Budget 2022 is all about to be presented on 1st February 2022 with lots of expectations to be projected on common people demand. The economic survey has defaulted on multiple schemes earlier and now the union finance minister is set to present the same.

There are multiple expectations from the budget 2022-23 which will be focusing on the increase in the 80c limit, an increase in the tax exemption limit for health insurance under Section 80D, with the ongoing relief to the covid LTA cash voucher and also the home buyers.

All Update on Union Budget 2022-23

- While there would be no amendment in the IT slabs the Finance ministry addresses the tax relief towards the disabled people Annuity and lumpsum obtained by the guardians reaching 60 years during the lifetime of the disabled person will be qualified for tax relief.

- The biggest announcements for the assessee includes

- The assessee would file an updated return on the tax payment in 2 years from the finish of the concerned assessment year.

- The new rule would assure the voluntary filing of the tax and diminish the litigation.

- There would be a 30% tax that moves on the virtual/digital assets with no deductions excluding the acquisition cost.

- There would be no set-off allowed with respect to the additional income.

- 1% TDS would be taken on the payments furnished on the transfer for the digital assets.

- Deduction for employer contribution to NPS raised to 14 from 10 percent before for State govt employees on par with central govt employees

- No amendment in the IT slabs.

- The budget comes with the boost for the real estate sector with the high-level committee of the urban planners and institutes to frame policies for sustainable urban development.

- TDS with 1% on transfer of the virtual assets.

- Until now no mention that the amendment in the personal tax rates or slabs or rise in any exemption or deduction limits in Finance ministers.

- The current tax advantage for startups that provides the tax redemption for 3 consecutive years to get extended by 1 more year.

- From 7 percent to 12 percent the corporate surcharge gets diminished.

- LTCG on the listed equity share units is for the maximum surcharge of 15% it asks to cap transfer of LTCG on 15%.

- In case of gift of virtual digital asset the recipient is to be taxed.

- The income on transferring of the digital assets is to get taxed with 30%.

- Tax incentives for startups to be started till March 31, 2023

- The proposal would be asked to increase the cooperative societies to 7% towards people whose income lies between Rs 1 cr and Rs 10 cr.

- The goal to raise the tax deduction limit to 14% on employers contribution to NPS account of state govt employees

- For cooperative societies, an alternate min tax is to be diminished by 15%.

- The new rule to permit the assessee to furnish an updated return is introduced. Within the period of 2 years, the updated returns would get furnished from the finish of the related assessment year saif FM.

- Finance minister Sitharaman would read the proposals towards the income tax.

- To serve out the easy living and doing the businesses “One Nation, One Registration’ would get established for anywhere registration.

- Expect the budget to begin the further tax deduction for “Work from home” to serve the new working arrangements.

- To diminish the late payment an online bill system would get introduced. The same is used by the central ministries mentioned by FM Sitharaman.

- ECLGS scheme prolonged till March 2023 has the purpose to provide the advantage to the business development for the MSMEs performing the banking and NBFCs.

- FM specified that the issuance of the e-passports seeing with the future tech perspective is to get started in 2022-23.

- Towards the small companies

- MSMEs like Udyam, e-shram, NCS & Aseem portals will be interlinked and their scope gets expanded.

- They would now act as portals through live organic databases furnishing the G-C, B-C & B-B services like credit facilitation, enhancing entrepreneurial opportunities.

- A fund along with the combined capital increased beneath the co-investment model serviced via NABARD to finance startups in agriculture & rural enterprises for farm produce value chain.

- The extension ECLG would furnish relief to the lending MSME industries. Parallel to that, the rectification of CGTSME will be an additional incentive for banks to grow for the purpose of lending said by SBI’s Soumya Kanti Ghosh.

- The extension of ECLGS (emergency credit line) till March 2023 is a complex process said by the experts.

- FM Sitharaman mentioned that some of the steps opted by the govt to drive the MSMEs for becoming more resilient and competitive

- Nearly 130 lakh MSMEs were being supported by the Emergency Credit Line Guarantee Scheme so as to diminish the impact of the pandemic.

- PLI policies for 14 sectors have seen benchmark results and built 60 lakh job opportunities.

- Sitharaman mentioned that their target is to grow the macro-growth within the micro-all inclusive welfare, digital economy and fintech, tech-enabled development, energy transition, and climate move.

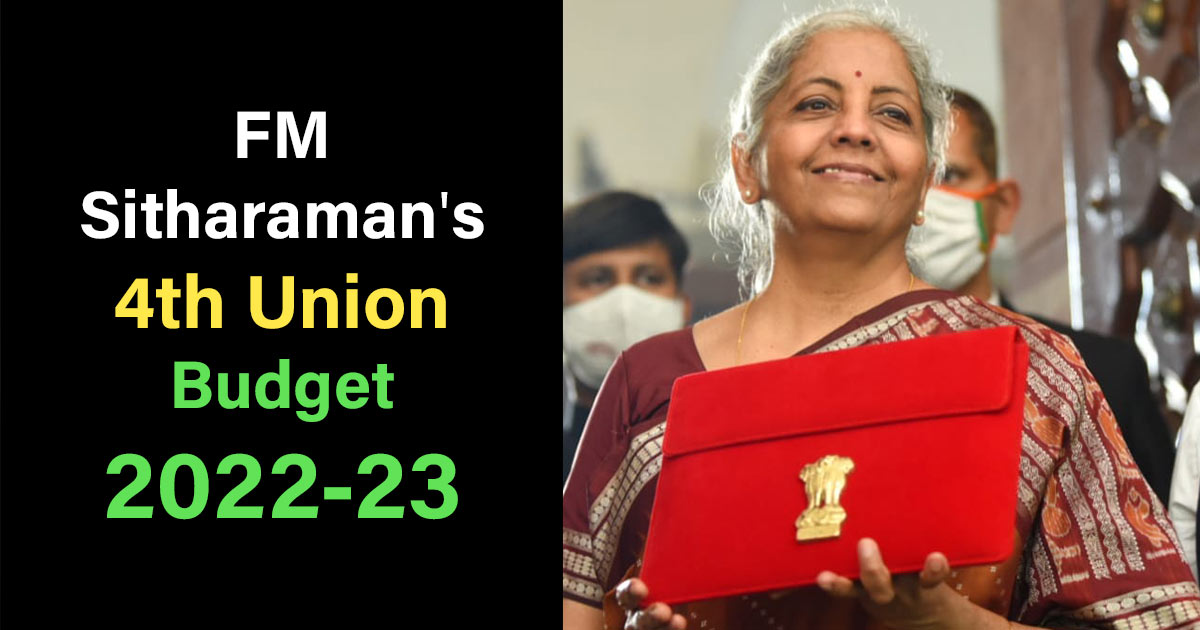

- FM Nirmala Sitharaman is addressing the budget through the tablet today specified by the speaker Om Birla.

- Cabinet gives the permit to Union Budget 2022.

- Budget expectations: MSME support is to be expected by Soumya Kanti Ghosh, group chief economic advisor, State Bank of India also as no other taxes imposed, provide with the financial support and financial glide path from this years budget.

- Union Budget 2022: inside a red pouch the FM Nirmala Sitharman takes the tablet to show the paperless budget.

each section explained briefly and every important points is covered