ARN is an acronym of Application Reference Number (ARN) which is created at the time of submitting an enrollment application that is signed electronically or Digital Signature (DSC) at GSTN Portal. Under this, a unique number is provided for doing any transaction at GST System Portal. It must be noted that ARN can also be used in the future course of GST.

After submitting the enrollment application successfully at the GST System Portal, an ARN number will be created automatically. In Fact, you also can use ARN for tracking the position of your enrollment application. ARN will help existing taxpayers to migrate into new Goods and Service Tax (GST). GST portal is the official portal created by the government authorities which will help to do all activities of GST online. ARN number is basically used for checking GST registration status online.

Compulsory Documents required for Application Reference Number (ARN):-

- Directors or partners list along with their identification and address proof. It is necessary to mention that you are doing business in the partnership or incorporation

- Memorandum of Association (MOA)/ Articles of Association (AOA), Certificate of incorporation, partnership deed

- PAN Card of Business Organization

- Cancelled cheque of bank account in which mentioned account holder name, IFSC code, MICR and branch details of bank

- Rent agreement or electricity bill as a feature and document of area of business

Process of GST ARN (Application Reference Number) in India

- The candidate will be required to mention PAN, E- Mail Address and Mobile Number in Part A of Form GST REG–01 at the GSTN Portal or through Facilitation centre

- The candidate will receive OTP on mentioned Mobile Number and E-mail address. After receiving OTP, PAN is verified at GSTN Portal

- After submitting the applicant successfully at GSTN portal, the candidate will be allotted Application Reference Number ARN number on the mentioned mobile number or e-mail. A confirmation message will be sent to the candidate in FORM GST REG-02 electronically

- After the confirmation message, the candidate must have to provide all the information in Part- B of Form GST REG-01 and also mentioned the application reference number

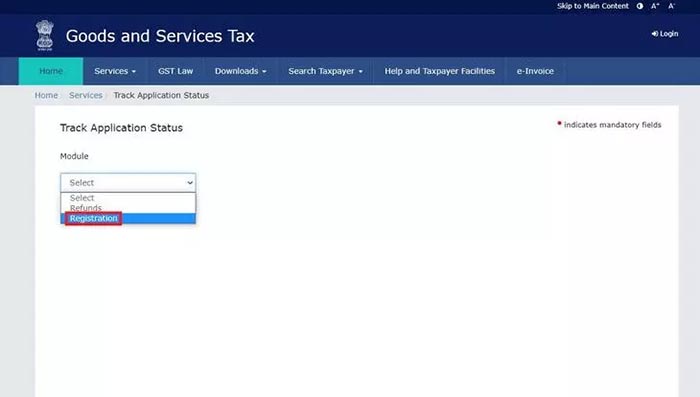

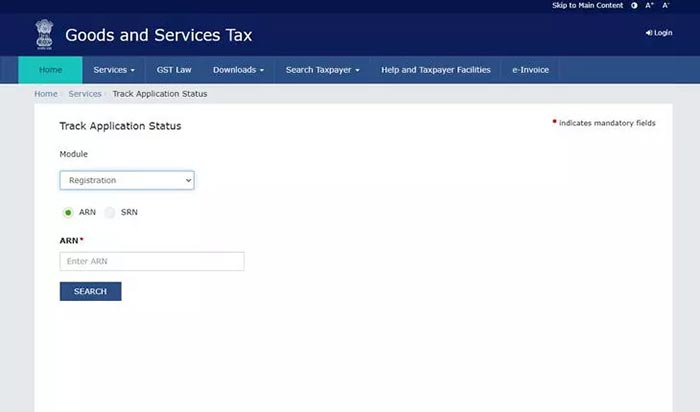

How to Check Application Status by ARN Number:

Once a taxpayer has applied for GST registration, they will be able to keep track of their registration on the government’s official GST portal. The Application Reference Number (ARN) or submission period can be furnished on the official portal to track their GST registration.

Step 1: Go to the link- https://services.gst.gov.in/services/arnstatus

Step 2: Select the Module list form registration form and enter the ARN number

Step 3: Enter the Captcha shown in the box

Step 4: Click on the search tab

Step 5: You will be shown the status of the application

I got an ARN number, can I raise Proforma Invoice using ARN and later final bill with GSTN

Ha ARN number ka prayog vyavsay me kiya ja sakta hai.

ARN

Loss my receipt

Agar kisi company ka reference no. Nhi pta ho to kya GST no. Ka use kr skte h

If someone do not know the reference no. then how could one the GST No.

dear sir or madam /

i add the additional address but the mistake wrongly address arn generate how to rectify after arn generate I rectify addrees

You can again request for change address in the GST portal

I have received the ARN number for GST registration, Can we raise the Tax invoice using the ARN number?

Kindly Clarify

No

Sir how to get my arn number

It can be retrieved through your mail

I have ARN no. But still, But till my status shown as clarification filed pending for order and assigned to CENTRE. Please help me to go the next step

Please raise complaint ticket regarding same on GST portal

I have applied for a GST number and I have got ARN AA271120130608M on 28-11-2020 till to date my application was not processed, how much time for processing my application

I applied for GST no and got ARN no, after that I got one notice about change unit(Ghatak ) from 67 to 63 how can I change this and what step I need to take?

You can change the same under the amendment of Core filed

Sir, this is my ARN AA371020005929F. I added additional clarification documents. But till my status shown as clarification filed pending for order and assigned to CENTRE. Please help me to go the next step

Please contact to GST portal

I have Generated TRN & Submit my application & Hyperlink come for Aadhar Authentication & I want to change some details in my application

How can I Do?

