The United States President Donald Trump appreciates the Modi government for taking the bold step of launching Goods and Service Tax (GST) Regime in India from 1st July. And stated that it will also create “great new opportunities” for the country.

The US President Donald Trump said that “We’re doing that also, by the way. Creating great new opportunities for your citizens. You have a big vision for improving infrastructure, and you are fighting corruption, which is always a grave threat to democracy.”

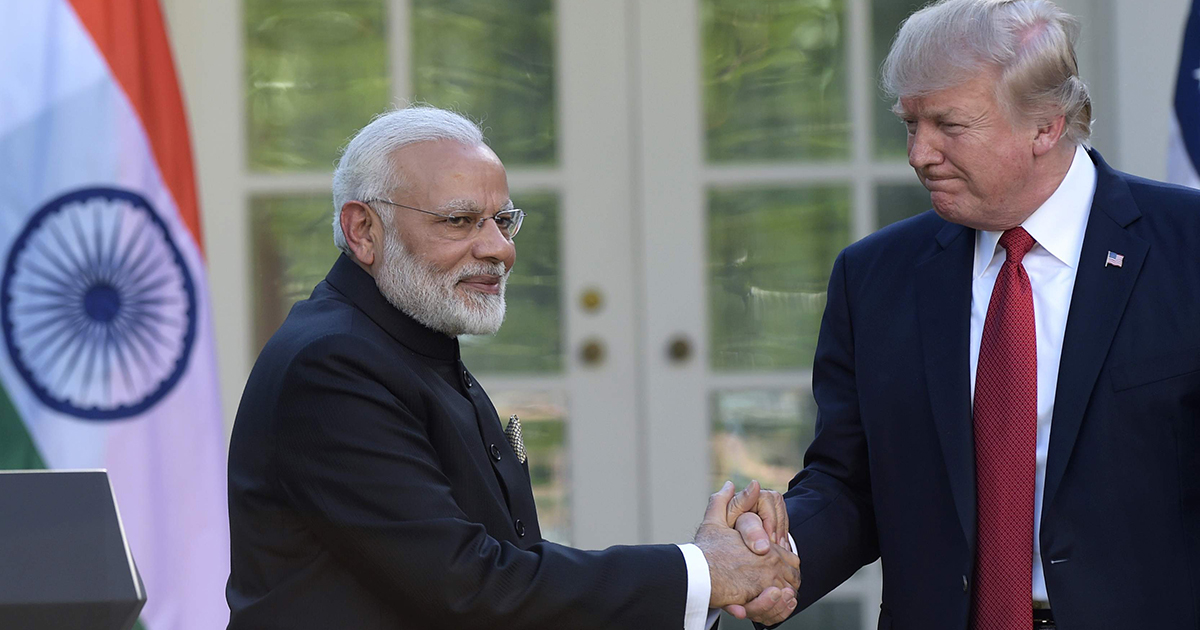

Prime Minister Narendra Modi and the US President interact with each other in White House Meeting at Rose Garden. Trump said that the economic development of both the nations is our common aim. Trump further added that “India has the fastest growing economy in the world. We hope we’re going to be catching you very soon in terms of percentage increase. We’re working on it.” Trump appreciated to the Indian people and the country and mentioned, “I am thrilled to salute you, Prime Minister Modi, and the Indian people for all that you are accomplishing together. Your accomplishments have been vast,”

Recommended: GST (Goods and Services Tax) Impact on Common Man

The Goods and Service Tax (GST) is set to be implemented on midnight on 30th June. The Prime Minister Narendra Modi said that the implementation of “one nation, one market, one tax“, a common man would be benefited with the new regime. Goods and Service Tax (GST), the biggest tax reform since independence will subsume 16 several taxes levied by the Central and State Government, including VAT, service tax and excise and make India a common unified market.

The GST Council has categorised goods or services into four slab rates i.e., 5, 12, 18 and 28 percent. The highest slab rate categories will further impose the cess on luxury and demerit goods, in order to compensate the state revenue losses in the starting first five years after the implementation of GST regime in India.

GST laws were passed by all the states and union territories in India excluding Jammu and Kashmir (J&K). The government is trying that the new indirect taxation structure would provide smooth functioning after the roll out of GST from 1st July.

There have been some issues raised about the readiness of the GST Network, Narendra Modi has assessed the progress of GSTN system and make a discussion with cyber security experts and requested to experts to pay the maximum attention to IT platform so that the entities would not face any trouble after the implementation of GST Regime.

34 Kendras or Centres has been selected as GST Suvidha Providers across the country for the implementation of the new regime. If anyone has issues and questions related to the new GST regime, these centres will solve their issues.