What does IMS stand for?

The mentioned functionality is said to be an effective rise in the ITC ecosystem of GST. Only the accepted invoices through the receiver shall become part of their GSTR-2B as their eligible ITC.

Hence, the IMS shall furnish the taxpayer a chance to review the authenticity of the received invoices. Once the suppliers save any invoice in GSTR 1 / IFF / 1A / the invoice shall be reflected in the IMS dashboard of the receiver.

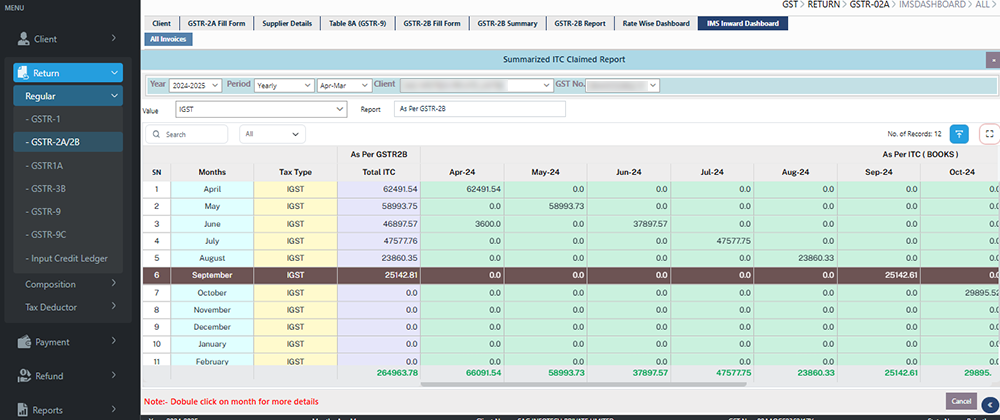

IMS Summarized ITC Claimed in Inward

A detailed overview of Input Tax Credit (ITC) claimed under the Goods and Services Tax (GST) has been given under the IMS Summarized ITC Claimed Report. It provides information on the credits claimed for distinct tax categories, including IGST, CGST, SGST/UTGST, and Cess.

The same report acts as a reconciliation tool, comparing the ITC available in Books with the data available in GSTR-2B and vice versa, which assists the businesses in determining discrepancies like under-claimed or over-claimed credits.

The report comprises a vendor-wise breakdown of ITC, permitting matching of the invoice information with the vendor filings. It emphasizes the mismatches, like missing invoices or wrong information. The report assures that the ITC is claimed only for the eligible goods and services complying with the GST norms. Also, it provides information on any reversals due to the ineligibility or late vendor payments.

Also, the report serves as a significant audit and compliance tool, supporting businesses in ensuring precise return filing, resolving vendor-related issues, and upholding compliance with GST laws. Performing the same tasks lessens the risk of penalties and facilitates superior tax management.

Gen GST Software IMS Advantages

Gen GST software is a solution made to facilitate GST compliance for businesses. The same supports handling tasks such as GST filing, invoicing, and tax calculations efficiently.

Integrating with an Inventory Management System (IMS) ensures easier tax compliance via automating tax computations, synchronizing inventory data, and facilitating processes like e-invoicing and Input Tax Credit (ITC) claims. The integration lessens manual errors, improves operational efficiency, and ensures compliance with the GST norms.

Here in the section below, we have discussed the process of IMS- Summarized ITC claimed report Features in Gen GST Software:

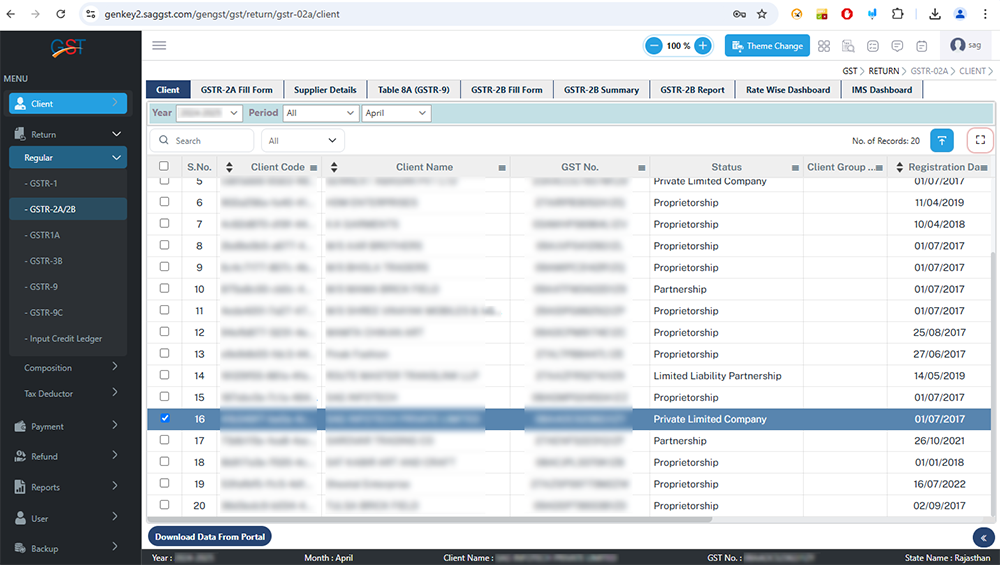

Step 1: To use this, kindly select the client first, Then Go to Return > Regular > GSTR-2A/2B > IMS Dashboard.

