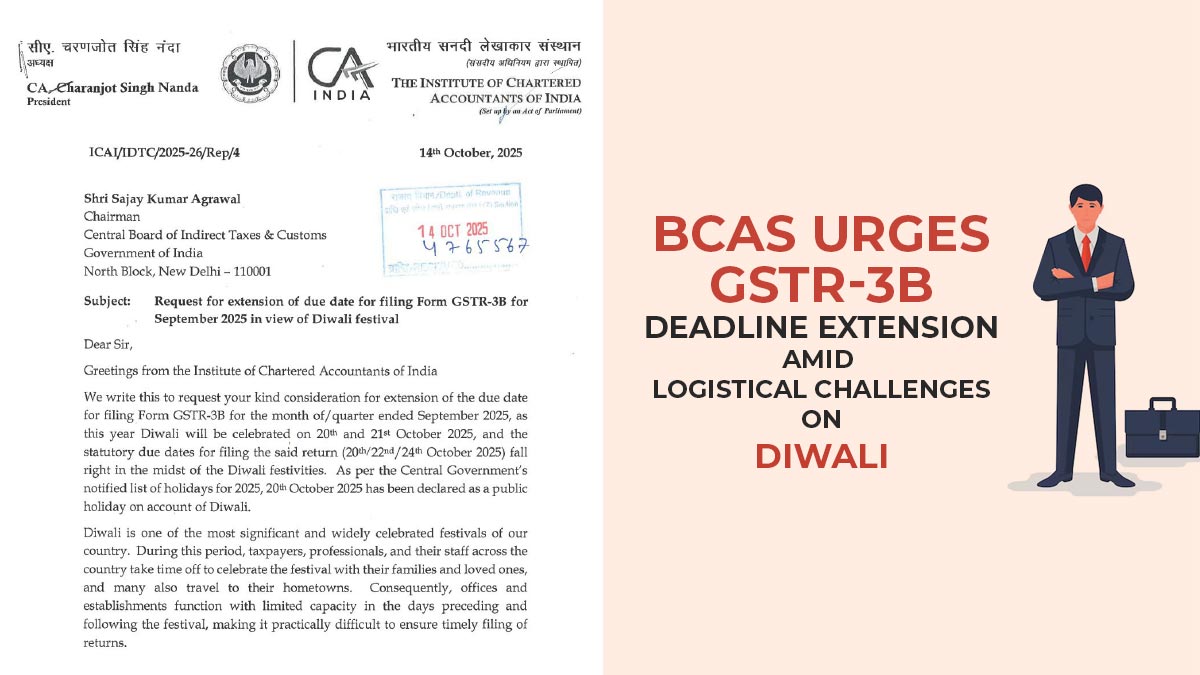

Bombay Chartered Accountant Society (BCAS) has urged the Finance Minister, through a representation, to request an extension of the statutory due date for filing the return in Form GSTR-3B and release tax liability for the month/quarter ending September 2025. Because of logistical issues on weekends and major festivals, the same request has been arrvied.

Taxpayers can report their summary GST obligations for a specific tax period and settle those liabilities via Form GSTR-3B, which is a simplified summary return. For each tax period, regular taxpayers should submit Form GSTR-3B returns. Form GSTR-3B needs to be filed by both the regular and casual taxpayers.

What Did BCAS Specify?

BCAS on October 8, 2025, mentioned that they submitted this representation of the necessity to extend the deadline for the filing of the monthly return in FORM GSTR-3B and the consequential payment of Goods and Services Tax (GST) liability for the tax period of September 2025.

BCAS, the standard statutory deadline to submit the return is October 20, 2025. It comes immediately after Sunday, October 19, 2025. The period encompassing October 20, 2025, to October 23, 2025, coincides with the primary days of Diwali, which is seen as a significant public holiday cluster across the nation.

Substantial preparatory work, including reconciliation, data entry, review of GST Input Tax Credit (ITC) eligibility (often dependent on GSTR-2B generation after the 14th of the month), and fund arrangement for tax payment, is engaged under the preparation and finalisation of FORM GSTR-3B.

Starting from October 19, 2025, the entire period is dedicated to Diwali, which severely impacts professionals, accountants, and company personnel, making the compliance window extremely restrictive, if not practically nonexistent.

BCAS cited that, “Therefore, as a significant step towards ease of doing business, it is earnestly requested that the due date for filing GSTR-3B of September 2025 be extended. Granting this essential administrative relief will enable registered persons and tax practitioners to complete the necessary compliance procedures following the conclusion of the festival period, ensuring accurate and complete return filing and promoting adherence to the provisions of the CGST Act without penalising taxpayers for unavoidable circumstances.”