An Overview of CARO 2020

The Companies Act of 2013 mandates the use of CARO 2020 as the new audit report format for statutory audits of companies. Following discussions with the National Financial Reporting Authority (NFRA), additional reporting requirements have been included in CARO 2020. The NFRA is an autonomous regulatory organization that oversees the accounting and audit profession in India. The primary objective of CARO 2020 is to improve the quality of reporting provided by company auditors.

Scope of the CARO 2020

CARO 2020 is mandatory for all statutory audits starting from 1st April 2021 for the financial year 2020-21. It applies to all companies that were subject to CARO 2016, except those explicitly excluded from its scope.

- An individual company.

- A small company is one whose paid-up capital is less than/equal to Rs 4 Crore and whose last reported revenue is less than/equal to Rs 40 crore).

- Companies that deal with banking.

- Charitable organizations registered with the IRS.

- The insurance industry.

- Also exempt from CARO, 2020 are the following private companies: –

- In the financial year, gross receipts or revenue (including revenue from discontinuing operations) are less than or equal to Rs 10 crore.

- A company with a paid-up share capital and reserve less than or equal to Rs 1 crore at the end of the fiscal year (i.e. at the end of the FY).

- Holdings or subsidiaries of public companies are not included.

- During the FY, whose borrowings are less than or equal to Rs 1 crore from any bank or financial institution at any point of time during the financial year.

Importance of Gen Bal Software When Generating the CARO Report

Gen Balance sheet preparation software simplifies the task of creating balance sheets, trading accounts, profit and loss accounts, and related accounting tasks for professionals. Additionally, the software provides convenient data import options from commonly used third-party software such as Tally and Busy.

The software offers the following features calculation of profit/loss data and automatic generation of balance sheets. The software also generates a data-based trial balance. Furthermore, it enables users to review tax audit reports, create trading accounts with quantitative details in column format, produce various audit reports, and perform other tasks.

Procedure to Generate CARO Report Via Gen Balance Sheet Software

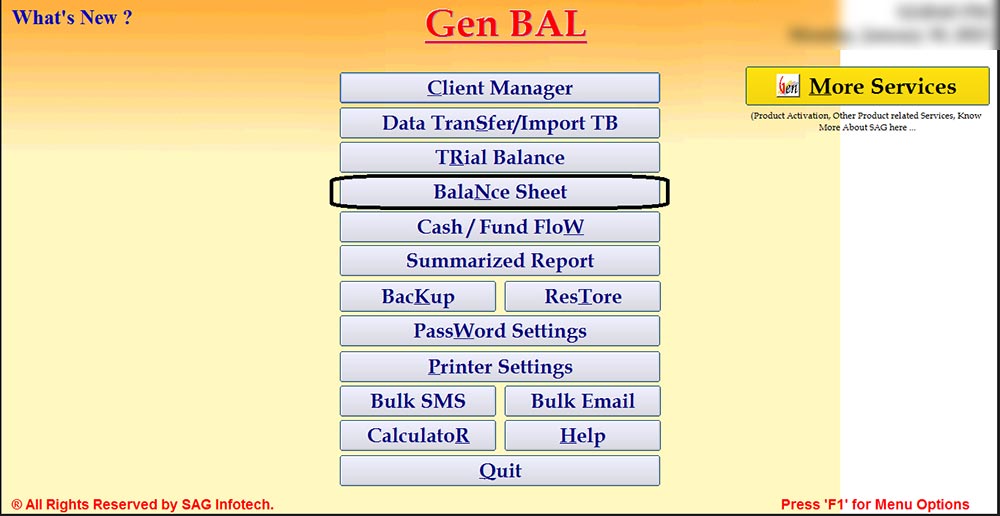

Step 1:- Open the Gen BAL Software and Go to the Balance Sheet tab.

