FY 2021-2022 ITR filing deadline is 31st July 2022. Nevertheless, it has been observed that most taxpayers wait until the last minute to file their ITRs. As in the past two years, some taxpayers assume that the government will extend the deadline again this year.

New ITR Portal is Not Completely Operational

The assessee is encountering issues like people who furnish several ITRs u/s 139(1) for the same PAN, Wrong upload of JSON furnish of one PAN in some additional PANs, not being enabled to download the income Tax acknowledgements and/or ITR forms after filing, validations of ITR Forms, Frequent revisions in ITD utilities, Login problems, time consumed in processing and generating, despite after the functioning of the income tax return upon the grounds of real-time, Income Tax Refund payable is shown as awaited, Mismatch in PAN Data when there is no mismatch, PAN Account locking even when PAN Number is active, Filing of Refund Reissue Requests, DSC validation issues, Bank account validation issues, New PAN registrations issues, Data saving issues on ITD Portal, and others.

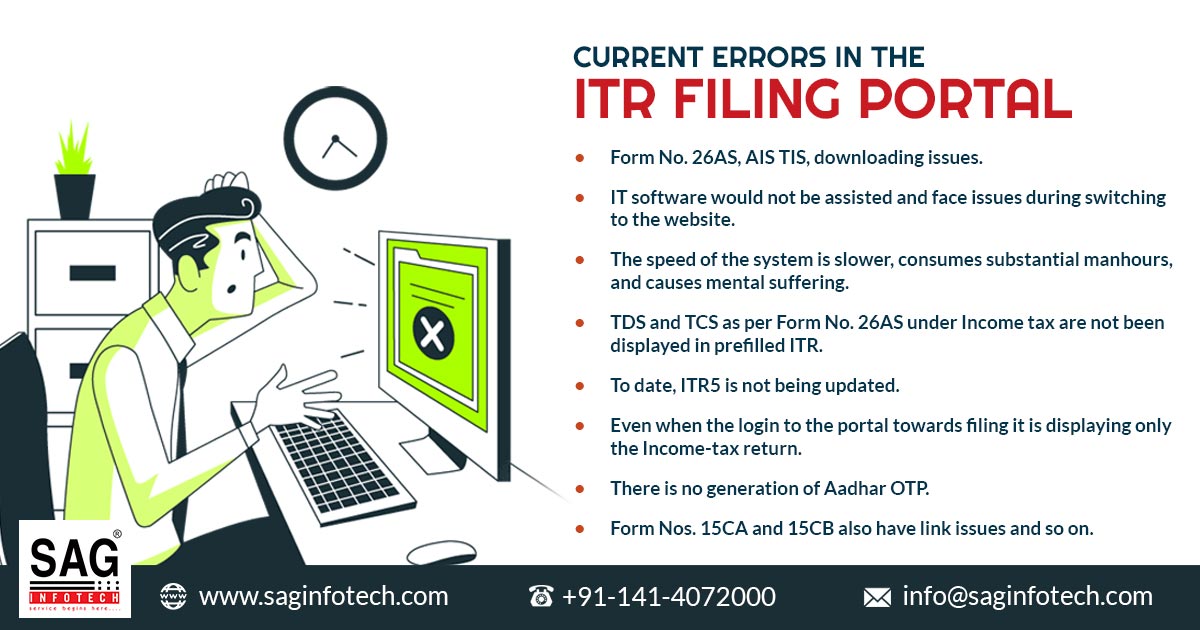

Current Mistakes in ITR Filing Portal

Several Issues While Filing Rectification Applications

The issues have been encountered from the start of the portal which carries on such as Rectification applications, filing of Income-tax return pursual to Notice u/s 139(9), incorrect processing of intimations u/s 143(1), updating of UDIN to map with documents filed on ITD website and so on, etc.

Lengthy and Time-consuming ITD Utilities

ITD utilities mentioned for the usage in the public domain are long and the rules and issues which take much time the same opt more time to compile the information and finishing of the compliances.

Reconciliation of AIS/TIS Date with ITR and AFS Takes More Time

The Reconciliation of AIS/TIS date with income tax return and AFS takes more time and thus circulates that various taxpayers obtain the notices because of the difference in the ITR furnished according to the reported data in AIS. Regardless, in the public domain, the clarifications issued mentioned that there would be no notices that are to be furnished because of any mismatches.

Filing Facility for The Transfer Pricing Audit Report Not Available

Beneath the income tax act 1961, the facility to file transfer Pricing Audit Report in Form 3CEB is yet to get enabled. There are various forms that are needed to get enabled yet such as slump sale forms Form 3CEA and others.

Earlier, Error on ITR Filing in Portal for AY 2021-22

Mentioned below are the issues that have been faced by the assessee along with the other stakeholders.

Not Efficient New Tax Forms Such as 10E, 10IE, 10ID

The New Tax Regime Forms such as Form 10IC, Form 10ID, Form 10IE, and others are not smooth and good to get furnished on the portal. Form 10E is made to report the arrears of the salaries before the FY 2000-01 that is needed to get amended.

No Access to Furnished Forms Via Software Vendors

Various forms are made with the intention of filing in an electronic way and this access is not being furnished to the software vendors to modify the filing via vendors that are not wanted.

However, there is some really good software in the market to see your tax filing just complete in a matter of minutes which will be ready to upload and file on official portals. This software is recognized and totally safe to implement in organization filing as well as in personal tax filing. Check them here if one needs the best Income tax compliance software in recent times.

I understand that we the people of our country have been driven to cyberpunk. Had it been with humans filing the returns with pen and paper it would have taken less than 5 minutes for the 90% of our tax payers who are the salaried class. Hence please don’t contstrain law abiding citizens to go through cyberpunk.

Minimum 30 days extension is required for filing returns. Many new compliances have been introduced.