The Bombay High Court in development has asked the Central Board of Direct Taxes ( CBDT to extend the due date to file the Income tax returns to January 15, 2025, following a Public Interest Litigation ( PIL ) filed via The Chamber of Tax Consultants.

A division bench Chief Justice Devendra Kumar Upadhyaya and Justice Amit Borkar observed that updated modifications to the utility software of the Income Tax Department averted the eligible taxpayers from claiming the Section 87A rebate. This rebate authorizes individuals with taxable incomes up to ₹7 lakh to receive a 100% tax rebate, reducing their tax liability to zero.

The PIL claimed via senior advocate Percy Pardiwala, argued that the modifications were arbitrary and deprived taxpayers of their regulatory rights. The petitioner emphasized that the Section 87A rebate is a fundamental right under the Income Tax Act and cannot be restricted by modifications to software.

It asked the court to seek CBDT to permit the affected taxpayers to file a revised return u/s 139(5) of the Act, allowing them to claim the rebate retroactively.

the Income Tax Department answering the allegations claimed that the modifications were required to align with the legal needs and avert the peculiarities in rebate claims. But this reasoning has been dismissed by the court outlining that procedural amendments must not override the substantive rights granted through legislation.

Read Also: Easy to Understand Updated, Belated and Revised IT Returns

It was noted by the court that the unilateral software amendments incurred dated July 5, 2024, do not allow rebate operations for particular taxpayers. It stresses that these procedural changes undermined the legislative objective of the rebate and charged an unfair financial load on eligible taxpayers.

The court stated, “Taxpayers should not bear the consequences of administrative inefficiencies or unilateral executive actions that undermine the legislative intent.”

The court acknowledging the problem issued interim relief asking CBDT to extend the ITR filing due date. The very extension furnishes the taxpayers a chance to furnish the returns with valid rebate claims. The significance of fairness, equity, and clarity in tax administration is been emphasized by the court citing that “Statutory benefits must align with the legislature’s objectives and should not be impeded by procedural hurdles.”

For final disposal, the case is been scheduled dated January 9, 2025, where the court will analyze the wider implications of software changes and their impact on the rights of the taxpayer.

The Bombay High Court, in the interim, has asked the CBDT to extend the ITR due date to January 15, 2025, quoting procedural irregularities in the Section 87A rebate. On January 9, 2025, the case is to be finalized.

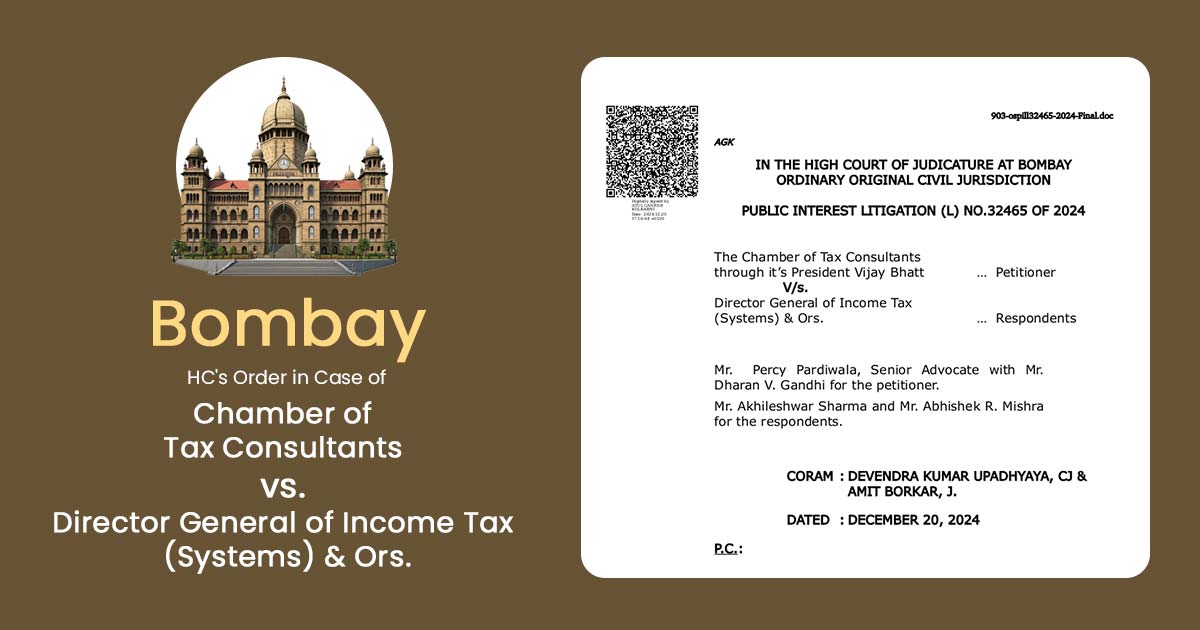

| Case Title | The Chamber of Tax Consultants Versus Director General of Income Tax (Systems) & Ors. |

| Citation | PIL No.32465 Of 2024 |

| Date | 20.12.2024 |

| Counsel For Appellant | Mr. Percy Pardiwala, Senior Advocate with Mr. Dharan V. Gandhi |

| Counsel For Respondent | Mr. Akhileshwar Sharma and Mr. Abhishek R. Mishra |

| Bombay High Court | Read Order |