The recently announced Union Budget 2016-17 has not made a positive impact on many of the Indian salaried employees and left them wondering whether they are rich or poor. But, in this whole mess of provisions, there’s a lot of ways that would help you out in saving your bulk of tax. To help you grasp chief tax proposals, we are presenting here a brief guide containing all the key points of the Budget.

You may like it: How to Save Income Tax in India

WHY YOUR TAXABLE INCOME IS NOT THE SAME AS YOUR INCOME

It is always better to disclose all your other taxables like bank interest along with your salary income in front of your employer during the starting of the fiscal year. The benefit from this is that it will help in calculating TDS and your trouble of paying tax in advance will be saved. Nevertheless, you will be required to file your own tax return even if the whole tax payable by you has been deducted at source.

Under each head of section, you can avail some tax benefits either by an exemption like HRA or a deduction like interest on savings bank accounts with an aggregation of Rs. 10,000 a year. Although the chances of having loss are very much rare, but the only probability in which you can incur a loss is when you go for selling your investments or properties or when house mortgage is paid.

USE THESE BENEFITS TO BOOST YOUR TAKE-HOME SALARY

No matter whether you have just incepted your career or you have created milestones in your job life for years, income tax have been legally deducted from your monthly salary.

The factors that are subject to tax include your basic pay, cash allowances, car and housing allowances and much more. The CTC incorporates your integrated salary, allowances plus your other benefits. It is the cost incurred by the employer. For all the private sector employees, the liability of tax can be reduced and their home pay can be increased up via the CTC components listed below:

Housing: It’s better to stay in an employer given house rather than go and hunt for an own house. But, having your own rental house is much more beneficial in the taxation terms. As House Rent Allowance (HRA) is typically a standard component of CTC, this can be saved.

An insight on both

House Rent Allowance (HRA)

One of the standard CTC components is HRA given by an employer to an employee. It’s only agenda is to cover the housing rent needs. The factors on which the exemption is limited include:

- Rent paid minus 10% of the basic salary.

- 50% of the basic salary where the home is situated in Delhi, Mumbai, Kolkata or Chennai, while 40% in rest of the cities.

- Actual HRA received, whichever is lowest.

There will be a deduction from gross taxable income if HRA is not a part of your CTC scheme subject to the utmost deduction of Rs. 5000 a month or Rs. 60000 an annum.

Point of caution: You should also acquire a copy of your landlord’s PAN card along with the rental receipts if your annual rent goes beyond Rs. 1 lakh and submit it to your accounts department.

Flat provided by the employer

The perks provided to the employee depends on whether the owner of the flat is the employer himself or not, or whether it has been taken the home on rent for your benefit or whether you are availing the hotel accommodation services.

In case if you are taking benefits of such kind of accommodations then the salary value won’t be exceeded by 24% in a hotel and 15% for the other scenarios. Moreover, if you are provided with a furnished accommodation by the employer, there’ll an add up of another 10% to the perquisites as the cost of furnishing (if the employer owns) or actual hire charges payable (if leased by the employer).

Different tax breaks

Leave travel concession(LTC):

You can get rid of tax via an annual holiday trip to anywhere in India. There will be no exemption for any kind of hotel, local conveyance, etc., expenses available to you. However, during the leaves, the tax exemption on any repayment of your travel expense is restricted to the airfare, which is of the economy class for the shortest available path to your holiday destination. Travel bills are again the handy stuff to be kept safe for claiming the exemption.

Leave Encashment

Employees can encash the amount of the leaves, which they haven’t availed. It’s a tendency that most of the employers sanction such encashments only when the employee retires or he/she resigns for the job. Minimum available exemption on such kind of encashment is of Rs. 3 lakhs, though there are detailed rules for calculating the same.

Other tax benefits

Transport Allowance

The tax exemption of up to Rs.1600 per month is paid by the employer for covering your day-to-day conveyance requirements.