Please contact to GST practitioner

I HAVE APPLIED GST TWO TIME FOR the SAME PAN AND GET TWO ARN. WHICH ONE IS ISSUE GST CERTIFICATE OR TWICE ISSUED GST REGISTRATION. HOW TO SOLVE THIS DUE TO AVOID DOUBLE TIME REGISTRATION IN the SAME PAN

Use first one

Sir, this is my ARN AA330820058502J. I added additional clarification documents. But till my status shown as “clarification filed pending for order and assigned to CENTRE. Please help me to go the next step.

This issue is related to GST portal so kindly raise grievance ticket regarding the same

Dear sir

I started a new business and registered for GSTIN business as shows pending for processing. My ARN AA290720024651F on 11-07-2020 Please do the need full.

You have to contact with GST portal for the same

Few months ago, I had online my lost certificate. It has been submitted also, but the arn number which is showing is invalid. Sir, please help me it’s a request 🙏

Sir, you can check the same on GST portal to verify the ARN no.

My ARN no AA070620001137U Submission date 01/06/2020. The current status is pending with Tax Officer for processing…how much time to be taken for approval

Approx 15 days

Hi,

I have applied for GST, I have got the ARN application process is pending. Please update how much time it will take to generate GST NO.

After generation of Application Reference Number (ARN), the Registration Certificate (RC) containing GSTIN will be issued after 3 working days, unless approved earlier by Tax Officer.

I have applied for GST have got the ARN application process is pending please help me….

Sir, in this case, you have to get in touch with GST portal only

God Morning sir

I have applied for GST number and I have got ARN AA3706200169770 on 25-06-2020 till to date my application was not processed, how much time for processing my application

Sir, please contact to GST portal

I have applied for GST for our firm bookrivers.com getting msg Pending for Processing assigned to CENTER, what does mean

The application is still not processed

Hi There,

I have done purchase activity by using ARN No before getting GST No, Now Can I claim INPUT From those Purchase invoices which is only having ARN No?

No, you cannot claim.

I have ARN no. But still, I have not GST no. How time for this process.

Sir, I summited GST form, but still not get ARN. it is showing pending for validation.

You have to contact gst helpdesk for the same.

Hi, We have applied for new GST registration by CA. We received the GST No over the registered mobile number but don’t receive Login credentials (Provisional ID and Password) over domain email ID. Is there is any way to get login details? Approach grievance portal complains but not yet resolved. Any suggestion on this.

Siba

HI,

contact your CA for login credentials at GST portal, where you may download the GST certificate too.

Regards

Hi, I have applied for GST and clarifications asked are filed and it is now in pending for order status. Can I ask my vendors to raise Invoice with the TRN? Will this be good for claiming GST refund at a later date? Kindly clarify.

No sir TRN is an only temporary number when you received your GST number then you will take profit of GST.

I filed for new GST registration on 21-06-2018 & got ARN No. after that SCN was issued on 26-06-2018 which I replied & it showed successfully filed SCN from that day till date almost a week I still not received my GST registration & no. it always shows pending orders.

Can I start business activities on behalf of ARN No?

Yes, you can start the business with ARN,.

What does this mean by

“Your application has been approved & assigned to centre /state( as the case may be) in case of the change in GST Core/ Non-core details?”

ARN IS INVALID WHAT INDICATES IN GST REGISTRATION

My firm is partnership firm newly established. Filled In all the particulars for GST registration and got application Ref No.AA290218024976S. Now received an email from the department stating that queries raised. It asks to log in and download the SCN. However, do not know how to log in and download the SCN. Please guide me.

You have to check status using TRN no., and then you have to submit the requisite information there and then have to submit your application again.

USING YOUR TRN LOGIN AND REPLY THE SAME

THE STATUS IS CLARIFICATION NOT FILED

IF YOU DO NOT FILE YOUR CLARIFICATION YOUR APPLICATION WILL BE REJECTED

DO IMMEDIATE ACTION

Hello sir,

I got my ARN number but after that, a page will appearing asking for Details of Authorized Signatory Primary Authorized Signatory

Personal Information ??????? here what details I can put please guide me…

Details of the proprietor have to be filled.

I GOT ARN NO. AND IN STATUS APPROVED & NEXT WHEN I GET GST RC COPY.

Contact department for the assistance.

Generally takes 10 to 15 days.

I got ARN, what will be the next process to get GST RC and how long to receive GST RC?

After getting ARN WHAT TIME IT WILL TAKE FOR ME TO GET GST?

It is on the part of the department for how much time it will take to process the application.

after 3 working day check your mail id

Hi Sir,

My ARN Number is AA291017031058E. It is currently showing the status as “Clarification filed – Pending for Order” and Assigned To: STATE

What will be the next step and how much time will it take for Approve?

Please contact the department.

Hello Sir, I am facing the same issue “Clarification filed – Pending for Order”. Did you get your GST certificate? If yes then please let me. Know what did you do to resolve the issue?

Thank you

Tushar

I started new GST number with my previous experience a government tender process I participated tender with ARN number sir actually sometimes tender date Finished we have do is it possible to ARN number with tender process

I started a new business and registered for GSTIN business as propritership.fromlast 4 days it shows pending for processing. My ARN is AA071017030473L what should I do now?

ARN: AA080917019708O

Form No.: GST REG-04

Form Description: Clarification/additional information/document for Registration

Submission Date 14/09/2017

Status Clarification filed – Pending for Order Assigned To STATE..!

I want to know how long does it takes to get GST approval..!

And in the meantime can I make bills or challan using this ARN number?

“there might be some technical error. You should contact the department for assistance.”

I have Received ARN NO. WHAT CAN I DO TO CREATE GST NO. In ARN GST STATUS SHOW IS APPROVED. I WANT TO KNOW GST NO

Provisional ID issued by department is your GST No.