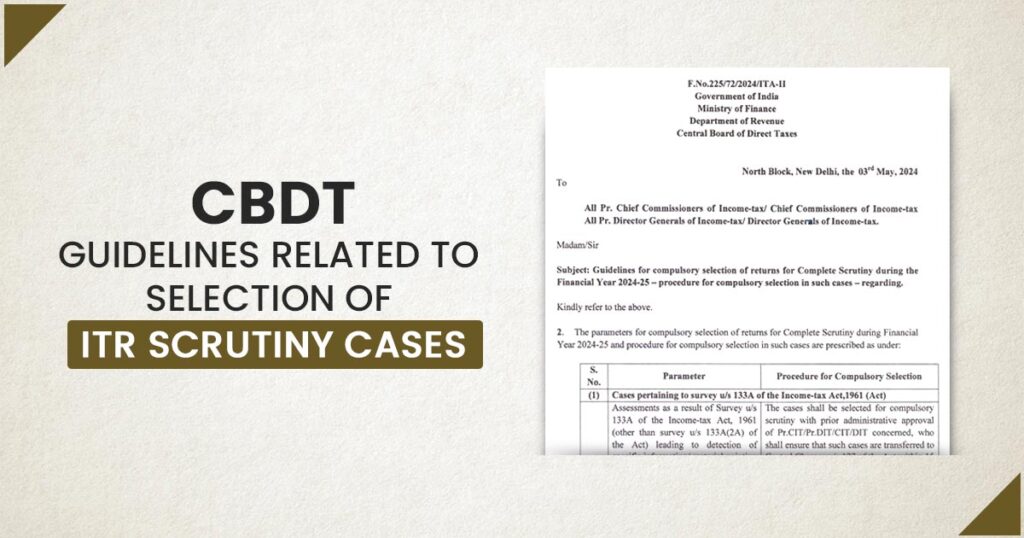

A notification for the process of the scrutiny of the ITR for FY 2024-25 has been issued by the Central Board of Direct Taxes (CBDT). The same motive is to increase clarity and ensure tax compliance among taxpayers.

Important Key Points for New Guidelines

Objective for Tax Scrutiny: As per the new norms the assessees shall be informed of the particular causes why their Income tax returns need to get shortlisted for the purpose of investigation. The same action is made to furnish transparency and diminish the uncertainties in the process of investigation.

Precise Information for Tax Evasion: An investigation shall be carried out for the cases in which the particular details for the tax evasion are furnished through any statute enforcement agency and the pertinent income tax return (ITR) is provided. Such matters list shall be made and provided for the additional measure.

Cases for Tax Scrutiny: The procedures draft several scenarios that warrant scrutiny:

- Survey Cases Under Section 133A: The matter that emerges via the surveys directing to tax evasion detection shall be investigated. Approval from the administration is needed in this case and is to get transferred to Central Charges within 15 days of notice issuance.

- Search and Seizure: U/s 153C the matters concerning search and seizure are selected for scrutiny, with crucial approvals and centralization within 15 days of notice.

- Non-filing of I-T Returns: Cases in which no return has been submitted in reply to a notice under section 142(1) will be scrutinized. Jurisdictional Assessing Officers (JAOs) are accountable for uploading appropriate documents for further action by the National Faceless Assessment Centre (NaFAC).

Concentrate on Tax evasion: CBDT carried on to stress the tax evasion matters. Cases can easily be determined while sharing the details from the other agencies in line with the authority’s continuous measures to combat tax evasion and enforce compliance.

Read Also: Alert! Heavy Penalties on Such Types of Tax-Evading Methods

Expert Understandings

Clarity and Fairness: The tax expert underscores that the new procedures have the motive to draw more clarity and righteousness to the process of investigation. The assessees have transparent insights into why their returns need to be chosen for investigation, which could diminish the stress and enhance trust in the system.

Preparation and Compliance: The assessees with particular criteria could effectively prepare for the investigation by assuring all the critical documentation is in place. It is anticipated to motivate dynamic and precise return filing, reducing cases of tax evasion, under the said norms.

Effects on Taxpayers:

- Improving Awareness: Concerning potential triggers for scrutiny, taxpayers will be more informed authorizing them to take visionary steps in their tax planning.

- Check Tax Evasion: Determined scrutiny parameters might prevent assessees from involving in activities that can directed to investigation, promoting the compliance culture.

Closure: Towards the investigation of the income tax returns the new norms of CBDT show a visionary stance in enforcing tax compliance. By improving the clarity and mentioning the criteria of investigation, the purpose of the procedure is to ensure a fair and uniform procedure, facilitating greater compliance with tax statutes among taxpayers.