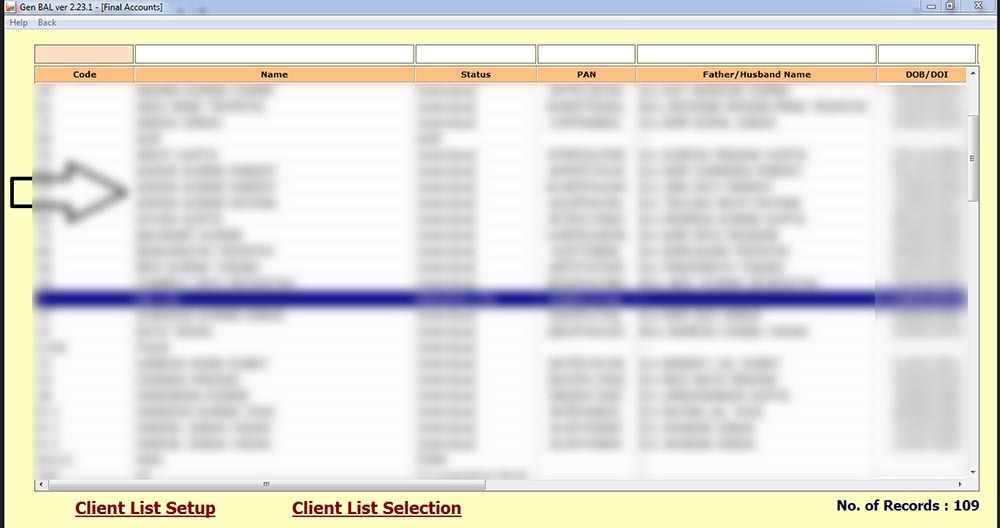

Step 2:- Select the Client for which you want to prepare the CARO Report.

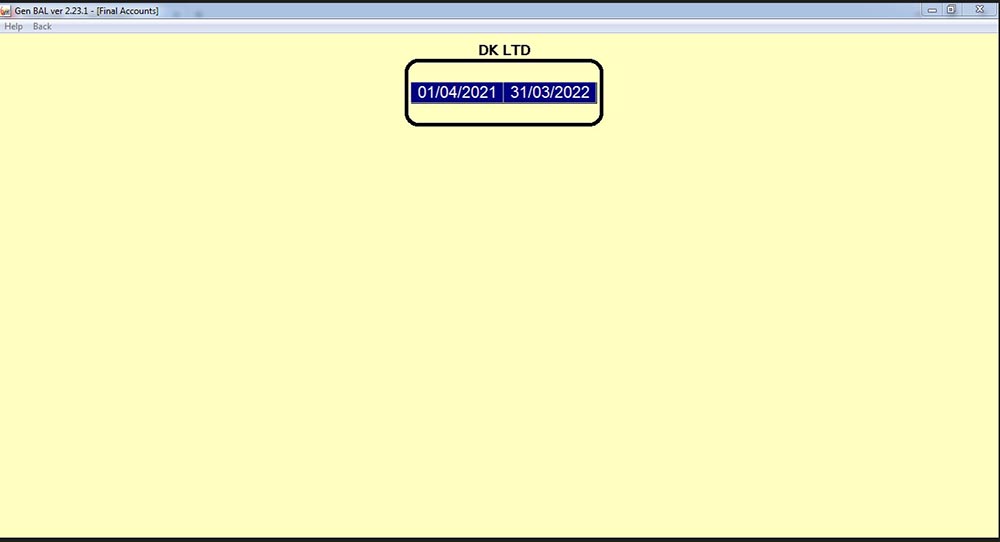

Step 3:- Select the year in which you want to check the CARO Report.

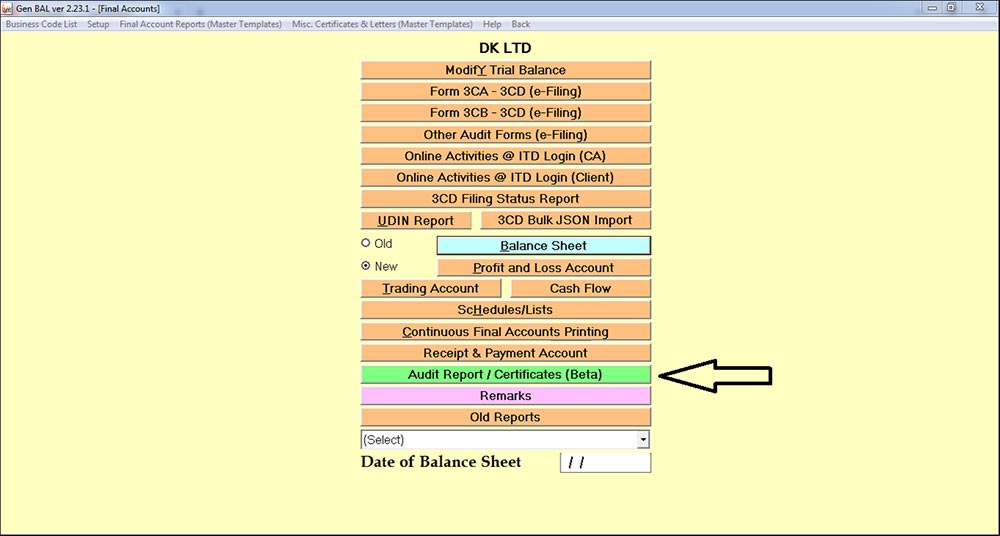

Step 4:- Click on the tab Audit Report/Certificates(Beta).

