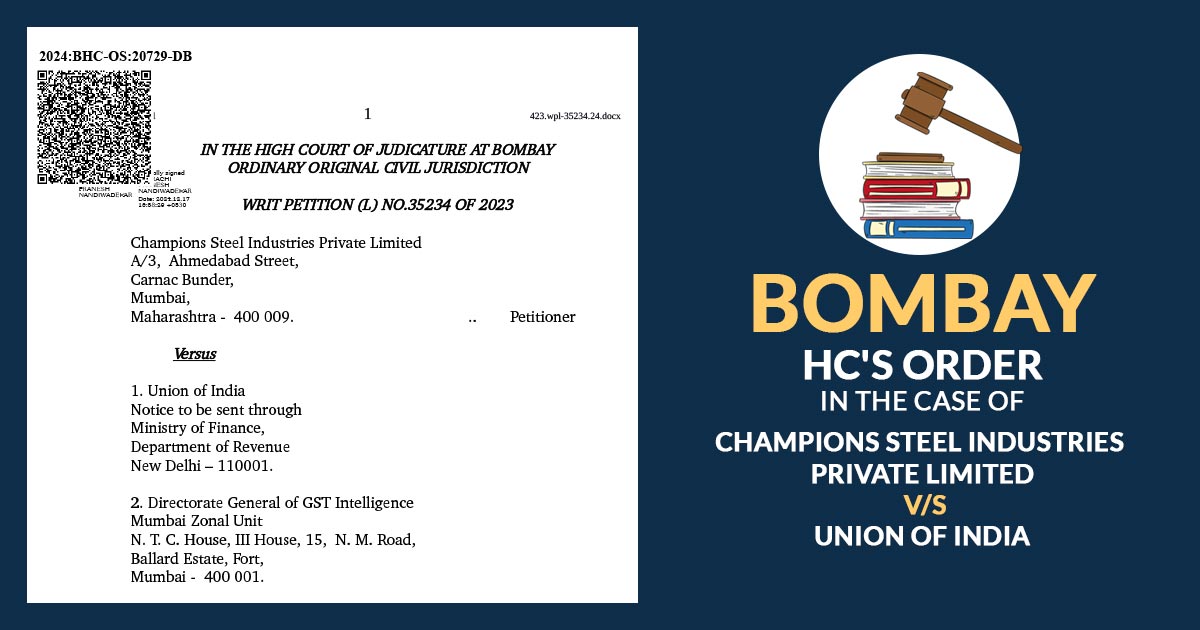

The Bombay High Court has overturned a decision that was previously made against Champions Steel Industries Private Limited. The court found that there were mistakes in how notices were delivered to the company, which affected the process.

Champions Steel Industries Private Limited, the applicant has contested a Show Cause notice on 23-12-2020 and the forthcoming O-I-O on 27-02-2021 issued by the Directorate General of GST Intelligence (DGGI). The claim was that the ineffective service of notices at the wrong addresses, which the applicant claimed breached their right to a fair hearing.

The applicant claimed that the SCN and the other communications were furnished before an address that does not associate with the company. As per the applicant, the same procedural lapse breaches the right to a fair hearing under the norms of natural justice.

A detailed examination has been conducted by the High Court of the documents by both parties and noted the difference is there in the service of the notices.

The registered address of the applicant as recorded in the official documents, is “A/3, Ahmedabad Street, Carnac Bunder, Mumbai – 400009.” in the original Show Cause Notice (SCN) issued in July 2020 the same address was shown.

On February 23, 2021, a notice for a personal hearing was sent to a different address in Pydhonie, Mumbai. Unfortunately, this notice contained mistakes in both the postal code and the location details.

It was marked by the court that the notices along with the O-I-O were sent to the Pydhonie address, which does not belong to the applicant. The respondents were unable to establish any relation between the address and the business of the applicant.

It was furnished by the respondents that the notices were not returned undelivered and hence it must be assumed to have been validly served. However, the court denied the argument by mentioning that the valid service needs the delivery to the precise address and procedural compliance cannot be bypassed on such presumptions.

Read Also: Gauhati High Court: SCN, Statement and GST Order U/S 73 Must Be Signed by Proper Officer

It was noted by the court that the applicant did not have the chance to take part in the adjudication procedure because of the failure of the respondents to serve notices at the valid address. The court held that such a lapse hits the adjudication fairness.

The O-I-O has been quashed by the two-member bench including Justices M.S. Sonak and Justice Jitendra Jain. Also, it remanded the case back to the adjudicating authority for fresh consideration.

The Bombay High Court asked the respondents to ensure that all the subsequent notices and communications are sent before the applicant’s true address at “A/3, Ahmedabad Street, Carnac Bunder, Mumbai – 400009” or their registered email ID.

| Case Title | Champions Steel Industries Private Limited vs Union of India |

| Citation | WRIT PETITION (L) NO.35234 OF 2023 |

| Date | 16.12.2024 |

| For the Petitioner | Mr. Prasanna Namboodiri, Ms. Pratibha Namboodiri, Ms. Tejal S. Darekar, Ms. Pallavi Dabak and Mr. Rishabh Jain |

| For the Respondents | Mr. Yogendra R. Mishra a/w Ms. Sangeeta Yadav |

| Bombay High Court | Read Order |