The GST has been a very prolong discussed taxation regime after the independence as it will suffice many of the taxation needs of the nation. In the near term of GST being applied to the economy, it will be the best scenario for examining the most probable causes of this taxation scheme. Earlier the GST council has given a head advice as to fix the states to their own will as to levy tax on the state transaction or not.

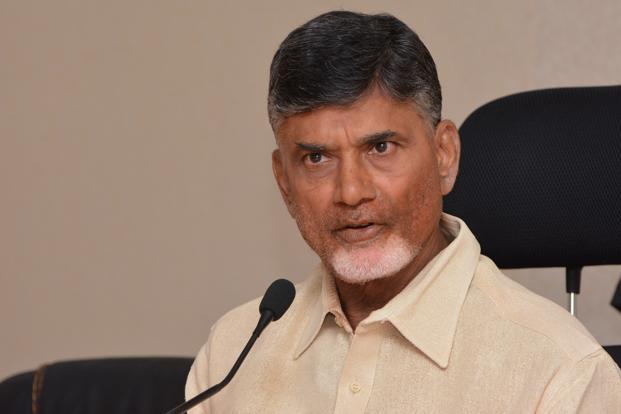

This time the Andhra Pradesh Cheif Minister N Chandrababu Naidu has emerged to request the center to levy the interstate tax after the transaction between the two. For this, the designatory state assemblies have to be in the line for discussion, while they have to pass three draft laws that are center GST law, integrated law, and the third one the compensation law which will compensate the states for the revenue loss.

Recommended: How GST Calculator Works in India?

Naidu is determined to take the interest off center towards the taxes within the states while he also described that the taxes should not exceed the 28 percent of limit and he will work in the same case. In the same issues, he mentioned that “The main concern of Andhra Pradesh is with some provisions of the central GST and Integrated GST, because of which we will lose income.”The decision has been detected to be towards the center and all the powers are within the union, while he also measured to take the interest of the center towards the territorial waters jurisdiction. West Bengal, Odisha, Kerala along with Andhra Pradesh are also objecting towards the center’s decision of restricting the levying of Value Added tax on the coastal area within the 12 nautical miles from the shore.

The states are expected to lose around 600 crores of revenue after the GST implementation and this has worthwhile given the states to look around the applicable laws. In the meanwhile, there a]is also a jurisdiction case pending with SC Karnataka high court which has partially given the judgment within the favor of state governments. An official from the parliament said that “AP fears that even though the Centre will partially allow state government’s control, a deemed provision in the legislation will ensure more autonomy for states.”