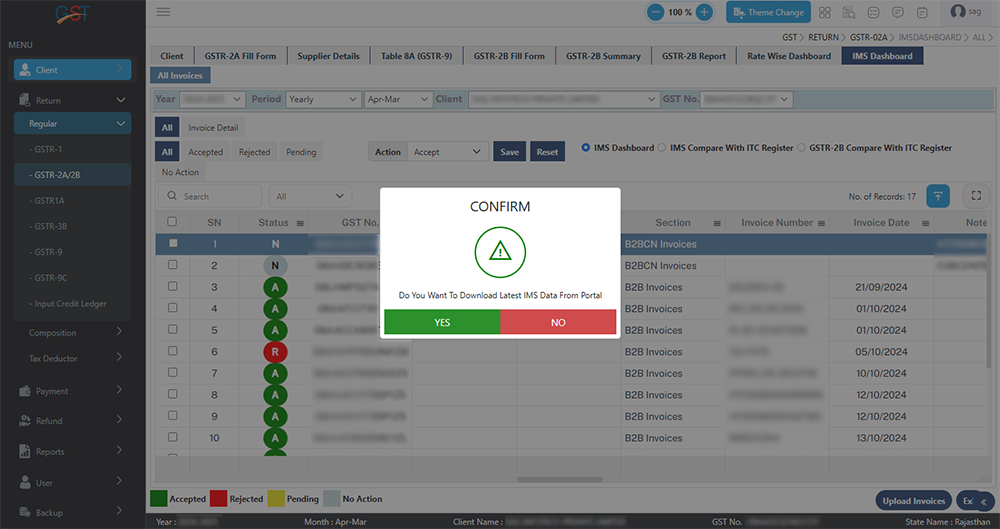

Step 2: After clicking on the IMS Dashboard, it will ask you to download the Latest IMS data from the portal.

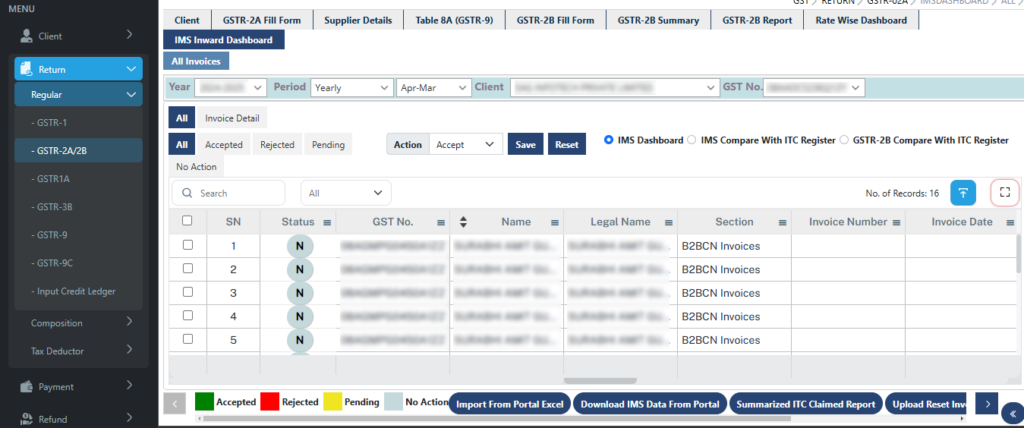

Step 3: After that, you can click on the summarized ITC Claimed Report.