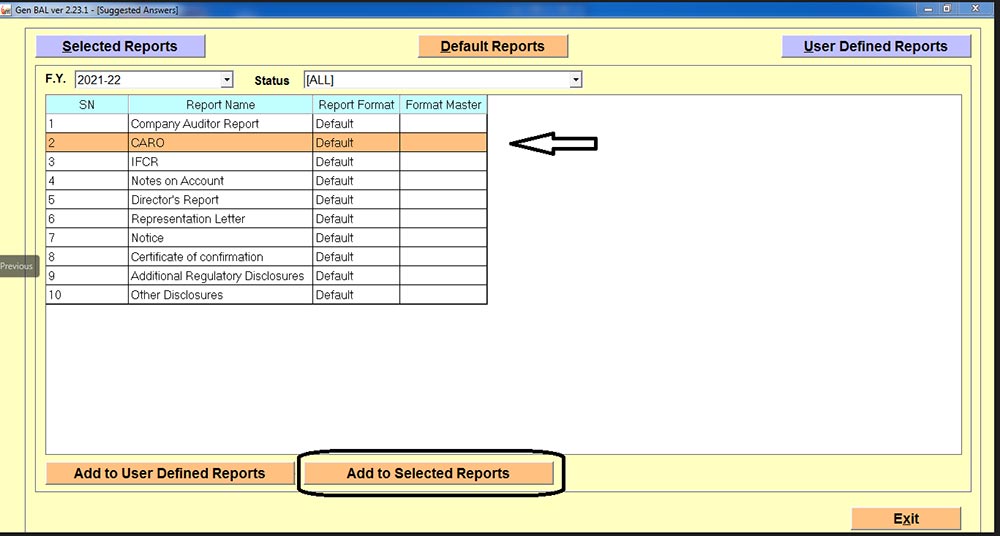

Step 5:- Select the CARO Report and click on the tab Add to Selected Reports.

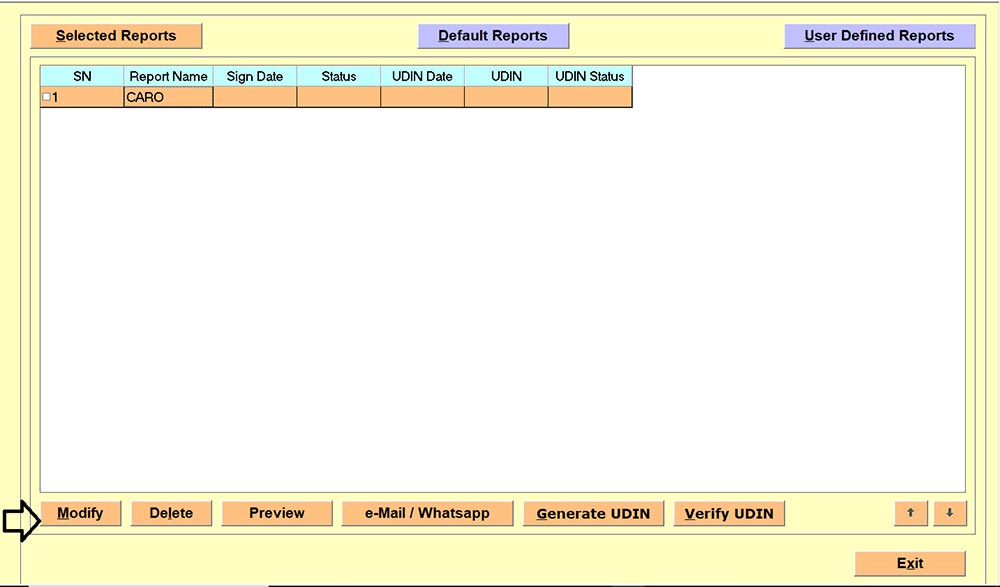

Step 6:- If you want to make modifications to the CARO Report can do so by clicking on the modify button otherwise click on the preview button and take the printout of the CARO Report.

Step 7:- You can save the file in Word or PDF from here.