Children’s education allowances

There’s a limited tax relief of Rs. 100 a month per child and Rs. 300 for the hostel charges.

Condition Apply: Both limited to two children.

Certain Repayments:

- Medical Expenses up to Rs. 15000 annually.

- Telephone charges with data charges included.

- Meal vouchers for up to Rs. 50 per meal can be exempted from tax.

Some Retirement Benefits

Employee Provident Fund

From April 1, 2016 onwards, if the amount exceeds by Rs. 150000, the employer’s contribution to PF becomes taxable. Back from February 10, 2016, an employee can take his PF amount only after completing his full service of 58 years. Though, certain conditions are there if he/she wants to withdraw the amount at the time of resignation.

There’s a 12-digit Universal Account Number allotted to the all the PF holders. It is a fresh scheme initiated by the PF authorities. Once your UAN gets verified by the employer, all your previous account money gets transferred to the new account, which isn’t taxable.

Gratuity

You are authorized to get gratuity payment in two cases. If you get a jump in your job after a continuous 5 year period or if you retire after 5 years of contribution to the service. Though, there are certain rules for calculating exemption, but the maximum gratuity amount is of Rs. 10 lakh that is exempted.

ESOPs

For keeping fresh talents revitalized, most of the companies apply the ESOP policies. In the scheme, the company offers the shares to the employees at a discounted price so that the employee can purchase it in the future.

Different take home salary

You are authorized to receive a CTC, which comprises of different elements such as your perks and other reimbursements. Your take home pay cheque would be much bigger if you follow a well-structured CTC and there’ll be less deductions of your taxable salary.

SAVINGS UNDER SECTION 80C

Under section 80C, the deduction is allowed from your Gross Total Income. It’s not that easy to save with the rapidly increasing inflation. However, tax breaks can be acted as incentives on savings. Investments, expenses and payments are the factors on which the deduction is allowed.

New Pension Scheme (NPS)

NPS is a very popular savings scheme that is very flexible in nature. Via this, you can avail a fixed income after the retirement as it offers both, a lump-sum amount as well as a monthly pension.

Public Provident Fund (PPF)

You will get a tax free interest of 8.7% if you contribute to PPF. Moreover, there’ll be maturity earnings fully exempted from tax. Once investing amount of Rs. 500 to Rs. 1.5 lakh every year deposited to any post office or any of the entitled bank, you can claim the deduction for the same.

National Savings Certificates (NSC)

Handled via the post offices in the country, the scheme provides the deduction of the amount invested in the same. Your interest will be qualified for the deduction if you reinvest the amount each year as it will be accrued annually on NSC. The compound interest will go bi-annual to annual from April 1, 2016.

Life Insurance

Deduction can be claimed for premium paid towards life insurance policies for self, wife and kids.

Small Savings

Small savings imply a notified scheme in which there’s a 5-year term deposit with the bank. It qualifies for the deduction.

Sukanya Samriddhi Account

You can get a tax break under the Prime Minister’s ‘Beti Bacho Beti Padhao’ mission. The Sukanya Samriddhi Account is for the endorsing the education of a girl child.

Source: timesofindia.indiatimes.com/

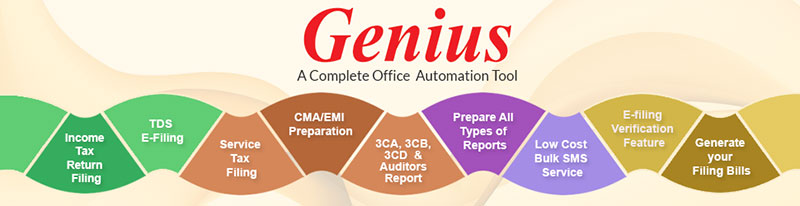

Recommended:

Budget 2016: Modifications Made by Jaitley to the Tax Regime

Union Budget 2016: Economize Tax Via Swiping Your Cards

What is Form 15G and 15H, How it Save TDS on Interest Income?

One Solution for Several Taxes E-filing