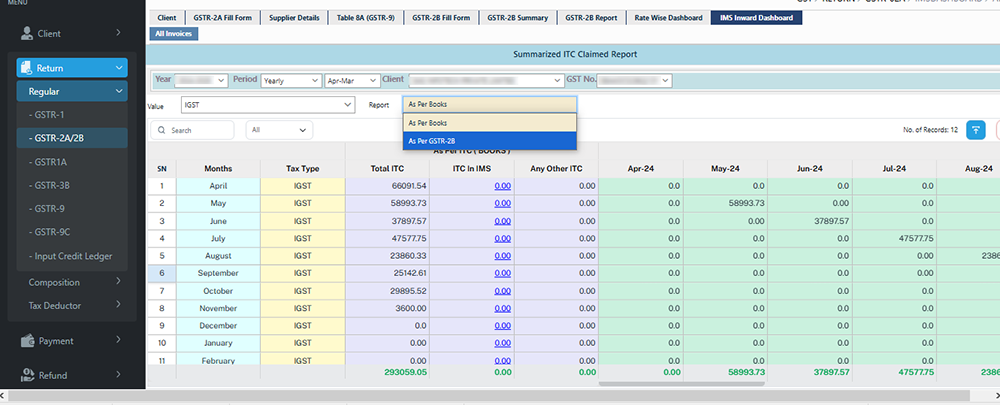

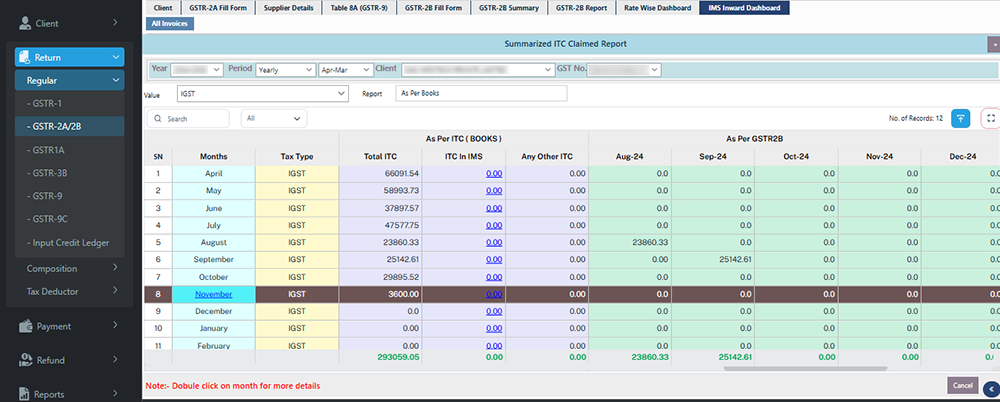

Step 4: After that, you can check the details here as per the books and as per GSTR 2B.

Step 5: Firstly, we will check the details as per the books. Here, you can view the details based on the books. This includes the complete particulars for the specific months’ ITC, invoice taxable value, IGST, CGST, SGST, and invoice value data. This represents the data as per ITC. If you want to check the details settled in a particular GSTR 2B month, simply scroll down the bar to verify whether the data is settled in this report.

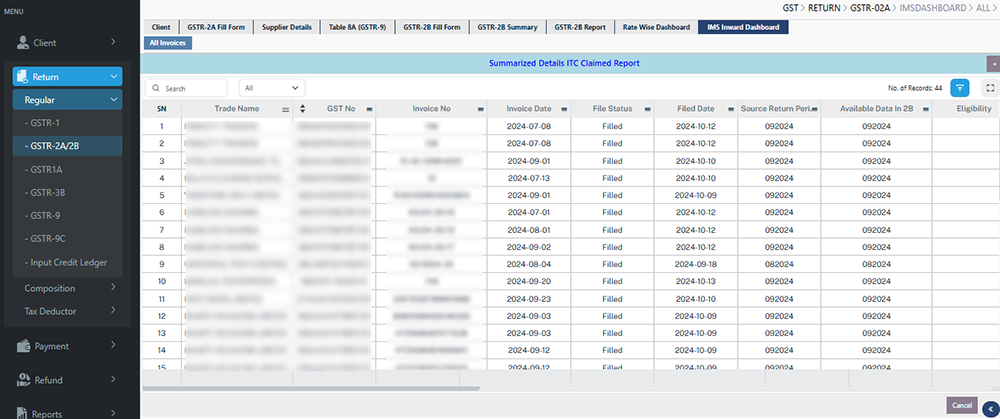

Step 6: If you want to cross-check all the invoices in the selected month’s data, you simply click on this option, and this will reflect all the invoices here, so you can check all the invoices settled in this 2B report. We just exited from this.

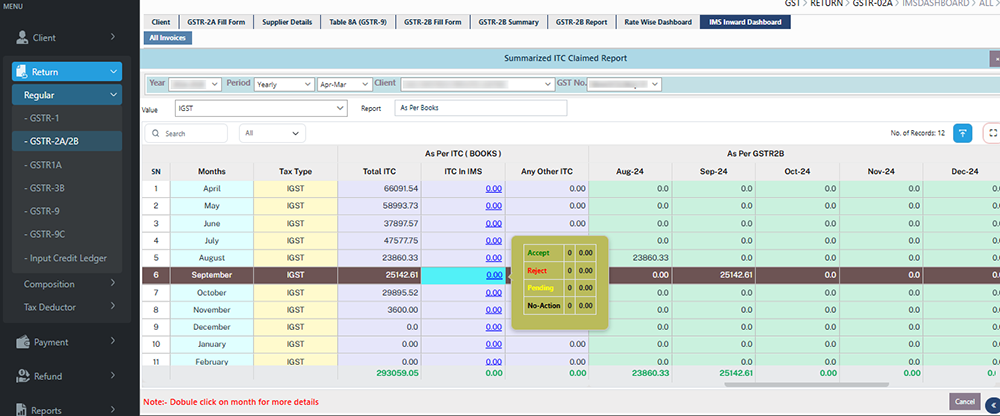

Step 7: If you want to check whether the IGST value for the selected month is correct, simply click on its ITC in the IMS. Here, you can check whether your ITC is accepted, rejected, pending, or has no action.

Step 8: After that, there is a report based on GSTR-2B. Simply click on ‘As per GSTR-2B’ to check your data according to the 2B, along with your ITC register. Here, you can see which data from previous periods has appeared in GSTR-2B. If you want to check the invoices for a particular month, just click on the relevant field, and you can view all the details.